Title: A Comprehensive Guide to Nevada Agreement to Reimburse for Insurance Premium Keywords: Nevada agreement to reimburse for insurance premium, reimbursement obligations, insurance policies, insurance coverage, timely reimbursement, specific insurance premium agreements, general insurance premium agreements, commercial insurance premium reimbursement, personal insurance premium reimbursement Introduction: In Nevada, an Agreement to Reimburse for Insurance Premium is a legal document that outlines the reimbursement obligations between parties regarding insurance premiums. This agreement ensures that the responsible party reimburses the insured for the cost of insurance coverage based on specific terms and conditions. Various types of agreement exist to fulfill distinct reimbursement needs, including general insurance premium reimbursement and commercial/personal insurance premium reimbursement. 1. Nevada Agreement to Reimburse for Insurance Premium: The Nevada Agreement to Reimburse for Insurance Premium is a comprehensive document designed to establish a legal obligation for reimbursement between two parties. It specifies the amount to be reimbursed and the terms and conditions surrounding the reimbursement process, ensuring clarity and protection for both parties involved. 2. General Insurance Premium Reimbursement Agreement: The General Insurance Premium Reimbursement Agreement in Nevada is a type of agreement used for reimbursing insurance premiums in various sectors. It covers a wide range of insurance policies, such as auto insurance, homeowner's insurance, and renter's insurance, among others. This agreement outlines the reimbursement procedure and conditions applicable to all general insurance premium reimbursement scenarios. 3. Commercial Insurance Premium Reimbursement Agreement: The Commercial Insurance Premium Reimbursement Agreement in Nevada focuses on reimbursing insurance premiums related to commercial policies, such as general liability insurance, commercial property insurance, and business interruption insurance. This agreement sets forth specific terms and conditions relevant to the commercial insurance sector, including reimbursement timelines, coverage limits, and obligations of both parties involved. 4. Personal Insurance Premium Reimbursement Agreement: The Personal Insurance Premium Reimbursement Agreement in Nevada is tailored to reimburse insurance premiums associated with personal policies, like health insurance, life insurance, and disability insurance. It outlines the reimbursement rights and responsibilities of the insured party, specifying the types of expenses eligible for reimbursement and any limitations or exclusions. Conclusion: A Nevada Agreement to Reimburse for Insurance Premium is a crucial legal instrument that ensures timely reimbursement of insurance premiums between parties involved. By utilizing the appropriate type of agreement — whether it's a general insurance premium agreement, commercial insurance premium agreement, or personal insurance premium agreement — parties can establish clear and enforceable terms for reimbursement, enhancing transparency and protection. It is essential for all parties to fully understand and abide by the terms set forth in the agreement to maintain a fair and effective reimbursement process.

