A Nevada Investment Management Agreement is a legally binding contract between a fund, Asia Management, and CICAM (Nevada Investment Corporation for Asset Management). This agreement outlines the terms and conditions under which CICAM will manage the investment portfolio of the fund on behalf of Asia Management. The agreement typically covers various aspects, such as: 1. Roles and Responsibilities: The agreement clearly defines the roles and responsibilities of each party involved. It establishes CICAM as the investment manager responsible for making investment decisions on behalf of the fund, while Asia Management acts as the fund's representative. 2. Investment Objectives: The agreement outlines the investment objectives, goals, and strategies to be employed by CICAM in managing the fund's portfolio. This may include details about target asset classes, risk tolerance, diversification strategies, and benchmark performance goals. 3. Investment Mandate: The agreement specifies the investment mandates authorized for CICAM. This defines any limitations or specific guidelines regarding the types of investments that can be made, such as geographical restrictions, sector allocations, or percentage limits for specific asset classes. 4. Fee Structure: The agreement outlines the fee structure associated with CICAM's investment management services. This may include management fees, performance-based fees, or any other charges related to the services provided. 5. Reporting and Communication: The agreement establishes the frequency and format of reporting by CICAM to Asia Management and the fund. It may specify the type of information to be included in the reports, such as portfolio performance, market analysis, and investment updates. 6. Termination: The agreement defines the conditions under which either party can terminate the agreement. This may include clauses related to notice periods, breach of contract, or specific circumstances that may trigger termination rights. It is worth noting that there might be different types of Nevada Investment Management Agreements offered by CICAM, categorized based on the nature of the fund or specific requirements of Asia Management. Some possible variations could include: 1. Equity Investment Management Agreement: This type of agreement specifically focuses on managing equity investments within the fund's portfolio, aiming to generate returns through ownership in publicly traded companies. 2. Fixed Income Investment Management Agreement: This variation centers on managing fixed income securities, such as bonds or treasury bills, in the fund's portfolio. The objective is to generate consistent income streams within acceptable risk parameters. 3. Balanced Investment Management Agreement: A balanced investment management agreement involves managing a mixed portfolio of both equity and fixed income investments. This strategy aims to balance the potential for capital appreciation with the stability of income generation. Note: The variations mentioned above are hypothetical and may not represent all possible types of Nevada Investment Management Agreements. The specific agreements offered by CICAM would depend on their product offerings and the investment needs of Asia Management and the fund.

Nevada Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Nevada Investment Management Agreement Between Fund, Asia Management And NICAM?

Are you within a position that you need to have files for either organization or person functions just about every day? There are plenty of legal document web templates available on the net, but getting versions you can depend on is not simple. US Legal Forms delivers thousands of develop web templates, like the Nevada Investment Management Agreement between Fund, Asia Management and NICAM, which can be created in order to meet federal and state requirements.

If you are presently knowledgeable about US Legal Forms site and have an account, just log in. Next, you can download the Nevada Investment Management Agreement between Fund, Asia Management and NICAM format.

Unless you provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is for your appropriate area/county.

