Determining the self-employed contractor status in Nevada is a crucial aspect of ensuring compliance with state regulations and determining the tax obligations of individuals working as independent contractors. This comprehensive process involves evaluating various factors and meeting specific criteria to correctly classify an individual's employment status. One important consideration in determining self-employed contractor status in Nevada is the level of control exerted over the worker by the hiring entity. The Nevada Labor Commissioner examines the degree of control exercised by the employer to assess if the worker has the freedom to control how, when, where, and with what tools they perform their work. This evaluation helps determine if the worker is truly self-employed or if they should be classified as an employee. Another aspect considered is the worker's opportunity for profit or loss. Independent contractors generally have the ability to make a profit on their work or may bear the risk of financial loss depending on their business decisions. This analysis involves assessing if the worker has a substantial investment in their equipment, tools, or facilities, and if they have the opportunity to provide services to multiple clients. The permanency and exclusivity of the working relationship are also taken into account. If the worker is hired for a specific project with a defined scope and duration, it is more likely that they would be classified as an independent contractor. On the other hand, individuals who work exclusively for one company and have a long-term or permanent relationship may lean towards being classified as employees. Nevada recognizes multiple types of self-employed contractor statuses, each with its own specific criteria and regulations. These include: 1. Independent Contractor: Individuals who are in business for themselves, perform services for other businesses, and have full control over how, when, and where they perform their work. They typically operate as a separate legal entity and are responsible for their own taxes and business expenses. 2. Sole Proprietor: Self-employed individuals who operate their own businesses as individuals and are responsible for all aspects of their business operations. They may or may not hire employees, but they retain full control over their work and are personally liable for any debts or obligations. 3. Limited Liability Company (LLC): An LLC is a legal structure that provides the benefits of both a corporation and a sole proprietorship or partnership. Owners, known as members, enjoy limited personal liability while still maintaining the flexibility and tax advantages of being self-employed. It is important for employers and workers alike to understand the criteria and guidelines established by the Nevada Labor Commissioner to accurately determine self-employed contractor status. This knowledge ensures compliance with the state's laws and helps protect the rights and obligations of both parties involved.

Nevada Determining Self-Employed Contractor Status

Description

How to fill out Nevada Determining Self-Employed Contractor Status?

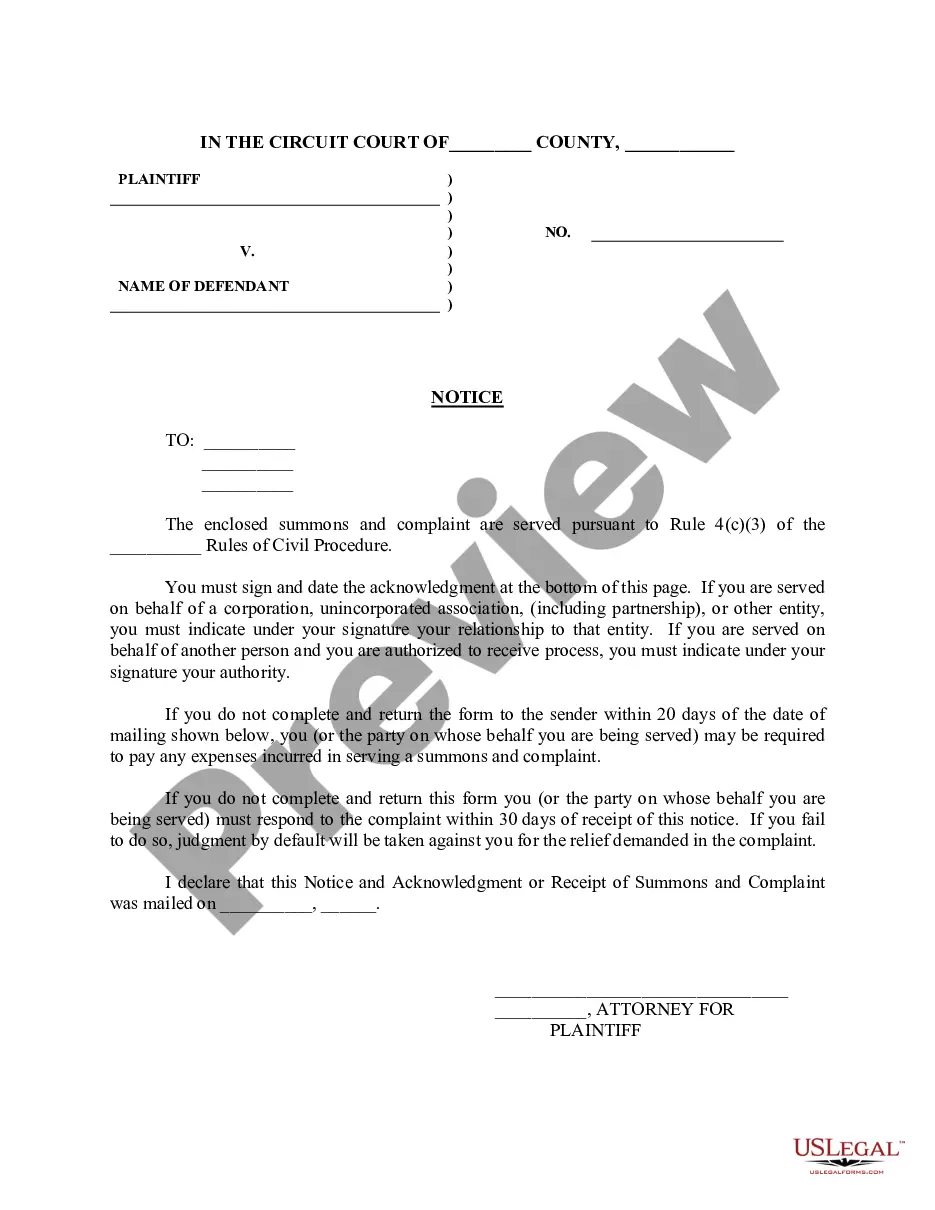

Are you presently in the placement in which you will need files for both enterprise or personal functions just about every day? There are plenty of authorized papers web templates available online, but finding types you can depend on is not straightforward. US Legal Forms delivers a huge number of develop web templates, like the Nevada Determining Self-Employed Contractor Status, that happen to be composed in order to meet state and federal specifications.

If you are already acquainted with US Legal Forms internet site and also have a merchant account, just log in. Afterward, it is possible to down load the Nevada Determining Self-Employed Contractor Status design.

Should you not provide an bank account and need to begin to use US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for the appropriate area/county.

- Use the Preview option to analyze the form.

- Read the description to ensure that you have chosen the correct develop.

- In the event the develop is not what you are searching for, take advantage of the Lookup industry to discover the develop that fits your needs and specifications.

- Once you get the appropriate develop, just click Buy now.

- Pick the pricing plan you would like, complete the necessary information to make your money, and buy your order making use of your PayPal or charge card.

- Choose a practical file file format and down load your duplicate.

Get all the papers web templates you possess bought in the My Forms menus. You may get a extra duplicate of Nevada Determining Self-Employed Contractor Status any time, if necessary. Just select the needed develop to down load or produce the papers design.

Use US Legal Forms, one of the most comprehensive selection of authorized varieties, to save time as well as prevent faults. The support delivers professionally produced authorized papers web templates which can be used for a selection of functions. Make a merchant account on US Legal Forms and start generating your life a little easier.