Nevada List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Are you currently in the place the place you need to have documents for sometimes organization or person reasons just about every day? There are plenty of legitimate record themes available on the net, but finding kinds you can rely is not straightforward. US Legal Forms provides 1000s of kind themes, such as the Nevada List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, which are published in order to meet federal and state demands.

When you are presently acquainted with US Legal Forms site and possess a free account, just log in. Afterward, you can obtain the Nevada List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 format.

Should you not come with an profile and would like to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is to the correct metropolis/county.

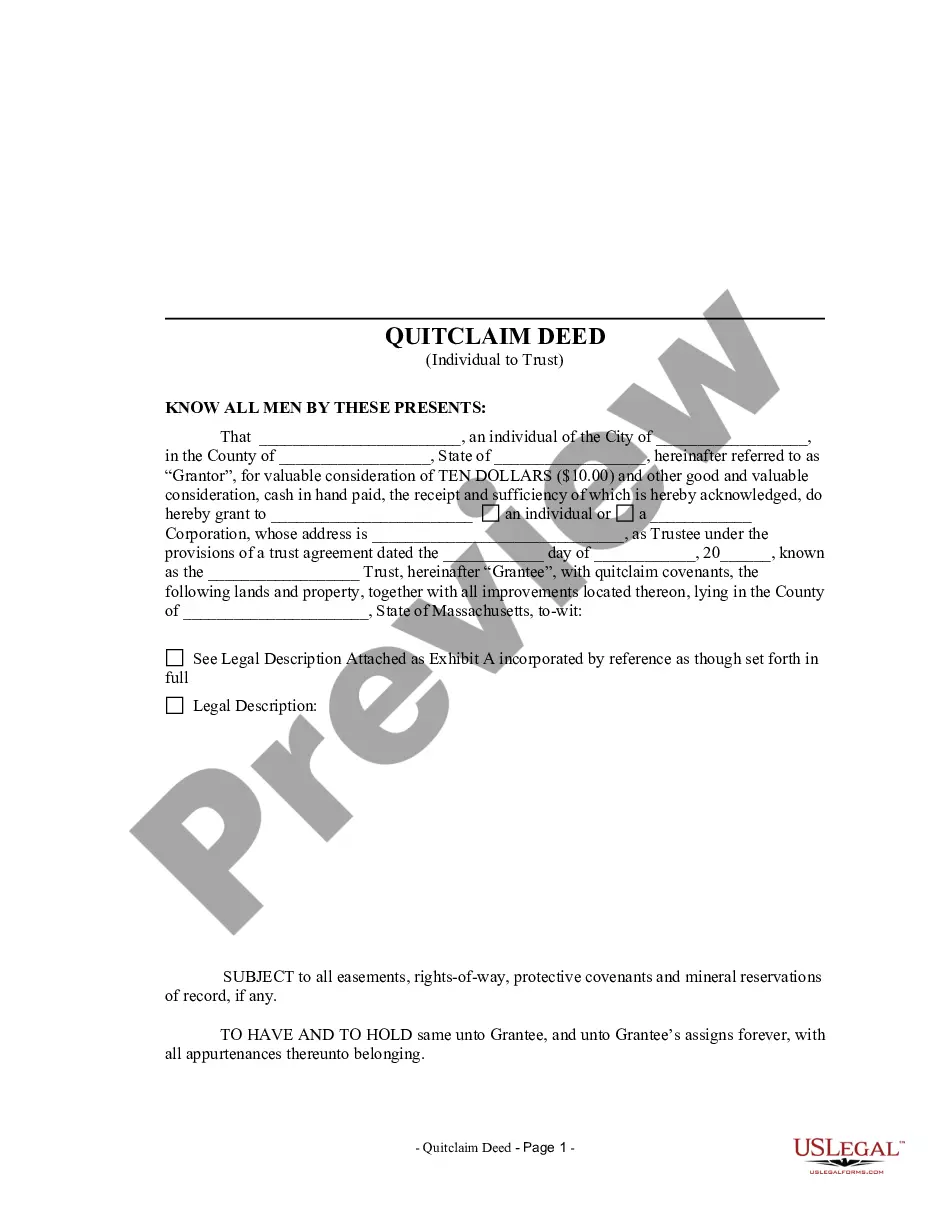

- Use the Preview switch to review the shape.

- See the outline to actually have selected the appropriate kind.

- If the kind is not what you are searching for, make use of the Look for area to discover the kind that suits you and demands.

- Whenever you find the correct kind, simply click Buy now.

- Pick the pricing plan you need, submit the desired information to make your account, and pay for an order utilizing your PayPal or bank card.

- Pick a practical paper format and obtain your duplicate.

Find all of the record themes you possess purchased in the My Forms menu. You can aquire a further duplicate of Nevada List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 at any time, if possible. Just select the needed kind to obtain or printing the record format.

Use US Legal Forms, probably the most extensive selection of legitimate varieties, to save efforts and steer clear of errors. The support provides professionally created legitimate record themes that you can use for an array of reasons. Make a free account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

What is a List of Creditors? When you file a voluntary petition under any bankruptcy chapter, you the debtor (or your attorney, if you use one) must prepare a List of Creditors and submit it to the Court. The List of Creditors is essentially a mailing list of creditors to whom you owe money.

Some assets may have multiple liens placed upon them; in these cases, the first lien has priority over the second lien. Unsecured creditors are divided between preferred and non-preferred, as certain unclaimed creditors like employees and tax agencies are given priority.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

It's true that even if a debtor is completely honest in their Chapter 7 bankruptcy filing, their case can still be dismissed for technical reasons. The 1% of Chapter 7 bankruptcy cases that are dismissed are typically due to technicalities.

The most sought exceptions are actions by parties to securities contracts to close out open positions; eviction of a debtor by a landlord where the lease has been fully terminated prior to the bankruptcy filing; actions by taxing authorities to conduct tax audits, issue deficiency notices, demand tax returns and make ...

Among the top 30 unsecured creditors that Yellow owes are some of the industry's most recognized names. This includes railroads such as BNSF and Union Pacific, retail giants like Amazon and Home Depot, and leading equipment suppliers like Goodyear, Michelin, and DTNA (Daimler Trucks North America).

The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units ...