Nevada Guardianship Expenditures refer to the various costs and expenses associated with the guardianship process in the state of Nevada. When someone is appointed as a guardian for an individual who is unable to make decisions and care for themselves, they are responsible for managing their finances and ensuring their well-being. As guardianship involves a range of responsibilities, there are different types of expenditures associated with this legal arrangement. One prominent type of Nevada Guardianship Expenditure is the cost of legal fees. When establishing a guardianship, it is crucial to consult with an attorney who specializes in elder law or guardianship matters. These legal professionals guide individuals through the complex legal process, including filing the necessary court documents and representing their interests before the court. Legal fees are an important expenditure to consider when embarking on the guardianship journey. Another notable expenditure involves the fees associated with filing the required court documents. These fees may vary depending on the county where the guardianship is being established. Guardians need to pay filing fees when submitting their initial petition for guardianship and other related documents throughout the process. It's essential to budget for these expenses to ensure a smooth guardianship proceeding. Alongside legal and court fees, Nevada Guardianship Expenditures also encompass costs associated with handling the ward's financial affairs. Guardians are accountable for managing the ward's assets, paying bills, and making financial decisions on their behalf. They may bear expenses related to maintaining the ward's property, paying utility bills, taxes, insurance premiums, and other essential costs. Keeping meticulous records of these expenditures is important to ensure transparency and accountability. Additionally, guardians may have to allocate funds for the ward's healthcare expenses. This can involve payment for medical consultations, medication, hospital bills, and other healthcare-related costs. The guardian must prioritize the well-being of the ward and ensure they receive adequate medical care, which may result in additional expenditures. Lastly, if the ward requires professional services such as caregiving, therapy, or assisted living accommodations, the guardian may need to allocate funds to cover these expenses. Each ward's needs are unique, and accordingly, the expenditures can vary significantly. In summary, Nevada Guardianship Expenditures encompass a range of costs and expenses associated with both the legal aspects and the day-to-day responsibilities of a guardian. These expenditures may include legal fees, court filing fees, financial management expenses, healthcare costs, and other types of required professional services. Guardians should be prepared to handle these expenditures responsibly to ensure the best interests of the ward and comply with legal obligations.

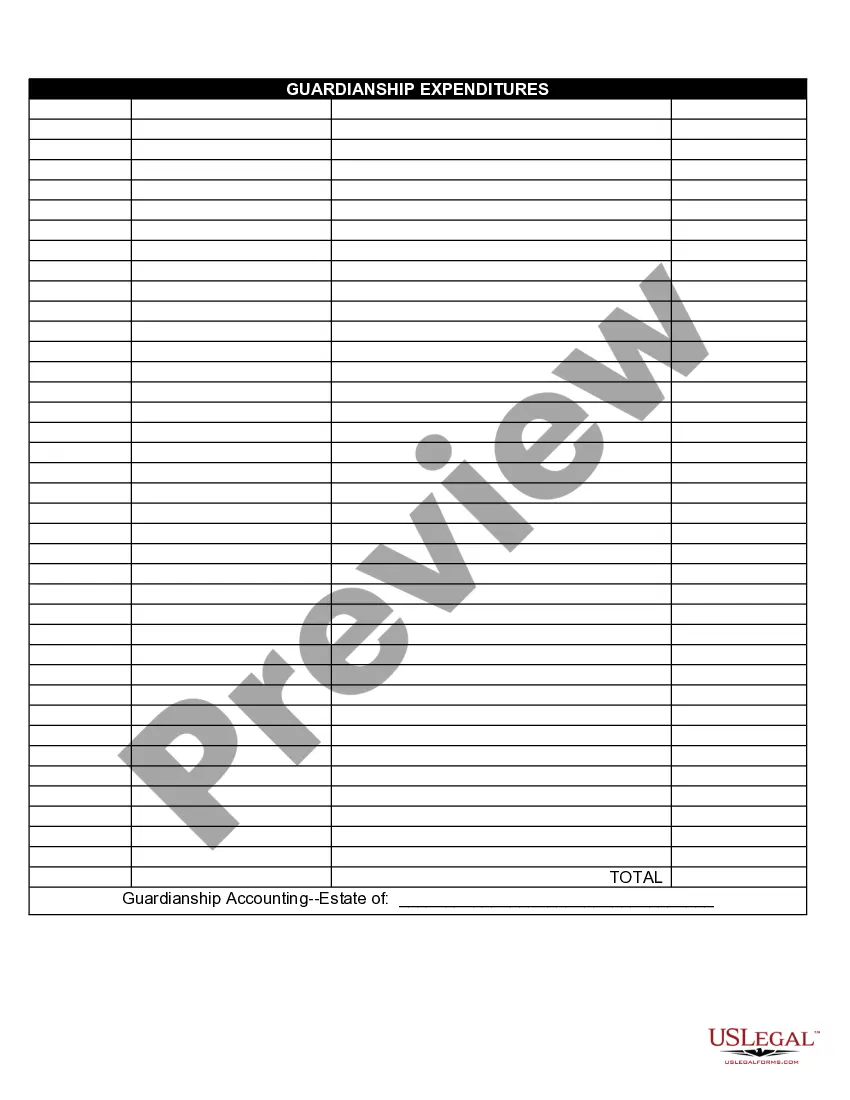

Nevada Guardianship Expenditures

Description

How to fill out Nevada Guardianship Expenditures?

US Legal Forms - one of the largest libraries of legal kinds in the States - provides a variety of legal papers themes it is possible to down load or print out. Using the web site, you may get a huge number of kinds for business and personal uses, categorized by groups, states, or key phrases.You will find the latest models of kinds just like the Nevada Guardianship Expenditures in seconds.

If you currently have a registration, log in and down load Nevada Guardianship Expenditures from the US Legal Forms local library. The Download switch will show up on each kind you perspective. You get access to all previously acquired kinds inside the My Forms tab of your account.

In order to use US Legal Forms the very first time, listed below are basic instructions to help you started:

- Be sure you have chosen the proper kind to your city/county. Go through the Preview switch to analyze the form`s content. Browse the kind explanation to ensure that you have chosen the proper kind.

- If the kind doesn`t suit your demands, make use of the Look for industry towards the top of the display screen to find the one which does.

- When you are pleased with the shape, affirm your choice by visiting the Acquire now switch. Then, choose the pricing prepare you like and offer your qualifications to sign up to have an account.

- Procedure the transaction. Make use of bank card or PayPal account to finish the transaction.

- Select the structure and down load the shape on the gadget.

- Make alterations. Fill out, edit and print out and sign the acquired Nevada Guardianship Expenditures.

Each and every web template you added to your account lacks an expiration time and is also your own permanently. So, if you would like down load or print out one more copy, just visit the My Forms segment and click about the kind you require.

Gain access to the Nevada Guardianship Expenditures with US Legal Forms, one of the most extensive local library of legal papers themes. Use a huge number of professional and condition-specific themes that fulfill your small business or personal requires and demands.