Nevada Relocation Expense Agreement

Description

How to fill out Relocation Expense Agreement?

Are you presently in a location where you need documentation for either business or personal purposes almost every time.

There are numerous legitimate form templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of form templates, such as the Nevada Relocation Expense Agreement, designed to meet state and federal requirements.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nevada Relocation Expense Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify it corresponds to the correct city/county.

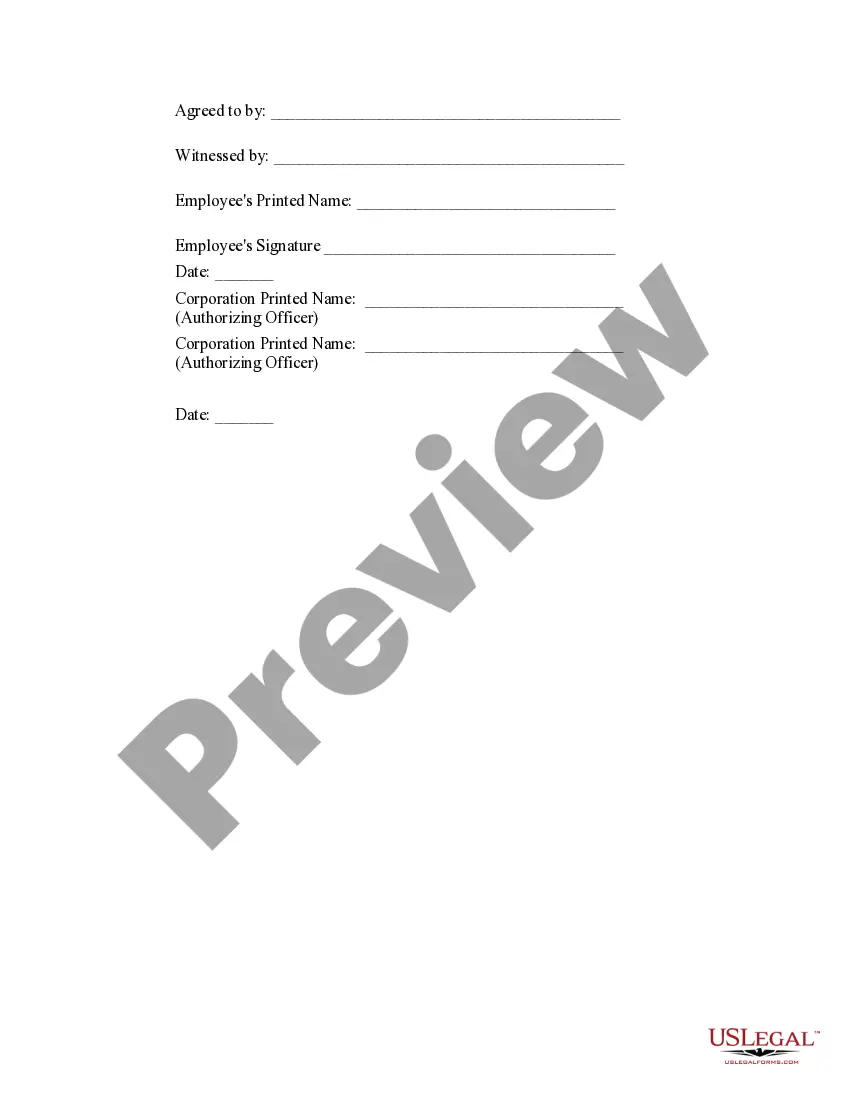

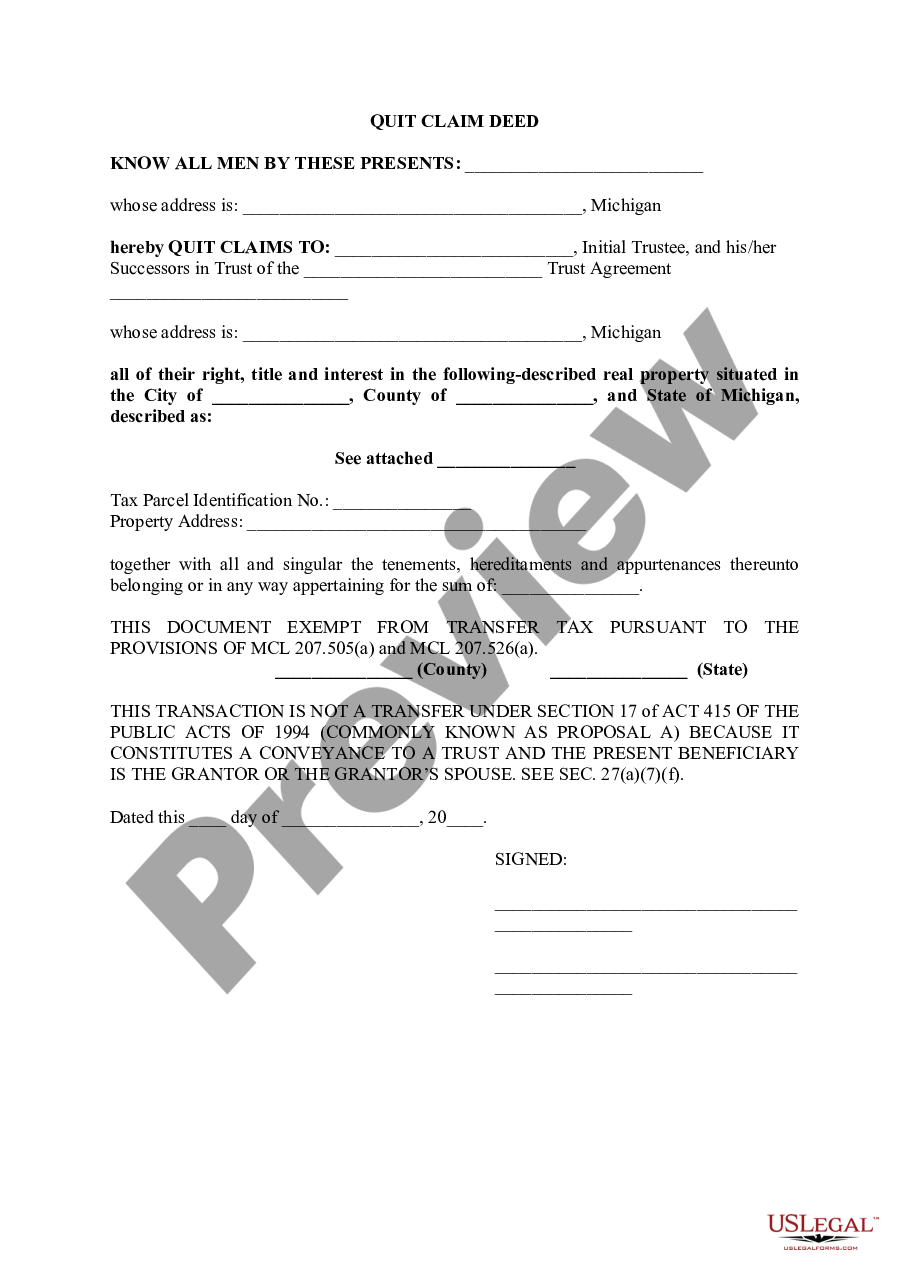

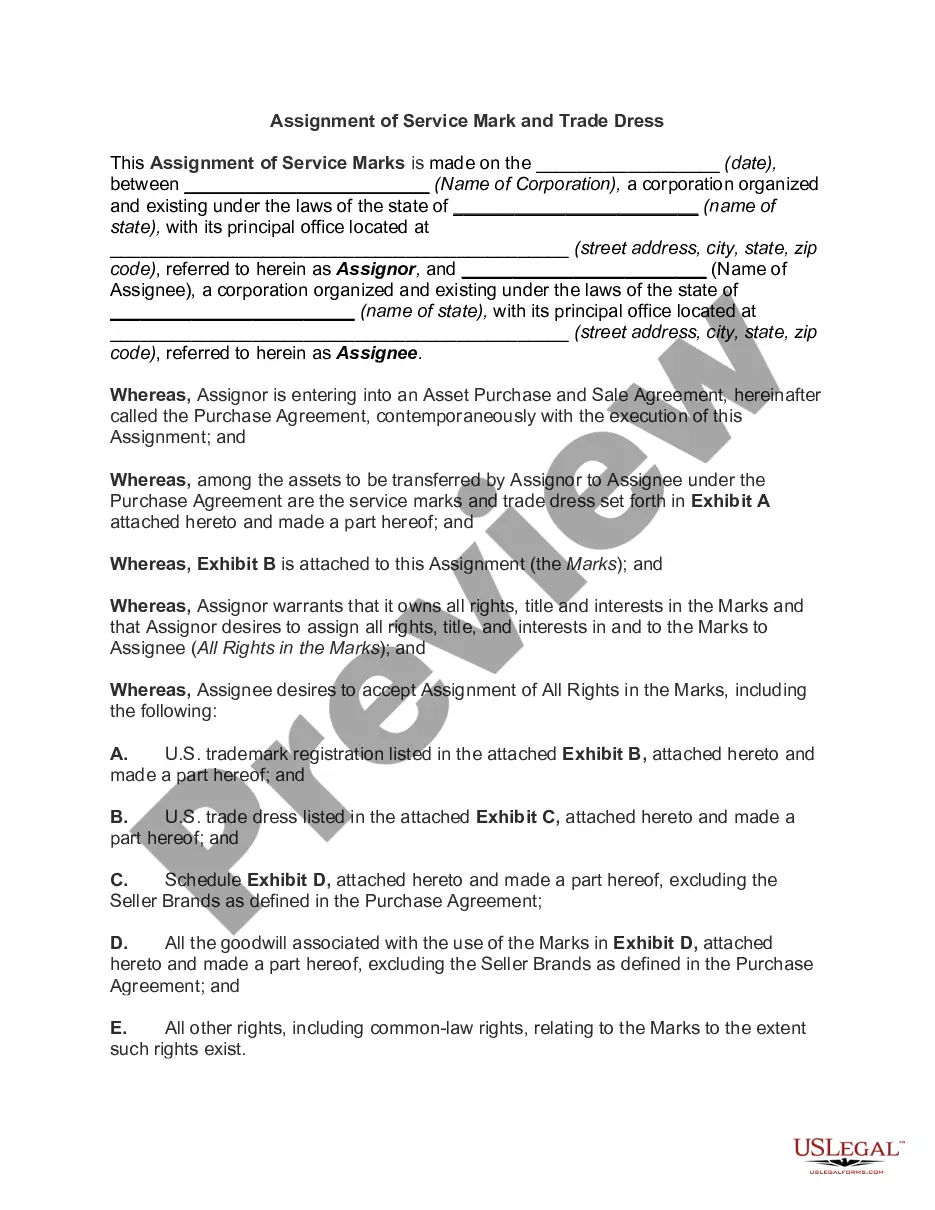

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

A Repayment Agreement is a legally enforceable contract stating that if the employee resigns or is terminated by the Company within a certain time frame following relocation, the employee agrees to repay the company any relocation expenses that were paid by the company.

Since it is legal, it is not a basis or ground to get out of the relocation agreement. Therefore, the stated reasonswork stress and quality of lifehave no bearing on the repayment obligation(s). If you have a relocation expenses repayment agreement, all you can do is stick it out until you can safely resign or quit.

A relocation agreement, sometimes referred to as an employee relocation agreement, is a legal contract executed by an employer and an employee in which the employer agrees to compensate an employee for relocating for business purposes.

If there was no contractual agreement to repay, you would not have to pay your employer for relocation costs. If there was a contract requiring reimbursement of relocation expense, such an agreement is valid and enforceable and you would be contractually obligated to repay the expenses.

How much do employers spend on employee relocation options?Travel to the new location.Packing and moving service costs.Moving insurance.Short-term housing.Storage units or other temporary storage solutions.Home sale or purchase.Tax gross up for benefits.Relocation taxes.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Most relocation contracts require you to work for the new company for one to two years, and repay if you voluntarily leave, or are fired for cause.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.