Description: A Nevada Demand for Payment of Account by Business to Debtor is a formal document used by businesses in Nevada to request payment from a debtor who owes them money. When a debtor fails to fulfill their financial obligation, a business can send this demand letter to prompt immediate payment. This legally binding document outlines the specific details of the debt and provides a final opportunity for the debtor to settle the account before further legal action is pursued. Keywords: Nevada, Demand for Payment, Account, Business, Debtor, formal document, request payment, financial obligation, demand letter, legally binding, debt, settle, legal action. There are different types of Nevada Demand for Payment of Account by Business to Debtor, including: 1. Initial Demand for Payment: This type of demand letter is usually sent as an initial communication from the business to the debtor. It outlines the outstanding debt, provides a deadline for payment, and emphasizes the consequences that may result from non-payment. 2. Follow-up Demand for Payment: If the debtor fails to respond to the initial demand or does not make the payment within the specified timeframe, a follow-up demand letter may be sent. This letter serves as a reminder to the debtor, urging them to settle the account promptly or face potential legal consequences. 3. Final Demand for Payment: A final demand letter is typically the last attempt by the business to collect the debt before taking legal action. It emphasizes the seriousness of the situation and warns the debtor of the potential consequences, such as lawsuits, credit damage, or collection agency involvement. 4. Demand for Payment with Added Interest or Fees: In cases where the debt has been outstanding for an extended period, the demand letter may include the addition of interest or late payment fees. This serves as an incentive for prompt payment and compensates the business for the delay in receiving the funds owed. 5. Demand for Payment with Specific Repayment Plan: If the debtor is facing financial difficulties or unable to pay the full amount owed immediately, the demand letter may propose a specific repayment plan. This option allows the debtor to settle the account in installments while ensuring timely payment for the business. In conclusion, a Nevada Demand for Payment of Account by Business to Debtor is a crucial tool to assert the rights of businesses in collecting unpaid debts. Sending a well-crafted demand letter helps businesses emphasize their seriousness in recovering the funds owed while providing debtors with a final chance to settle the account before resorting to legal measures.

