Nevada Self-Employed Independent Contractor Employment Agreement — Commission for New Business A Nevada Self-Employed Independent Contractor Employment Agreement is a legally binding contract that outlines the terms and conditions between a self-employed individual and a company for commission-based employment. This agreement applies specifically to the state of Nevada, ensuring compliance with state employment laws. Keywords: Nevada, self-employed, independent contractor, employment agreement, commission, new business 1. Purpose of Agreement: The purpose of this Nevada Self-Employed Independent Contractor Employment Agreement is to establish a mutual understanding between the self-employed individual, referred to as the contractor, and the company, regarding their professional relationship, commission structure, and responsibilities in generating new business. 2. Definition of Self-Employed Independent Contractor: As defined in this agreement, a self-employed independent contractor is an individual who operates their own business or works on a freelance basis. They are not considered an employee of the company and are responsible for managing their own taxes and insurance. 3. Commission for New Business: The primary earnings for the contractor will be based on a commission structure established for generating new business. The agreement should outline the percentage or amount of commission that the contractor will receive for each successful sale or acquired client. 4. Scope of Work: The agreement should clearly define the scope of work and responsibilities of the contractor in terms of generating new business. It may include prospecting, lead generation, sales presentations, client acquisition, or other related activities. 5. Payment Terms: The agreement must specify the payment terms, including when and how the commission will be paid. It should state whether the commission will be disbursed upon a successful sale, client payment, or any other agreed-upon conditions. 6. Non-Compete Clause: To protect the company's interests, a non-compete clause may be included in the agreement, preventing the contractor from engaging in similar business activities that directly compete with the company during the term of the agreement and within a specified geographical area. 7. Termination and Renewal: The agreement should outline the conditions under which either party can terminate the contract, such as breach of contract, failure to meet sales targets, or expiration of the agreed-upon term. It should also specify whether the agreement can be renewed or extended. Types of Nevada Self-Employed Independent Contractor Employment Agreement — Commission for New Business: 1. Real Estate Agent Commission Agreement: This type of agreement is specific to real estate agents who earn commissions based on successful property sales or client referrals. It may include additional clauses related to property listings, buyer representation, and compliance with real estate regulations. 2. Sales Representative Commission Agreement: Sales representatives often work as independent contractors and earn commissions based on successful sales transactions. This agreement may include specific provisions regarding sales territories, targets, and sales activity reporting. 3. Business Development Consultant Agreement: For individuals offering business development services, this type of agreement outlines the commission structure for securing new clients or generating business opportunities. Additional clauses may address lead generation techniques, marketing strategies, and confidentiality requirements. In conclusion, a Nevada Self-Employed Independent Contractor Employment Agreement — Commission for New Business is an essential document that defines the terms and conditions for self-employed individuals working on a commission basis in Nevada. It ensures a clear understanding between the contractor and the company regarding their responsibilities and financial arrangements, ultimately promoting a fair and mutually beneficial professional relationship.