Nevada Agreement to Reimburse for Insurance Premium

Description

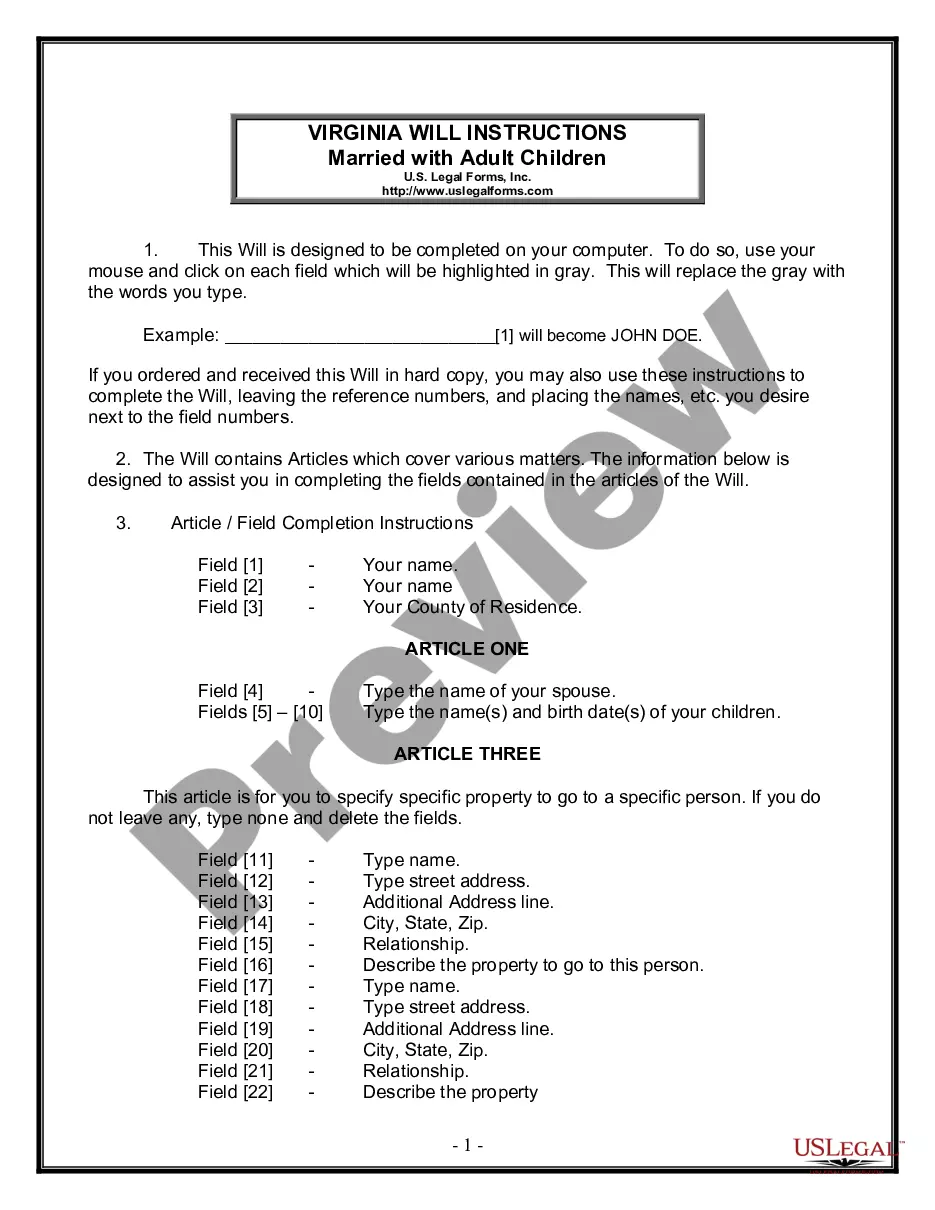

How to fill out Nevada Agreement To Reimburse For Insurance Premium?

Choosing the right legitimate record template can be quite a struggle. Of course, there are plenty of layouts accessible on the Internet, but how would you discover the legitimate form you will need? Make use of the US Legal Forms website. The assistance delivers thousands of layouts, such as the Nevada Agreement to Reimburse for Insurance Premium, that you can use for business and personal requirements. Each of the varieties are checked out by experts and satisfy state and federal requirements.

When you are presently listed, log in to your bank account and click the Download option to have the Nevada Agreement to Reimburse for Insurance Premium. Use your bank account to appear throughout the legitimate varieties you may have bought in the past. Proceed to the My Forms tab of your bank account and get another duplicate from the record you will need.

When you are a brand new user of US Legal Forms, here are basic guidelines that you can adhere to:

- Initially, make certain you have chosen the correct form for your personal city/state. You can examine the form utilizing the Preview option and read the form description to ensure this is basically the best for you.

- In the event the form is not going to satisfy your expectations, make use of the Seach area to find the proper form.

- When you are positive that the form is suitable, click the Purchase now option to have the form.

- Select the costs plan you want and enter the essential information. Make your bank account and pay for the transaction using your PayPal bank account or bank card.

- Opt for the document format and download the legitimate record template to your product.

- Total, revise and printing and signal the attained Nevada Agreement to Reimburse for Insurance Premium.

US Legal Forms will be the greatest library of legitimate varieties for which you can discover various record layouts. Make use of the service to download skillfully-made paperwork that adhere to state requirements.

Form popularity

FAQ

Once you file a claim, you might wonder, How long does an auto insurance company have to settle a claim? The short answer is, usually around 30 days. However, it can vary depending on a few other factors. Insurance claims typically take about one month to resolve.

How To Record Insurance Reimbursement in AccountingDetermine the amount of the proceeds of the damaged property. This is the amount sent to you by the insurance company.Locate the entry made to record the cost of the repair.Debit insurance proceeds to the Repairs account.Record a loss on the insurance settlement.

The insuring agreement is the section of an insurance contract containing the obligation of the insurer to pay covered claims, subject to specified conditions and exclusions. It contains the insurance company's promise to pay for loss, if it should result from the perils insured against.

Most insurers will pay out the actual cash value of the item, and then a second payment when you show the receipt that proves you'd replaced the item. Then you'll get the final payment. You can often submit your expenses along the way if you replace items over time.

In life policies premiums are payable in advance. The Long-term Insurance Act prescribes that if premiums are not paid on due date there should be a grace period of at least 15 days before a policy lapses. Insurers may grant a longer period, often 30 days.

1. When insurer elect to set aside the contract on the ground of innocent misrepresentation, non-disclosure, concealment or mistake, the assured is entitled to the return of the premium, in absence of fraud on his part and of any express conditions to the contrary; 2.

Unilateral Contract a contract in which only one party makes an enforceable promise. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. By contrast, the insured makes few, if any, enforceable promises to the insurer.

Return-of-premium life insurance pros and consIf you outlive your policy's term, you get your premium payments back. The returned money isn't taxed since it's not income, but simply a return of the payments you made.

A health insurance claim is when you request reimbursement or direct payment for medical services that you have already obtained. The way to obtain benefits or payment is by submitting a claim via a specific form or request.

Reimbursement Policies insurance policies in which the insured must first pay losses out-of-pocket and then seek reimbursement for any covered loss from the insurer, as opposed to policies in which the insurer is required to "pay losses on behalf of" an insured.