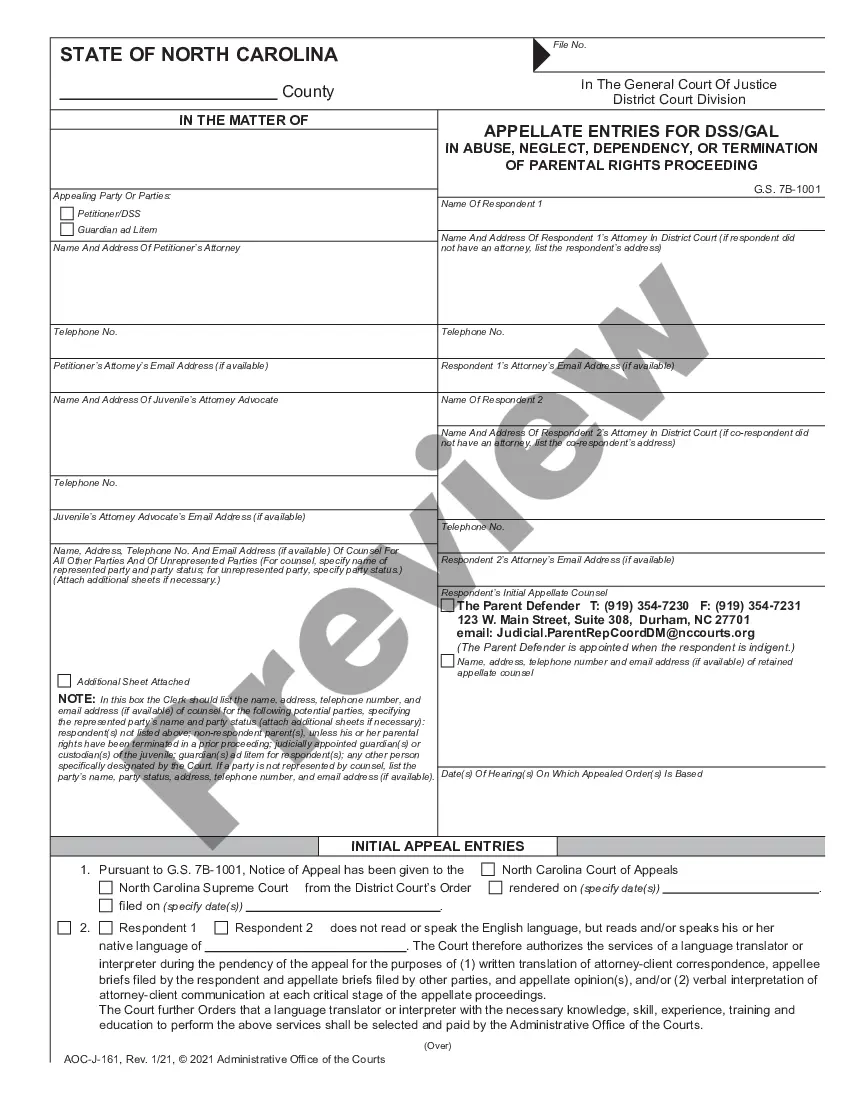

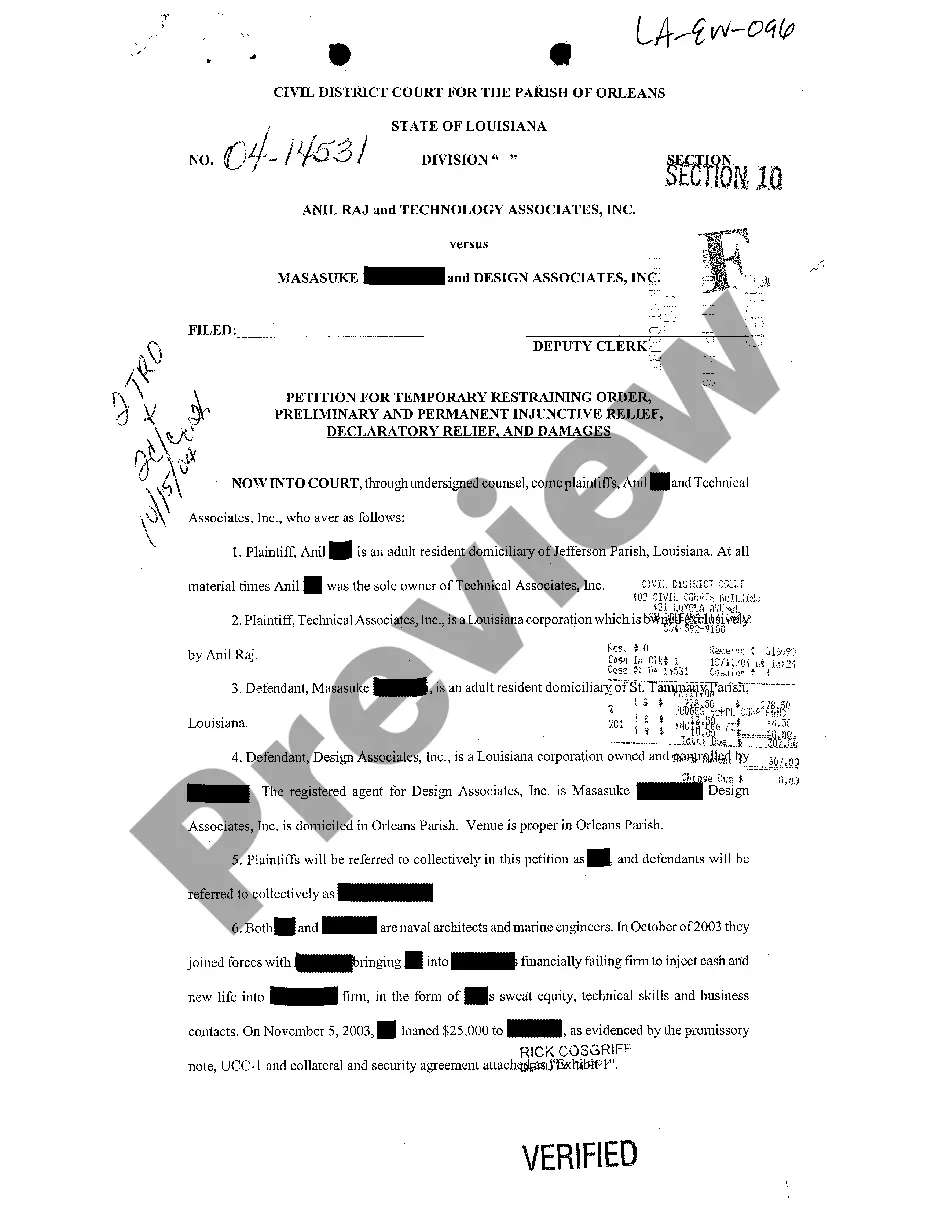

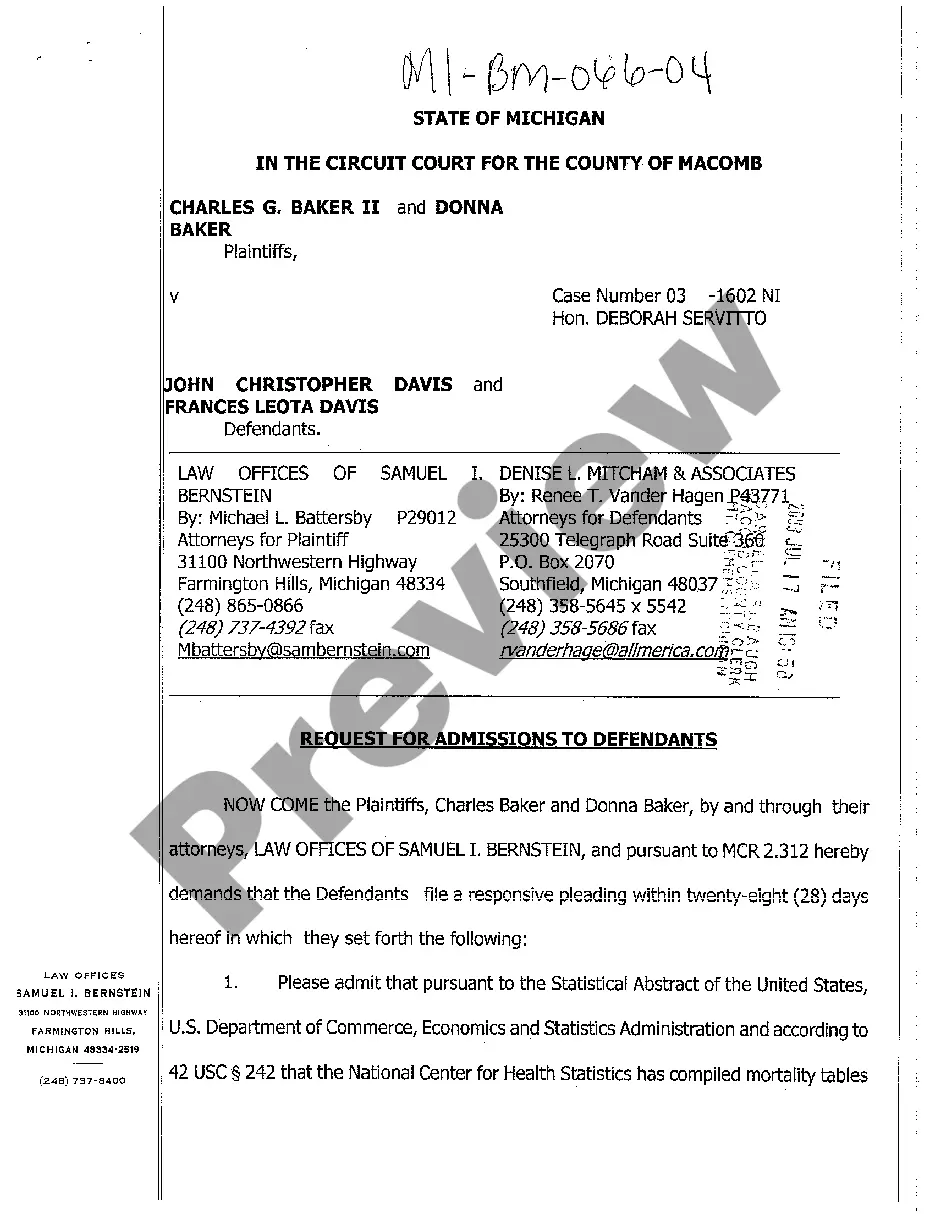

Nevada Demand for Payment of Account by Business to Debtor

Description

How to fill out Nevada Demand For Payment Of Account By Business To Debtor?

