Nevada Employee Time Report (Nonexempt)

Description

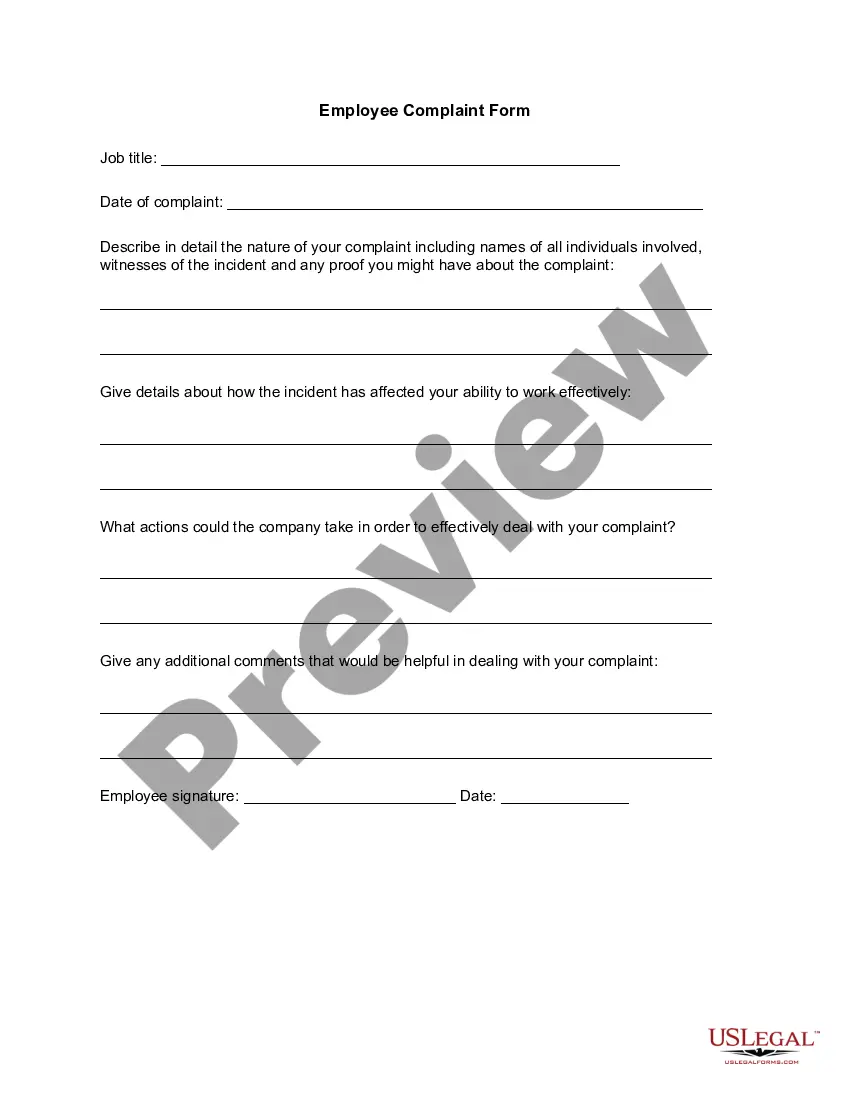

How to fill out Employee Time Report (Nonexempt)?

If you require extensive, acquire, or generate legal documentation templates, utilize US Legal Forms, the premier selection of legal forms available online.

Make use of the site's user-friendly and efficient search feature to locate the documents you require.

A range of templates for business and personal use are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Utilize US Legal Forms to locate the Nevada Employee Time Report (Nonexempt) within a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Nevada Employee Time Report (Nonexempt).

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your correct city/state.

- Step 2. Use the Review option to examine the contents of the form. Remember to read the description.

Form popularity

FAQ

Reg. 285/01, which is being retained for transitional purposes. Subsection 21.2(1) provides that, under certain circumstances, employees must be paid at least three hours' pay at the employee's regular rate of pay, even though the employee has worked less than three hours.

Most blue collar employees who are paid hourly wages qualify as non-exempt, whereas most white collar employees who are salaried are exempt. Misclassified non-exempt employees have various legal options, including: filing a wage claim with the U.S. Department of Labor or the Nevada Labor Commissioner, or.

Show up or reporting timeNevada law does not require employers to pay employees for reporting or showing up to work if no work is performed. An employer is also not required to pay an employee a minimum number of hours if the employer dismisses the employee from work prior to completing their scheduled shift.

In most cases, yes. Federal employment lawsmost notably the Fair Labor Standards Act (FLSA)allow for a number of employer changes, including changing the employee's schedule.

Currently, there is one state, Oregon, with full state predictive scheduling regulations that apply to every city. Additionally, Vermont and New Hampshire have specific regulations in place around flexible working hours for employees.

For the typical 40-hour-a-week employee, that should come to 40 hours of paid time off (PTO) per benefit year. Employees should notify their employers as soon as practicable about taking their paid leave. Employers may require new employees to wait until their 90th calendar day to take paid leave.

Exempt employees are mostly paid on a salary basis and not per hour. Unlike non-exempt employees, employers may decide whether to pay exempt employees for any extra work outside the official 40 working hours per week. As a business owner, this allows you flexibility in your payment and employee benefits policies.

If your employer fails to pay you on time, you can collect a penalty of one day's wages for every day your paycheck is late, up to 30 days. If you quit, the penalty begins on the day your paycheck was due. If you were fired or laid off, the penalty begins three days after your paycheck was due.

Nevada's Overtime Minimum WageNevada overtime law requires all employees working more then 40 hours a week or 8 hours a day to be paid time-and-a-half wages for any additional hours worked. Daily overtime applies for workers earning less then $12.38 per hour (or $10.89 per hour with health benefits).

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.