The Nevada Model Statement of ERICA Rights is a legal document that outlines the rights and protections provided by the Employee Retirement Income Security Act (ERICA) in the state of Nevada. ERICA is a federal law that governs employee benefit plans, such as pension plans and health insurance plans, offered by private employers. The Nevada Model Statement of ERICA Rights is designed to inform employees about their rights and ensure that they have access to important information regarding their benefits. It is typically provided to employees when they enroll in an employee benefit plan or upon request. The statement includes detailed information on various aspects of ERICA rights, highlighting key provisions and protections. Some relevant keywords associated with the Nevada Model Statement of ERICA Rights include: 1. ERICA: Employee Retirement Income Security Act, a federal law that governs employee benefit plans. 2. Employee benefit plans: Refers to the various benefit plans provided by employers, such as pension plans, health insurance plans, and disability plans. 3. Rights and protections: Ensuring employees are aware of their rights under ERICA and the protections provided to them. 4. Disclosure requirements: Outlining the employers' obligation to provide employees with information regarding their employee benefit plans, including plan features, funding, and management. 5. Fiduciary responsibilities: Explaining the responsibilities of plan administrators, fiduciaries, and trustees in managing and safeguarding employee benefit plans. 6. Claims and appeals process: Detailing the procedure employees must follow when filing claims for benefits or appealing denied claims. 7. Plan documents and summaries: Informing employees about the availability of plan documents, such as the Summary Plan Description (SPD), and their right to review them. 8. Vesting and eligibility: Describing the criteria for becoming eligible to participate in the employee benefit plan and the rights employees acquire upon vesting. 9. Qualified domestic relations orders (QDR Os): Discussing the rules and procedures for dividing retirement benefits in case of divorce or separation. 10. Prohibited transactions: Highlighting transactions that are considered prohibited under ERICA and the potential penalties or consequences. It is important to note that the Nevada Model Statement of ERICA Rights may vary slightly depending on the specific requirements set forth by the state. Different types or versions of the statement may exist due to amendments or updates made to the original model statement. Employers should ensure they provide the most up-to-date and state-specific version to their employees to comply with Nevada's regulations.