Nevada Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

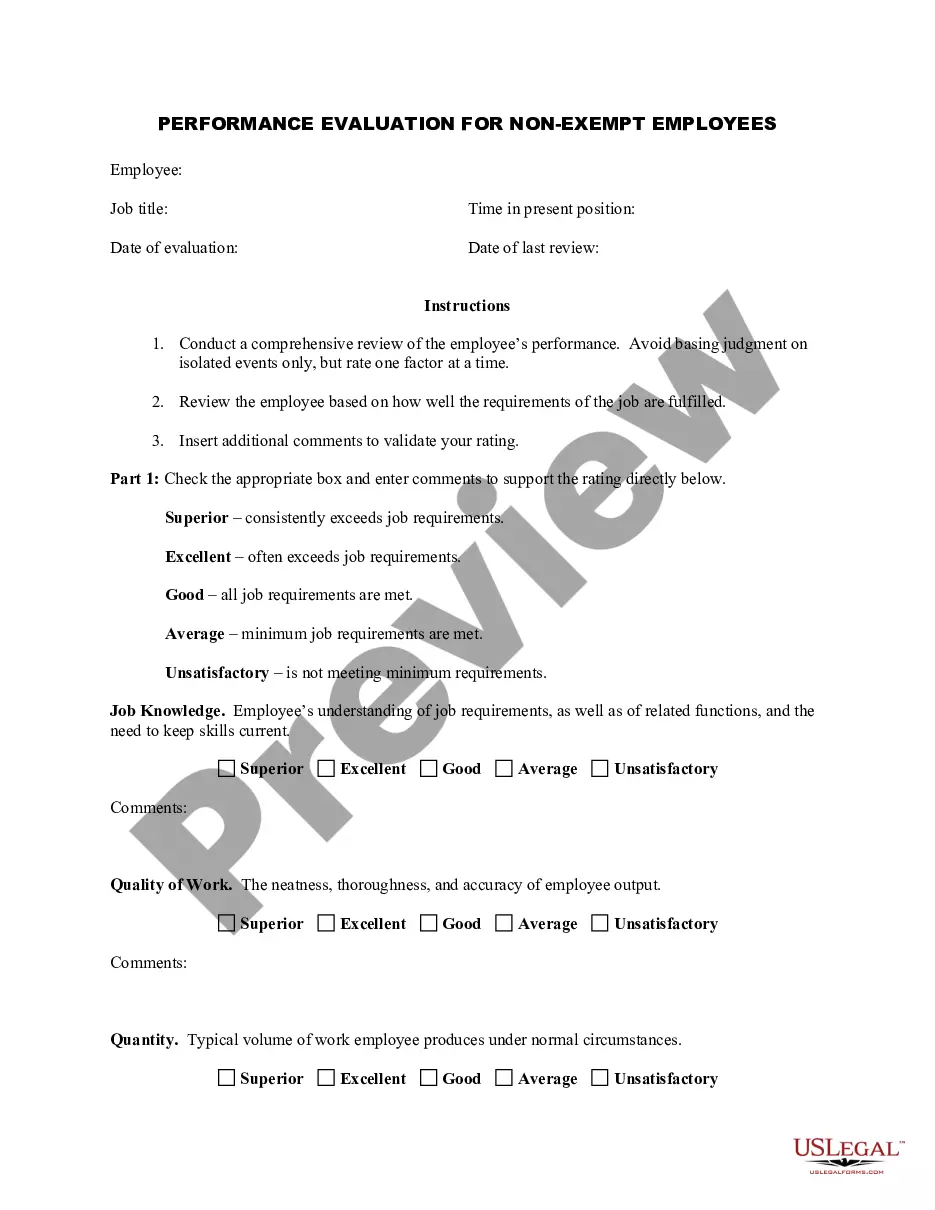

How to fill out Nevada Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Are you inside a place in which you need documents for possibly enterprise or individual functions just about every day? There are plenty of legal file themes available on the Internet, but discovering versions you can rely isn`t effortless. US Legal Forms offers a large number of form themes, just like the Nevada Self-Employed Independent Contractor Employment Agreement - commission for new business, that are composed to meet state and federal needs.

If you are currently informed about US Legal Forms site and also have a free account, merely log in. After that, it is possible to down load the Nevada Self-Employed Independent Contractor Employment Agreement - commission for new business design.

If you do not provide an profile and need to begin using US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for the appropriate town/state.

- Use the Preview option to examine the shape.

- Look at the outline to actually have selected the right form.

- In the event the form isn`t what you are searching for, use the Search area to obtain the form that meets your needs and needs.

- If you obtain the appropriate form, just click Purchase now.

- Select the prices strategy you need, fill out the desired information to produce your account, and pay for your order using your PayPal or Visa or Mastercard.

- Pick a hassle-free file file format and down load your version.

Locate all the file themes you might have purchased in the My Forms menus. You can obtain a additional version of Nevada Self-Employed Independent Contractor Employment Agreement - commission for new business whenever, if needed. Just go through the essential form to down load or print the file design.

Use US Legal Forms, one of the most extensive collection of legal forms, to save efforts and prevent mistakes. The services offers professionally made legal file themes which can be used for an array of functions. Make a free account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board. Contractors, including subcontractors and specialty contractors must be licensed before submitting bids.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.