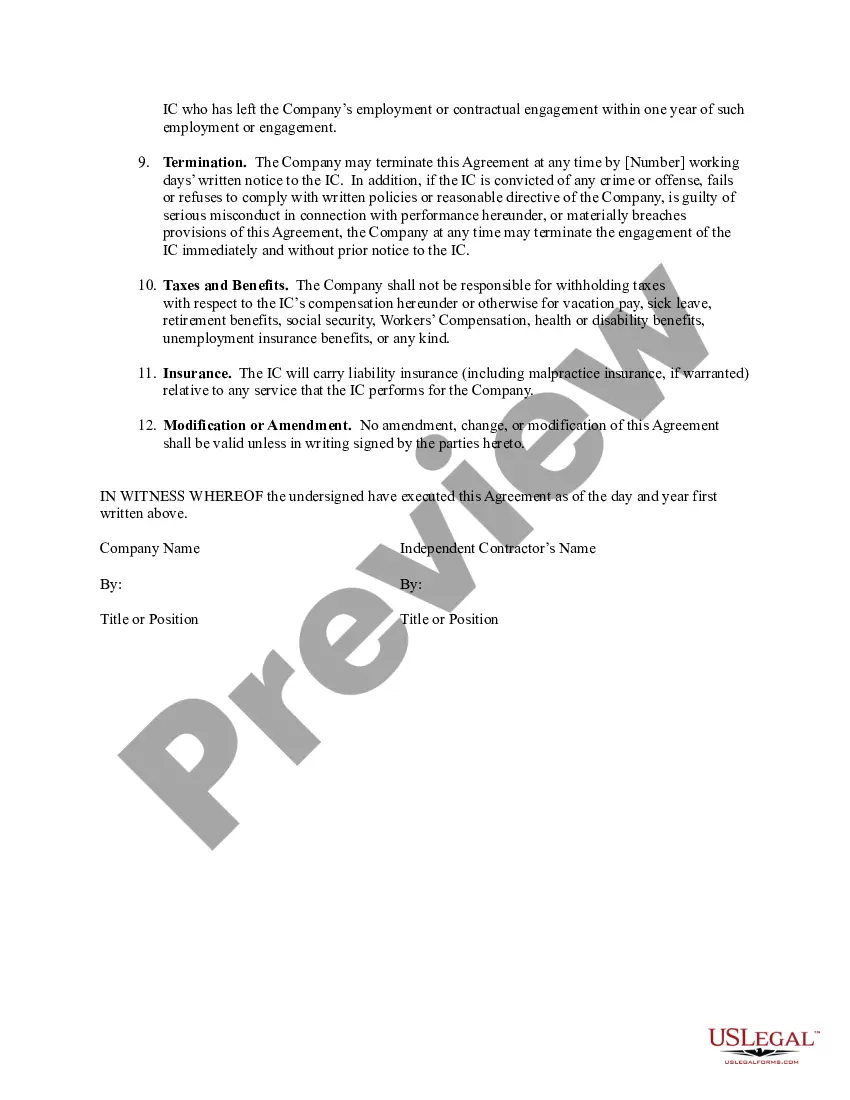

Nevada Sample Self-Employed Independent Contractor Agreement — For Ongoing Relationship: A Nevada Sample Self-Employed Independent Contractor Agreement is a legal document that establishes the rights and obligations between a self-employed independent contractor and a client in the state of Nevada. This agreement is designed to govern an ongoing working relationship between the parties involved. In Nevada, there are different types of Sample Self-Employed Independent Contractor Agreements that can be tailored to suit specific needs: 1. General Nevada Self-Employed Independent Contractor Agreement: This type of agreement outlines the general responsibilities and terms of the ongoing relationship between the contractor and the client. It covers areas such as scope of work, compensation, payment terms, confidentiality, intellectual property rights, termination conditions, and dispute resolution methods. 2. Nevada Self-Employed Independent Contractor Agreement for Services: This specific agreement is used when the independent contractor provides services to the client. It elaborates on the nature of the services being rendered, deadlines, quality standards, and any additional provisions related to the specific type of services being offered. 3. Nevada Self-Employed Independent Contractor Agreement for Consultancy: If the independent contractor is hired to provide professional consultancy services, this agreement type would be appropriate. It highlights the expertise, consulting deliverables, client expectations, and any other relevant provisions unique to the consultancy engagement. 4. Nevada Self-Employed Independent Contractor Agreement for Creative Projects: In cases where the independent contractor is involved in creative endeavors such as graphic design, photography, or content creation, this agreement can provide specific terms regarding the ownership and usage rights of the intellectual property created during the collaboration. 5. Nevada Self-Employed Independent Contractor Agreement for Construction Work: For ongoing construction projects, a specialized agreement can be crafted to outline the contractor's responsibilities, project milestones, safety regulations, insurance requirements, and other pertinent details specific to the construction industry. Regardless of the specific type, a Nevada Self-Employed Independent Contractor Agreement generally protects both parties involved by clearly defining their rights, responsibilities, and expectations throughout the ongoing professional relationship. It ensures legal compliance and minimizes potential disputes or misunderstandings. Creating a comprehensive agreement using a suitable sample ensures that all relevant aspects are addressed and agreed upon by both parties.

Independent Contractor Agreement Nevada

Description

How to fill out Nevada Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

Finding the right legitimate record template can be a have difficulties. Obviously, there are a variety of layouts accessible on the Internet, but how do you discover the legitimate form you want? Utilize the US Legal Forms website. The service provides a large number of layouts, for example the Nevada Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, that can be used for company and private needs. Every one of the kinds are examined by pros and meet up with federal and state specifications.

Should you be currently authorized, log in in your profile and click the Down load switch to obtain the Nevada Sample Self-Employed Independent Contractor Agreement - for ongoing relationship. Make use of profile to look with the legitimate kinds you might have purchased in the past. Visit the My Forms tab of the profile and obtain one more version from the record you want.

Should you be a whole new end user of US Legal Forms, listed here are basic directions so that you can stick to:

- Initially, ensure you have selected the right form to your city/region. It is possible to check out the shape while using Preview switch and look at the shape information to make certain this is the best for you.

- In case the form fails to meet up with your preferences, use the Seach discipline to get the appropriate form.

- Once you are positive that the shape would work, select the Get now switch to obtain the form.

- Opt for the prices strategy you would like and type in the essential information and facts. Make your profile and pay money for the transaction with your PayPal profile or charge card.

- Opt for the file file format and download the legitimate record template in your gadget.

- Full, modify and print out and indication the received Nevada Sample Self-Employed Independent Contractor Agreement - for ongoing relationship.

US Legal Forms is definitely the greatest local library of legitimate kinds in which you can discover numerous record layouts. Utilize the service to download appropriately-made files that stick to status specifications.

Form popularity

FAQ

Second, as an independent contractor, your spouse will have to pay his or her own self-employment taxes since you will not be doing payroll taxes as if he or she were an employee.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Such a partner who devotes time and energy in the conduct of the trade of business of the partnership, or in providing services to the partnership as an independent contractor, is a self- employed individual rather than a common law employee.

Yes. The contractor should receive a 1099 form if the LLC is treated as a partnership as well as a single-member LLC (disregarded entity).

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Partners in a partnership (including certain members of a limited liability company (LLC)) are considered to be self-employed, not employees, when performing services for the partnership.

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

The fixed, periodic compensation of a partner (often referred to as guaranteed payments or the partner's draw) is therefore self-employment income rather than employee wages. A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.