Nevada Model Statement of ERISA Rights

Description

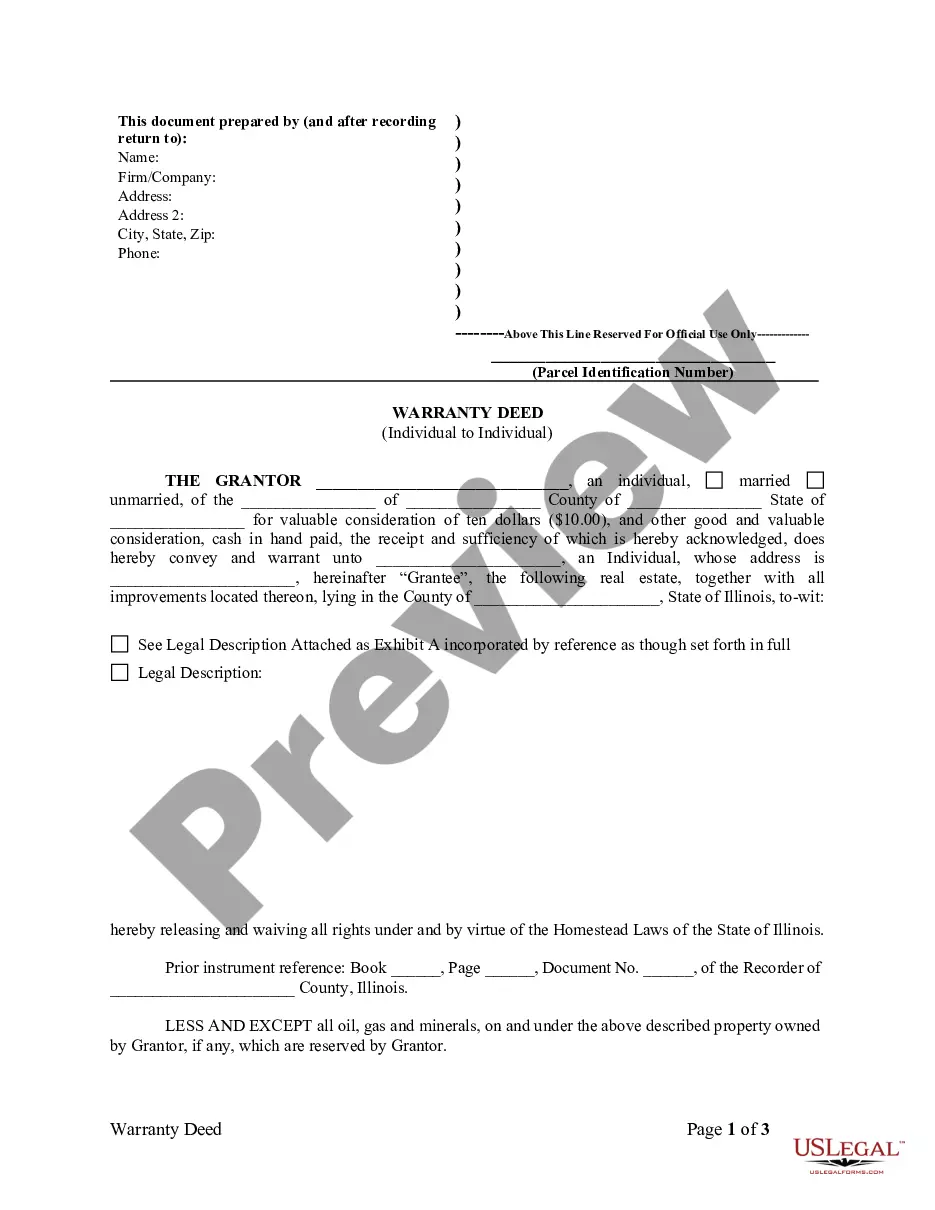

How to fill out Nevada Model Statement Of ERISA Rights?

If you need to total, acquire, or print out legitimate record templates, use US Legal Forms, the largest assortment of legitimate forms, which can be found on the web. Make use of the site`s simple and easy handy look for to obtain the papers you want. Various templates for business and individual purposes are sorted by types and says, or search phrases. Use US Legal Forms to obtain the Nevada Model Statement of ERISA Rights in a few mouse clicks.

When you are previously a US Legal Forms customer, log in to the bank account and then click the Obtain switch to get the Nevada Model Statement of ERISA Rights. You can even entry forms you formerly downloaded in the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that appropriate city/region.

- Step 2. Utilize the Review choice to examine the form`s content material. Never overlook to learn the outline.

- Step 3. When you are not happy using the develop, use the Search area towards the top of the display to discover other variations from the legitimate develop format.

- Step 4. Once you have identified the form you want, select the Get now switch. Select the pricing plan you choose and include your accreditations to register for the bank account.

- Step 5. Procedure the purchase. You should use your credit card or PayPal bank account to complete the purchase.

- Step 6. Pick the format from the legitimate develop and acquire it in your gadget.

- Step 7. Total, revise and print out or indication the Nevada Model Statement of ERISA Rights.

Each legitimate record format you purchase is yours forever. You possess acces to every develop you downloaded inside your acccount. Click on the My Forms area and select a develop to print out or acquire once more.

Remain competitive and acquire, and print out the Nevada Model Statement of ERISA Rights with US Legal Forms. There are many expert and state-specific forms you can utilize for your personal business or individual requirements.

Form popularity

FAQ

IRS language refers to a "basic plan document when describing the part of the document that contains the non-optional required provisions of the Employee Retirement Income Security Act and the Internal Revenue Code. Please refer to this document when interpreting your adoption agreement provisions.

Written Plan Document.An employee welfare benefit plan under ERISA must have a written plan document containing all of the terms governing the plan. A written contract of insurance with an insurance company does not normally contain all of the rules required by ERISA and is therefore not a plan document.

Understanding the Summary Plan Description When you are first hired, you should receive an SPD covering your new employer's health care and retirement benefits within 90 days. The company may distribute the document to you electronically if you regularly use a computer at work or as a hard copy.

What Does ERISA Cover? Plans that are covered under ERISA include employer-sponsored retirement plans, such as 401(k)s, pensions, deferred compensation plans, and profit-sharing plans. ERISA also covers certain non-retirement plans like HMOs, FSAs, disability insurance, and life insurance.

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

The summary plan description is an important document that tells participants what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan and how to file a claim for benefits.

The Employee Retirement Income Security Act (ERISA) requires plan administrators to give to participants and beneficiaries a Summary Plan Description (SPD) describing their rights, benefits, and responsibilities under the plan in understandable language. The SPD includes such information as: Name and type of plan.

A Summary Plan Description (SPD) is a document that employers must give free to employees who participate in Employee Retirement Income Security Act-covered retirement plans or health benefit plans. The SPD is a detailed guide to the benefits the program provides and how the plan works.

The plan document should contain:Name of the plan administrator. Designation of any named fiduciaries other than the plan administrator under the claims procedure for deciding benefit appeals. A description of the benefits provided. The standard of review for benefit decisions.

When and to whom must the SPD be given? The employer must distribute the SPD to all eligible employees within 120 days of adopting the retirement plan.