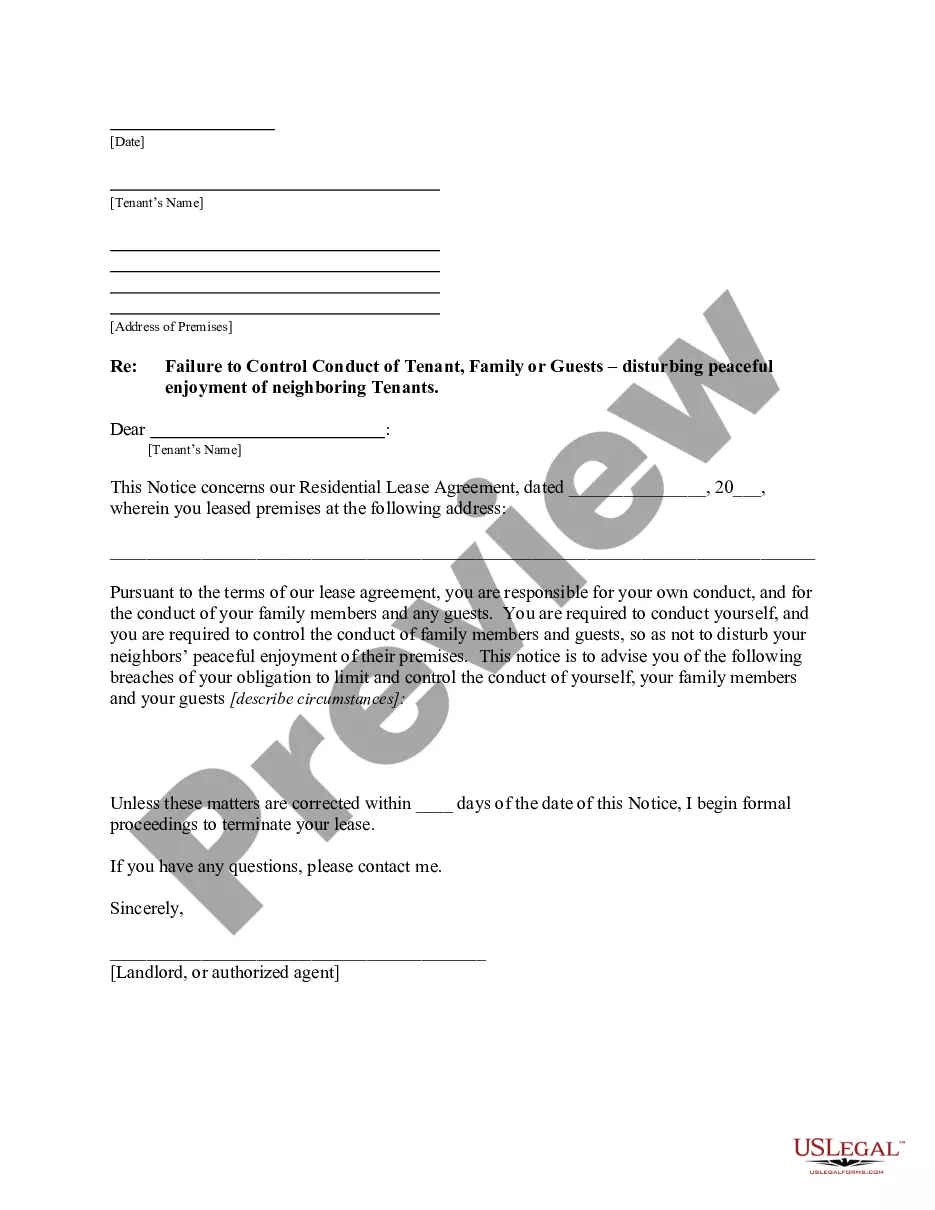

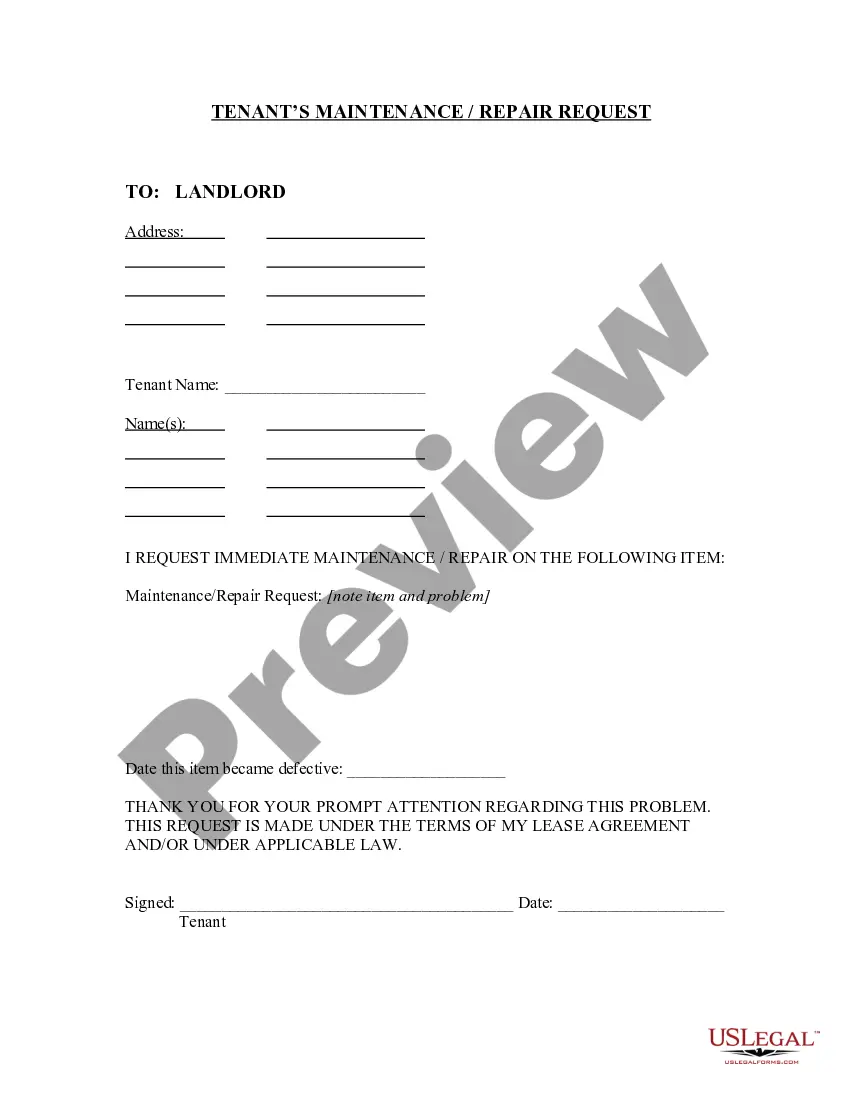

- Use the Review button to examine the shape.

- Look at the outline to actually have chosen the proper develop.

- In the event the develop is not what you are searching for, take advantage of the Search field to discover the develop that meets your requirements and requirements.

- When you find the appropriate develop, just click Get now.

- Pick the costs prepare you would like, complete the desired information to generate your bank account, and purchase the order making use of your PayPal or bank card.

- Choose a practical paper format and download your copy.

Discover every one of the document web templates you have bought in the My Forms menu. You can get a extra copy of Nevada Investment Management Agreement between Fund, Asia Management and NICAM at any time, if necessary. Just click on the needed develop to download or print out the document format.

Use US Legal Forms, by far the most comprehensive collection of legal forms, in order to save some time and stay away from blunders. The services delivers skillfully manufactured legal document web templates that can be used for an array of functions. Make an account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with ...

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

The management agreement is a binding legal agreement, generally between the fund's general partner on behalf of the fund and the fund's investment manager. This form management agreement provides an example of how to document the management fee and other elements of the fund and manager relationship.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Investment Management Agreement (IMA means a formal arrangement between a financial adviser and an investor stipulating the terms under which the adviser is authorized to act on behalf of the investor to manage the assets listed in the agreement.

An Investment Management Agreement (IMA) is a legally binding contract between an investor and an investment manager, outlining the terms and conditions of their relationship.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.