The Nevada Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows individuals in Nevada to decline the standard retirement plan offered by their employer, which typically includes a lifetime income stream for both the retiree and their spouse. By waiving the JSA, individuals can choose alternative payment options that better suit their needs, potentially providing them with greater financial flexibility. The JSA is primarily intended to protect the spouse of a retiree by ensuring they receive a portion of the retirement benefit in the event of the retiree's death. However, some individuals may have reasons to opt for a different payment arrangement, such as not having a spouse, having a significantly younger spouse, or desiring a higher income during their retirement years. One type of Nevada Waiver of Qualified Joint and Survivor Annuity is the "Single Life Annuity" option, which provides the retiree with a higher monthly payment for their lifetime but does not guarantee any benefits for their spouse after their death. This option is suitable for individuals who do not have a spouse or are comfortable with the possibility of their spouse not receiving any post-retirement income. Another type is the "Pop-Up Annuity," which functions like a Single Life Annuity but offers a modified provision. In the event the retiree's spouse outlives them, the spouse will receive the full monthly benefit for the remainder of their life. This option can be beneficial for individuals who want to ensure their spouse is financially supported if they survive them. Furthermore, the "Term-Certain Annuity" is a variation of the JSA that allows the retiree to receive payments for a specified period, typically between ten and twenty years. If the retiree passes away before the term ends, their beneficiary or estate will continue receiving the remaining payments until the term concludes. This option provides a way to secure income for a fixed time frame, making it suitable for those who desire a specific income stream or have a pre-determined financial goal. Nevada's residents considering the Nevada Waiver of Qualified Joint and Survivor Annuity should carefully assess their individual circumstances and consult with a financial advisor or retirement expert to determine which option best aligns with their needs. It is crucial to consider factors such as marital status, age gap with a spouse, financial obligations, and long-term goals to make an informed decision that ensures financial security throughout retirement.

Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

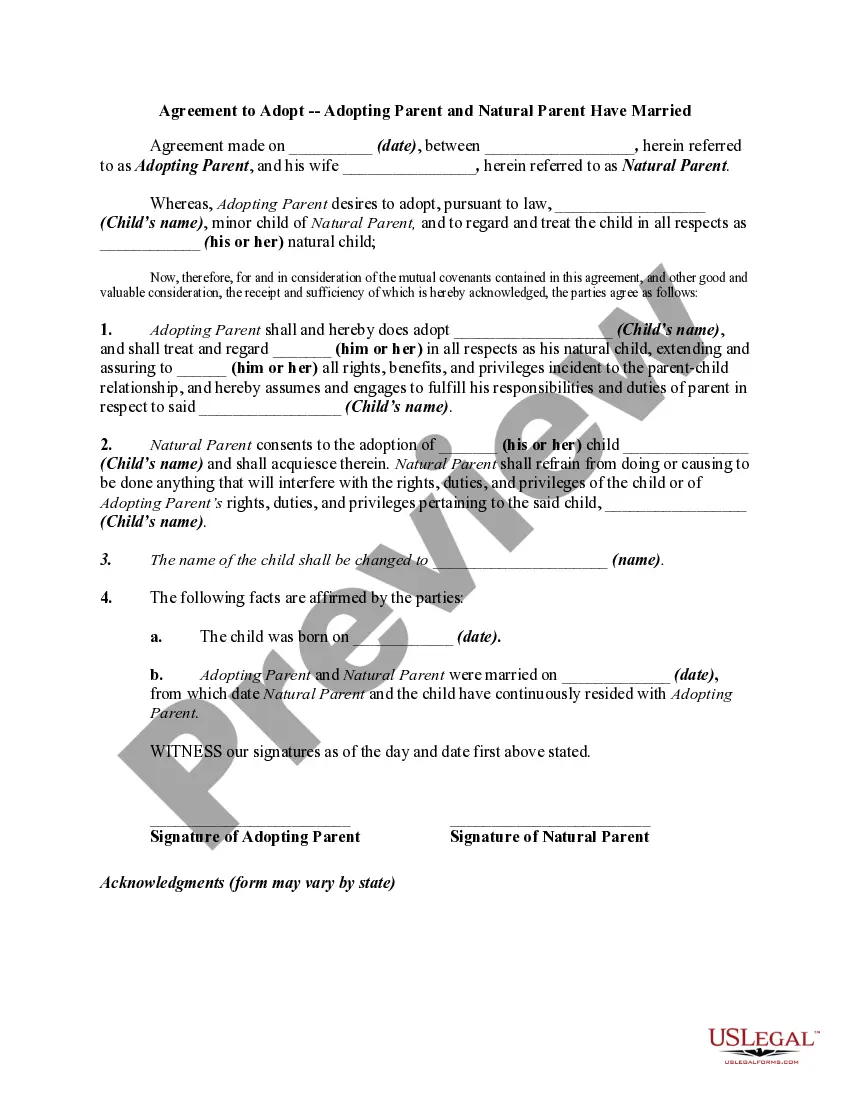

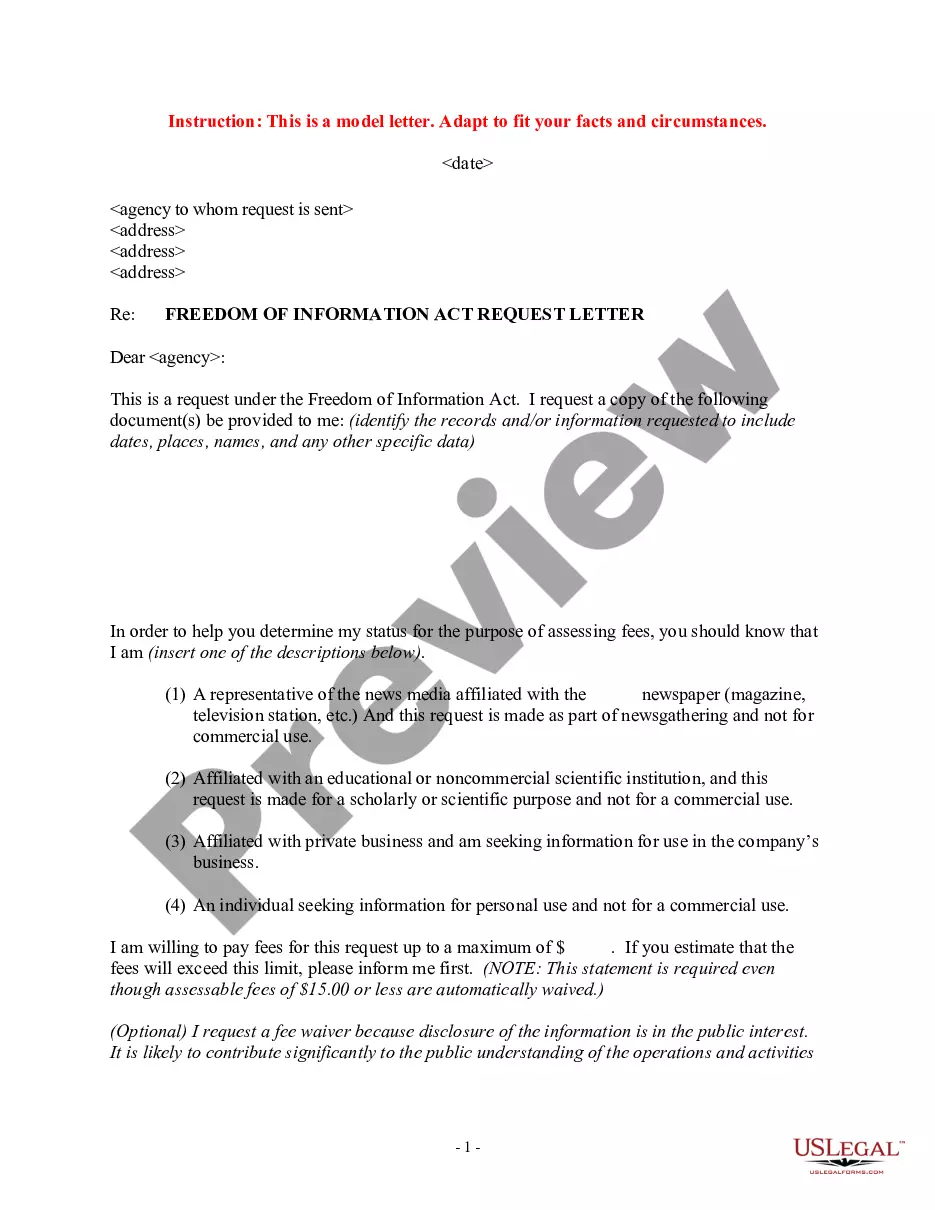

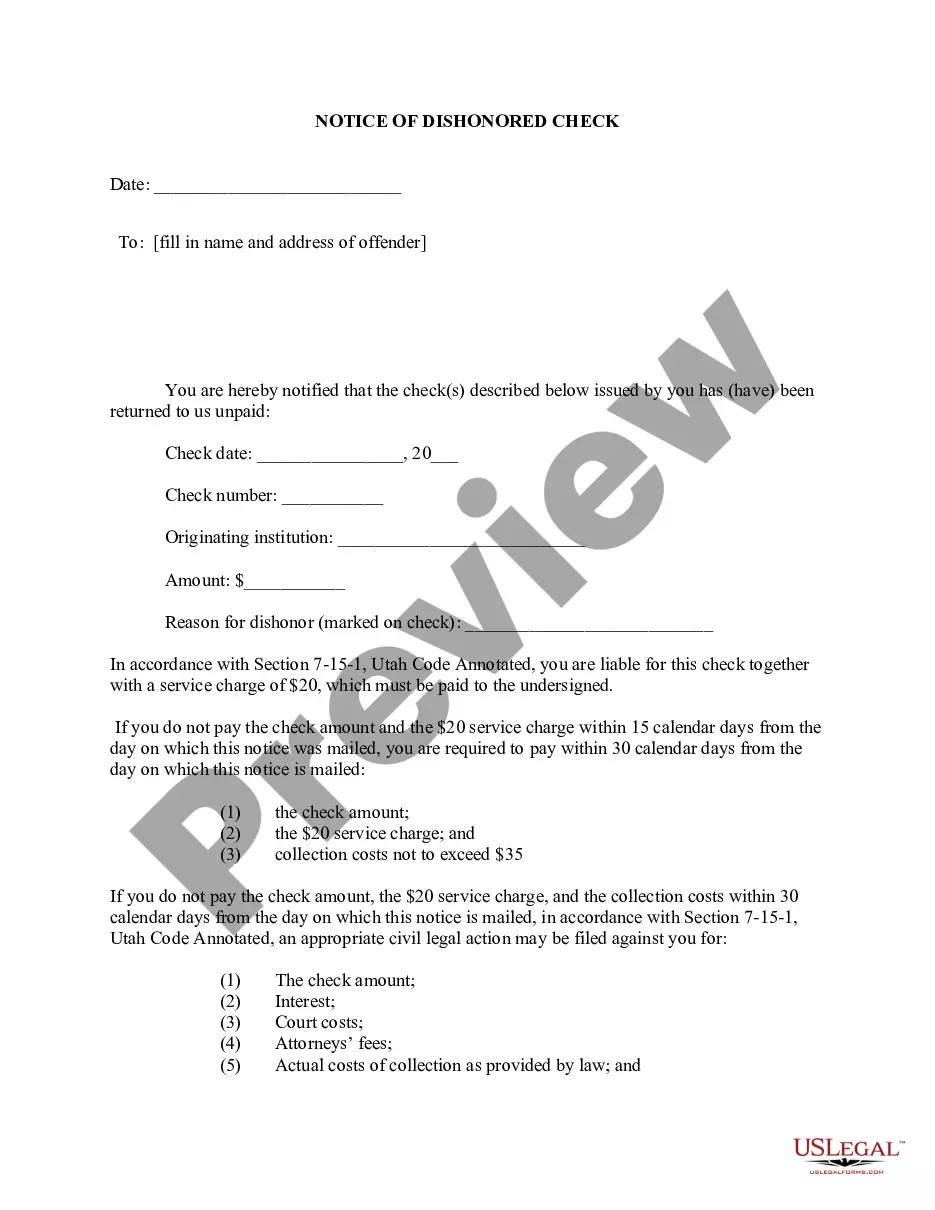

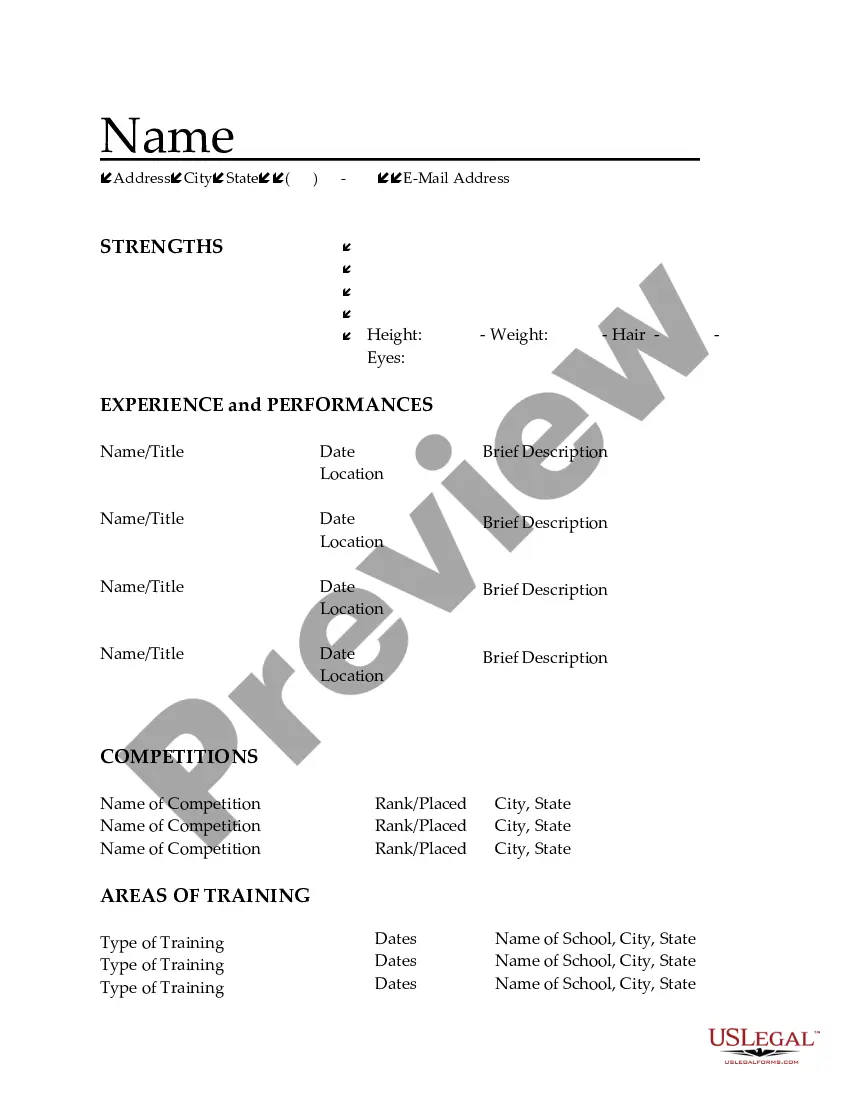

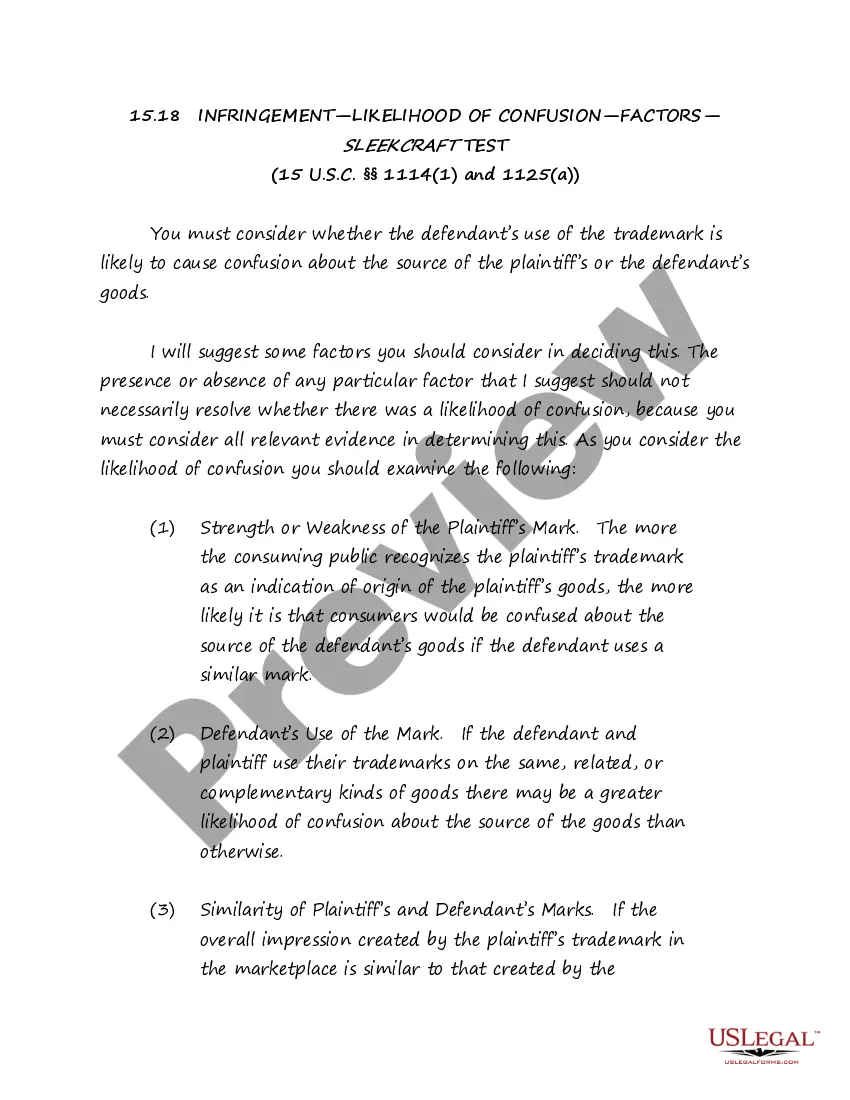

How to fill out Nevada Waiver Of Qualified Joint And Survivor Annuity - QJSA?

Are you currently within a situation in which you need papers for possibly organization or personal functions just about every day time? There are tons of legitimate document web templates accessible on the Internet, but getting versions you can trust is not simple. US Legal Forms offers a huge number of type web templates, like the Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA, which are written in order to meet state and federal demands.

When you are previously acquainted with US Legal Forms web site and have your account, simply log in. Afterward, it is possible to acquire the Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA format.

Unless you provide an account and wish to start using US Legal Forms, abide by these steps:

- Obtain the type you want and ensure it is for that right town/state.

- Take advantage of the Preview key to examine the form.

- Read the information to actually have selected the correct type.

- When the type is not what you`re seeking, make use of the Lookup discipline to find the type that fits your needs and demands.

- Once you obtain the right type, simply click Purchase now.

- Pick the rates strategy you would like, submit the required information to produce your money, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Pick a practical paper structure and acquire your version.

Locate each of the document web templates you possess purchased in the My Forms menus. You can obtain a further version of Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA at any time, if required. Just select the essential type to acquire or print the document format.

Use US Legal Forms, one of the most considerable collection of legitimate forms, to conserve time as well as steer clear of blunders. The assistance offers appropriately created legitimate document web templates which can be used for a selection of functions. Make your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.