Are you presently in a situation in which you need papers for possibly company or individual purposes virtually every day time? There are tons of legal file themes available on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms delivers a huge number of develop themes, much like the Nevada Demand for Payment of Account by Business to Debtor, which can be created in order to meet federal and state needs.

Should you be already familiar with US Legal Forms website and have a free account, basically log in. After that, you can obtain the Nevada Demand for Payment of Account by Business to Debtor web template.

If you do not offer an bank account and wish to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is to the right area/county.

- Utilize the Review switch to examine the form.

- Browse the outline to ensure that you have chosen the proper develop.

- When the develop isn`t what you are searching for, make use of the Look for discipline to get the develop that suits you and needs.

- Once you discover the right develop, just click Buy now.

- Opt for the pricing strategy you would like, fill out the necessary information to create your money, and pay for your order utilizing your PayPal or credit card.

- Select a handy file format and obtain your copy.

Locate each of the file themes you have bought in the My Forms menu. You may get a extra copy of Nevada Demand for Payment of Account by Business to Debtor any time, if needed. Just click the needed develop to obtain or print the file web template.

Use US Legal Forms, by far the most comprehensive assortment of legal varieties, to conserve time as well as stay away from faults. The services delivers expertly made legal file themes that can be used for a range of purposes. Generate a free account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

Here are ten strategies for writing a settlement demand letter:Stay Focused.Do Not Threaten.Make Your Case Stand Out.Understand Policy Limits Before Writing.Support Your Claim.Include All of Your Damages.Do Not Make a Specific Demand.Do Not Offer a Recorded Statement.More items...

How to write a demand letterEstablish facts. Don't assume everyone knows the facts.Refer to evidence. If there's evidence (like a contract), you don't need to include it, but you should refer to it.Make a demand. Be specific as to what you want.Set a deadline and establish method of payment.Offer a consequence.

How do you write a letter of demand?Involved parties information (the claimant and recipient's information)The date when the debt was incurred.If there is a dispute, the date when there was improper charging should be included.02-Apr-2020

Things you should clearly mention in your NoticeThe date when the debt agreement or loan was undertaken.The Amount due to be recovered.The failed dates of repayment or default date.When the cause of action arose.Full name and address of the defaulter.Full name and address of the person from whom loan was taken.More items...

7 Tips for Writing a Demand Letter To the Insurance CompanyStep 1 of 2. 50%Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

My name is (Name) and I write to notify you of outstanding payment of (Money amount) dollars. (Describe in your words). This payment regards that (Specification) was delivered to your company's location at (Address) on the date (DD/MM/YY). We wish to request that you honor the payment agreement at your earliest.

Here are ten dos and don'ts when writing a settlement demand letter in a personal injury case:DON'T Write War and Peace.DO Highlight Unique Facts About Your Case.Don't Send the Demand by Certified Mail.DO Differentiate Your Case.DON'T Make a Specific Settlement Demand.DO Demand Policy Limits.DON'T Go Over-the-Top.More items...

How to write a demand letterEstablish facts. Don't assume everyone knows the facts.Refer to evidence. If there's evidence (like a contract), you don't need to include it, but you should refer to it.Make a demand. Be specific as to what you want.Set a deadline and establish method of payment.Offer a consequence.

How to Write a Final Demand LetterStep 1 Enter the Header Information.Step 2 Enter the Amount Due.Step 3 Complete the Debtor's Details.Step 4 Enter the Payment Option.Step 5 Detail the Consequences and Sign.07-Apr-2022

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...