The Nevada Notice of Annual Report of Employee Benefits Plans is a crucial document that serves as a means for employers to comply with state regulations and report essential information regarding their employee benefit plans. This report outlines the details of the various employee benefits offered by companies in Nevada, providing comprehensive insights for both employers and employees. The purpose of the Nevada Notice of Annual Report of Employee Benefits Plans is to ensure transparency and accountability in the employment sector, promoting fair practices and protecting the rights and interests of workers. By submitting this report, employers fulfill their obligation to provide accurate and up-to-date information about the benefits they offer to their employees. Key elements covered in the Nevada Notice of Annual Report of Employee Benefits Plans include comprehensive details on employee benefit programs such as health insurance plans, retirement plans, disability benefits, life insurance coverage, and any other relevant perks provided by the employer. Additionally, the report may also include information on eligibility criteria, enrollment procedures, contribution amounts, and vesting schedules. It is crucial to note that there are various types of Nevada Notice of Annual Report of Employee Benefits Plans, each catering to specific categories of employee benefit plans. Some different types include: 1. Health Insurance Plans: This category focuses on reporting details about the health insurance coverage offered by employers, including the type of plans, coverage options, premiums, deductibles, and any variations in coverage provided to different employee groups. 2. Retirement Plans: This category encompasses reporting details about employer-sponsored retirement plans such as 401(k), pension plans, or other retirement savings plans. Employers would provide information regarding plan types, contribution percentages, vesting schedules, investment options, and any company matches or employer contributions. 3. Disability Benefits: This section focuses on reporting any short-term or long-term disability benefits provided to employees. It may include information about the waiting periods, coverage duration, and the amount or percentage of an employee's income that would be provided as disability benefits. 4. Life Insurance Coverage: This category entails reporting details about life insurance plans offered by employers, including coverage amounts, beneficiaries, and any supplemental life insurance options available to employees. 5. Other Benefits: This category covers any additional benefits provided by employers, such as dental or vision insurance plans, flexible spending accounts (FSA), employee assistance programs (EAP), tuition reimbursement, commuter benefits, or wellness programs. When completing the Nevada Notice of Annual Report of Employee Benefits Plans, employers must ensure accuracy, compliance with state regulations, and provide ample detail to assist employees in understanding their available benefits. It is crucial for both employers and employees to be well-informed about the provisions, terms, and conditions of the various benefits offered, fostering a healthier and more productive work environment.

Nevada Notice of Annual Report of Employee Benefits Plans

Description

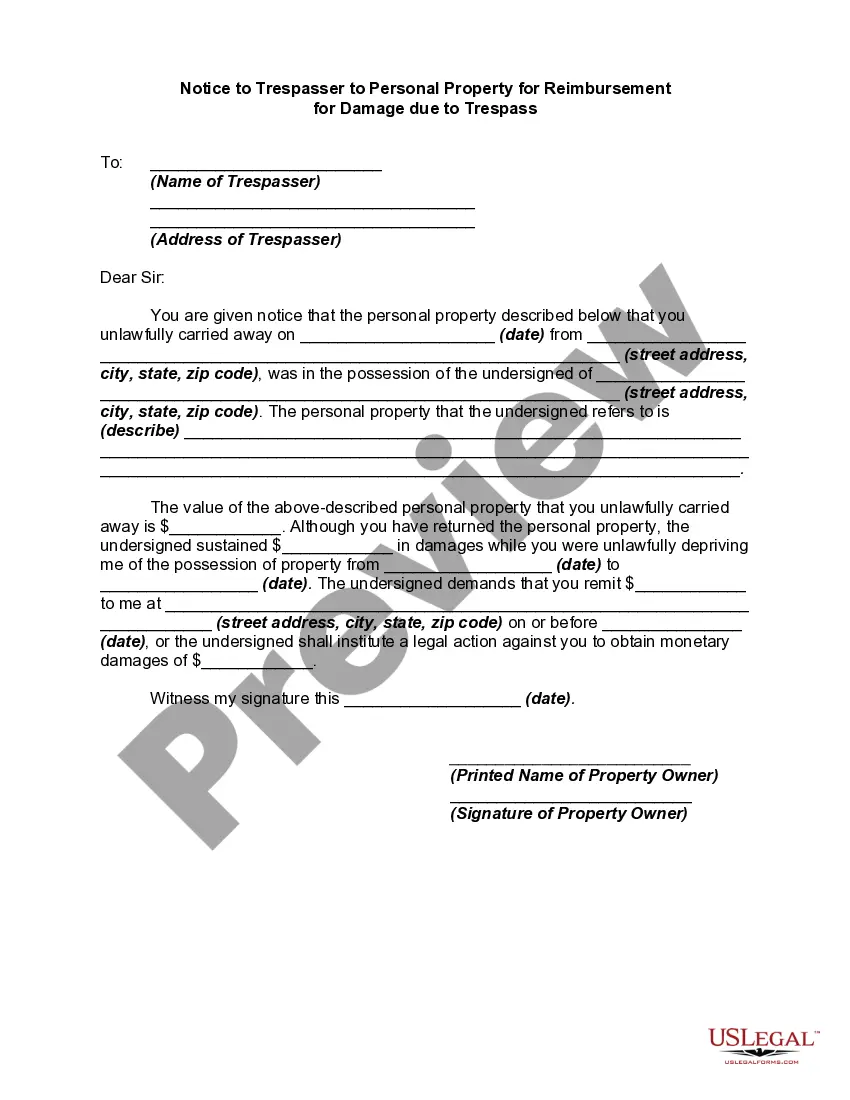

How to fill out Nevada Notice Of Annual Report Of Employee Benefits Plans?

US Legal Forms - one of the greatest libraries of legitimate kinds in the USA - delivers a wide array of legitimate papers layouts you can down load or produce. Making use of the internet site, you may get thousands of kinds for organization and individual reasons, categorized by types, says, or keywords and phrases.You can get the most up-to-date models of kinds such as the Nevada Notice of Annual Report of Employee Benefits Plans within minutes.

If you have a monthly subscription, log in and down load Nevada Notice of Annual Report of Employee Benefits Plans through the US Legal Forms local library. The Download option will appear on each kind you look at. You get access to all in the past saved kinds in the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to help you get began:

- Be sure you have picked the proper kind to your town/state. Click on the Review option to review the form`s content. Look at the kind outline to actually have selected the proper kind.

- In the event the kind doesn`t satisfy your demands, utilize the Lookup field on top of the display screen to find the one that does.

- When you are content with the form, confirm your choice by visiting the Get now option. Then, choose the pricing plan you favor and provide your accreditations to sign up on an account.

- Approach the financial transaction. Make use of charge card or PayPal account to perform the financial transaction.

- Find the formatting and down load the form on your product.

- Make adjustments. Fill out, change and produce and indication the saved Nevada Notice of Annual Report of Employee Benefits Plans.

Each and every template you included with your money does not have an expiry day and is also your own permanently. So, if you wish to down load or produce yet another duplicate, just check out the My Forms area and click on in the kind you require.

Get access to the Nevada Notice of Annual Report of Employee Benefits Plans with US Legal Forms, one of the most substantial local library of legitimate papers layouts. Use thousands of professional and condition-particular layouts that meet up with your business or individual requirements and demands.