Nevada Employment Firm Audit

Description

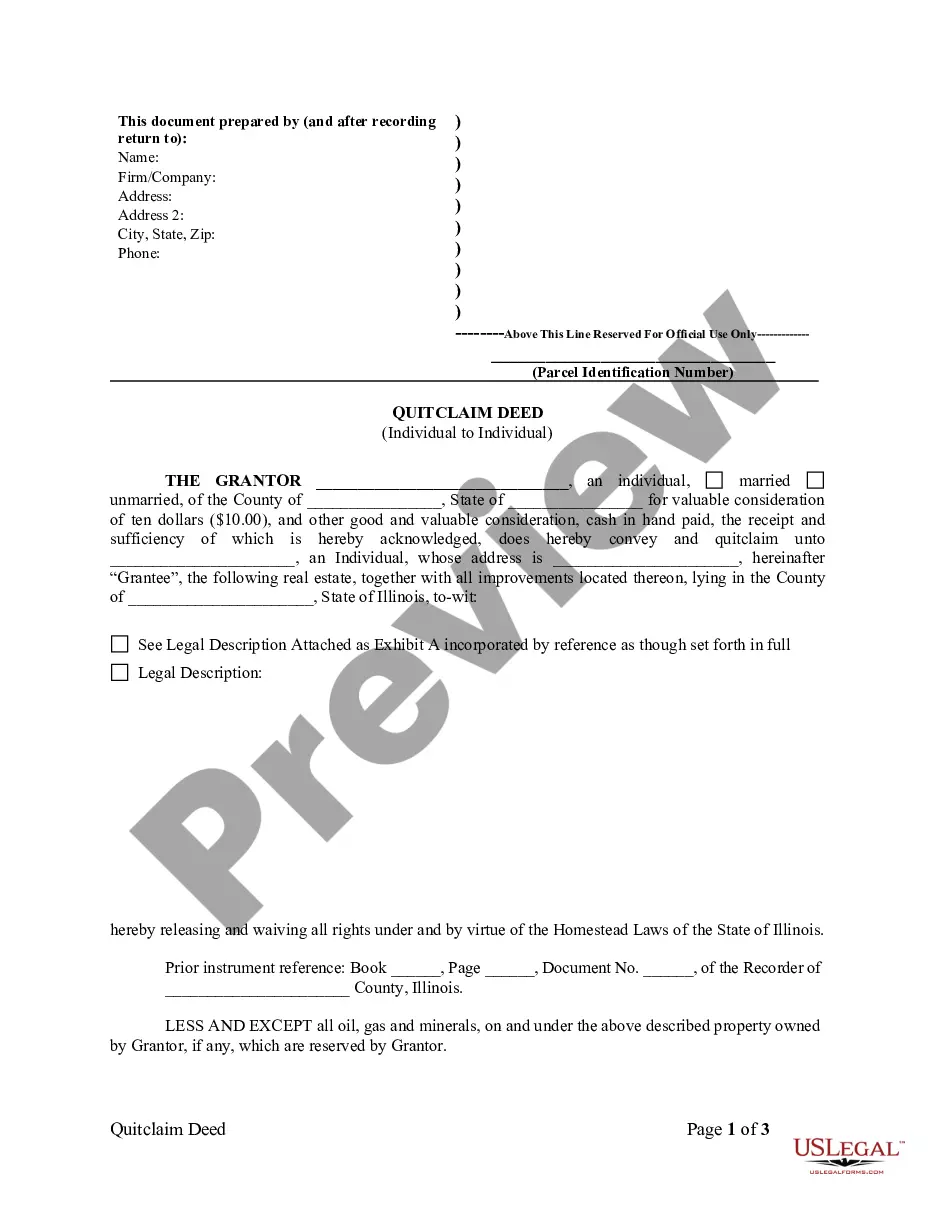

How to fill out Employment Firm Audit?

You could spend many hours online searching for the approved document format that satisfies the state and federal requirements you seek.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can conveniently access or create the Nevada Employment Firm Audit through the service.

If available, utilize the Review button to examine the format as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, alter, create, or sign the Nevada Employment Firm Audit.

- Every legal document format you acquire is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions outlined below.

- First, ensure you have selected the correct format for the area/city you choose.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

The 24-hour rule in Nevada refers to the requirement for employers to provide employees with at least 24 hours of rest between shifts. This rule helps promote work-life balance and protects employee rights. Ensuring you follow this regulation is vital, especially during a Nevada Employment Firm Audit, to maintain compliance and avoid potential penalties.

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

A job audit is a formal procedure in which a compensation professional meets with the manager and employee to discuss and explore the position's current responsibilities.

Who is eligible for Nevada Unemployment Insurance?Unemployed, and.Worked in Nevada during the past 12 months (this period may be longer in some cases), and.Earned a minimum amount of wages determined by Nevada guidelines, and.Actively seeking work each week you are collecting benefits.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

Collecting Unemployment After Being FiredIf you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if you were fired for misconduct relating to your job, you won't be eligible for benefits.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

In Nevada, however, you will be disqualified from receiving benefits for a period of time if you were fired for criminal activity, deliberately disregarding your employer's rules, or carelessness to an extent that demonstrates substantial disregard for your employer's interests.

Collecting Unemployment After Being Fired If, for example, you deliberately disregarded your employer's reasonable rules or policies, or you were so careless on the job as to demonstrate a substantial disregard of your employer's interests or your job duties, you will be disqualified.

Your weekly benefit entitlement is calculated by taking a percentage of your earnings in the quarter in which you earned the most during your base period. There is no minimum weekly payment, but the maximum you can receive in unemployment benefits in Nevada per week is $469.