Nevada Work for Hire Addendum - Self-Employed

Description

How to fill out Work For Hire Addendum - Self-Employed?

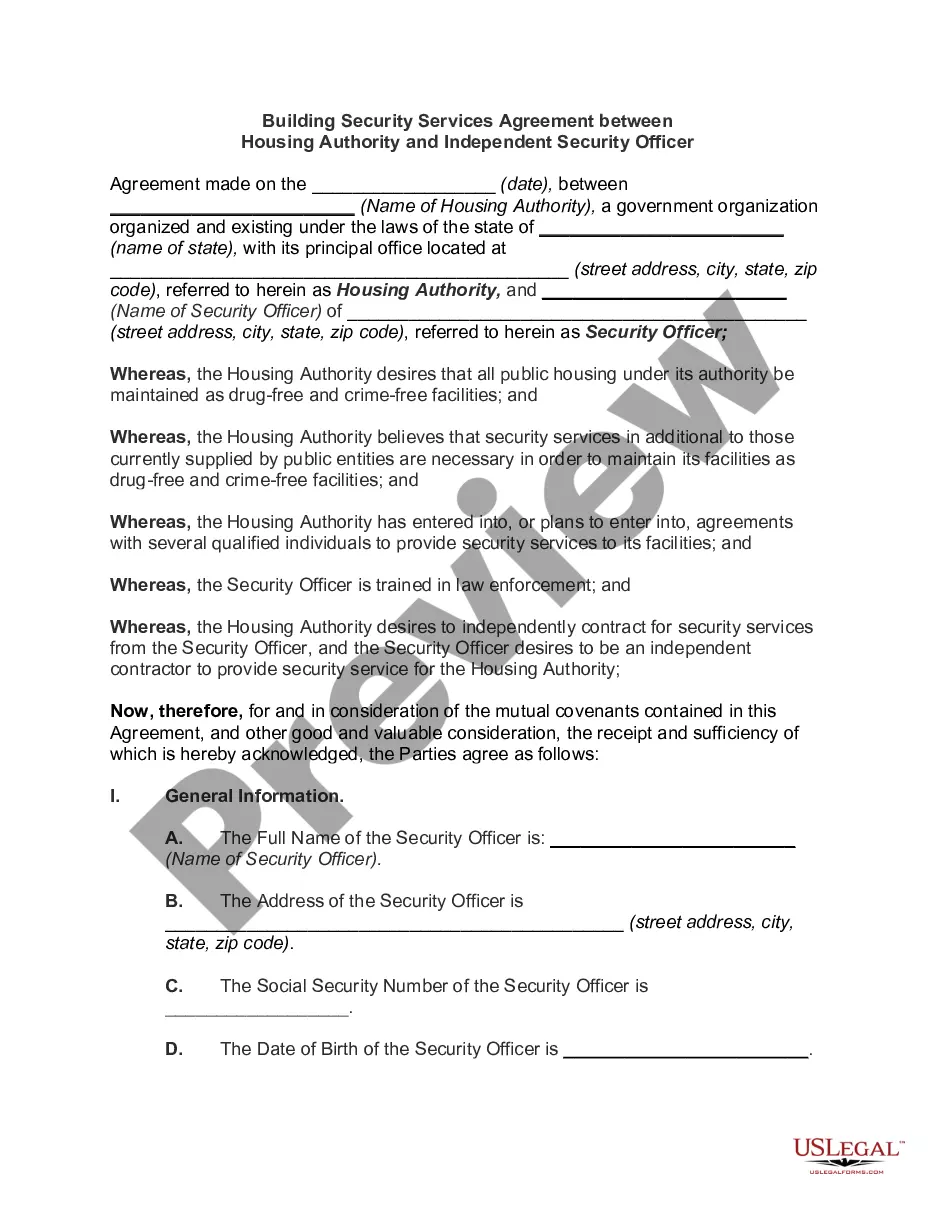

You can dedicate time online searching for the authentic document template that meets the state and federal requirements you will need.

US Legal Forms offers a vast selection of legitimate forms that are vetted by experts.

You can download or print the Nevada Work for Hire Addendum - Self-Employed from our service.

First, make sure that you have chosen the correct document template for the state/city you select. Review the form details to ensure you have selected the right form. If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can fill out, edit, print, or sign the Nevada Work for Hire Addendum - Self-Employed.

- Every legal document template you purchase is your property permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

Nevada law requires all employees to have workers' compensation insurance coverage. This policy covers the cost of medical treatment and lost wages for workplace injuries and occupational diseases.

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

Working partners, domestic workers in your home, independent contractors and so-called casual workers, hired on an at-need basis, need not be covered. Sole proprietors can choose not to have coverage.

Who needs to be checked? Employers need to carry out checks on all employees, workers and apprentices who started on or after 29 February 2008, whether or not they have written contracts. You do not have to check those who undertake work as genuinely self employed contractors though.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Nevada law requires a person to provide workers' compensation coverage for employees but also subcontractors, independent contractors and their employees. Such contractors are deemed to be employees of the prime contractor unless the subcontractor is an independent enterprise.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Although rare, it is possible for a worker to have two separate and distinct contracts with the same payer, where one contract could be seen as an employer-employee relationship with the other employment being considered as self-employed.