This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

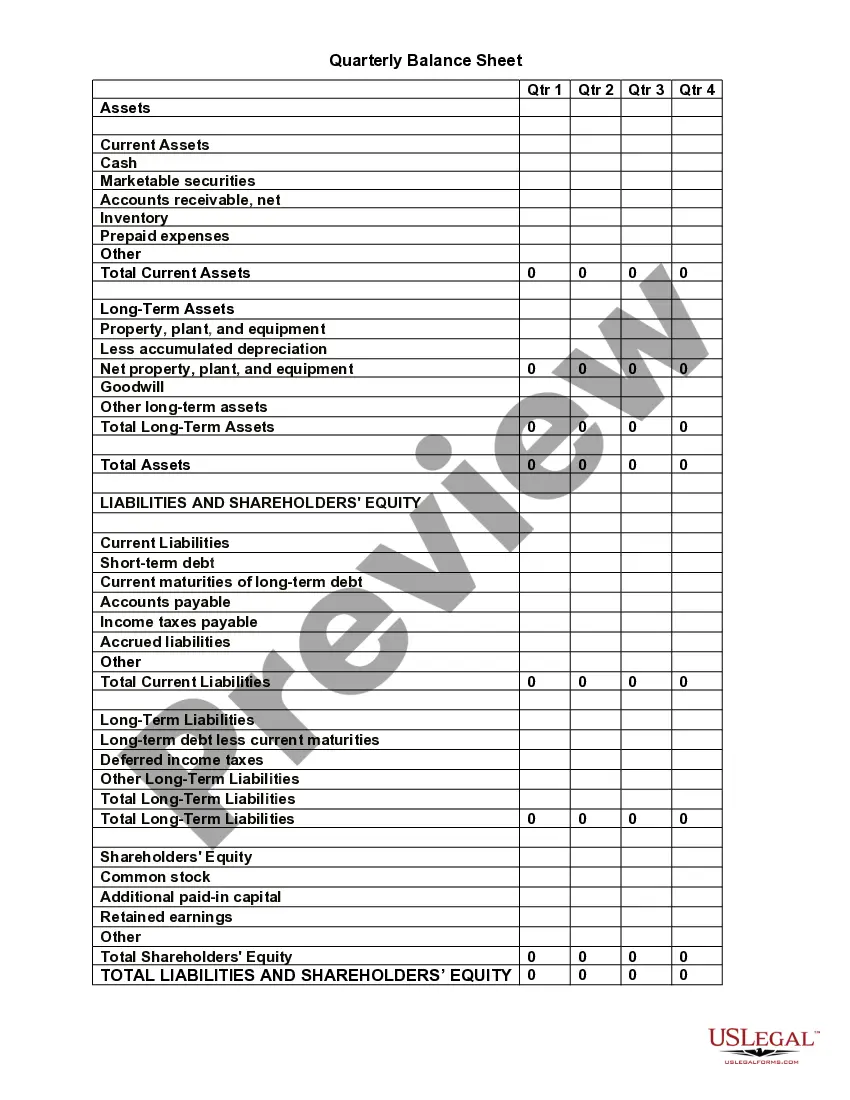

Nevada Yearly Expenses by Quarter

Description

How to fill out Yearly Expenses By Quarter?

Selecting the correct sanctioned document template could be a challenging task.

Indeed, there are numerous templates available on the web, but how can you acquire the sanctioned form you seek.

Utilize the US Legal Forms website. The platform offers an extensive array of templates, including the Nevada Yearly Expenses by Quarter, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the form summary to confirm it is suitable for you.

- All forms have been reviewed by professionals and comply with state and federal regulations.

- If you are already authorized, sign in to your account and click the Download button to retrieve the Nevada Yearly Expenses by Quarter.

- Use your account to review the legal forms you have previously obtained.

- Navigate to the My documents tab in your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure that you have selected the appropriate form for your city/county.

Form popularity

FAQ

The biggest areas of expenditures are in the core functions of health and human services ($13.1 billion, roughly 44.5 percent of the budget), education ($7.1 billion, or about 24.2 percent of budget), and infrastructure ($2.6 billion, around 8.9 percent of the budget).

Nevada runs on sales tax. In Nevada, 58% of tax revenue came from general sales tax, 24.4% from selective sales tax, 6.7% from licenses, 3.7% from property tax, 1.3% from severance and 7.9% from other tax sources.

Nevada runs on sales tax. In Nevada, 58% of tax revenue came from general sales tax, 24.4% from selective sales tax, 6.7% from licenses, 3.7% from property tax, 1.3% from severance and 7.9% from other tax sources.

Nevada enacted its FY 2022-2023 biennial budget in June 2021. The enacted budget included total spending of $23 billion in FY 2022 and $21.9 billion in FY 2023, and general fund spending of $4.6 billion in FY 2022 and $4.6 billion in FY 2023.

The table below notes what share of Nevada's general revenues came from the federal government in 2014. That year, Nevada received approximately $2.8 billion in federal aid, 24.8 percent of the state's general revenues.

Nevada's constitution requires that the State have a balanced budget, which means it cannot deficit spend. As soon as it becomes apparent Nevada's budget is becoming unbalanced, such as when revenues fall short of projections, adjustments must be made to keep the state operating in the black.

Nevada enacted its FY 2022-2023 biennial budget in June 2021. The enacted budget included total spending of $23 billion in FY 2022 and $21.9 billion in FY 2023, and general fund spending of $4.6 billion in FY 2022 and $4.6 billion in FY 2023.

The total estimated government spending in Nevada in fiscal year 2016 was $11.5 billion. Per-capita figures are calculated by taking the state's total spending and dividing by the number of state residents according to United States Census Bureau estimates.

Slightly more than two-thirds (67 percent) of the General Fund finances two departments: the Department of Health and Human Services accounts for 31.2 percent of the General Fund, and the Department of Education accounts for 35.8 percent of the General Fund.

Nevada's General Fund revenues are derived from several sources. Sales and Use Taxes make up the largest source of revenue in the General Fund and the State 2% Sales Tax the largest major fund source, at approximately $2.6 billion over the biennium, for 29.0 percent of the total.