Nevada Restructuring Agreement refers to a legally binding agreement made between entities or individuals involved in a financial restructuring process in the state of Nevada, USA. It signifies an arrangement where parties mutually agree to modify the terms and conditions of debt obligations or financial contracts to alleviate financial distress and enhance the chances of successful debt repayment. This agreement is primarily designed to help debtors and creditors find a viable solution to reorganize and pay off outstanding debts more efficiently, rather than resorting to bankruptcy proceedings. By entering into a Nevada Restructuring Agreement, debtors can gain the opportunity to restructure their debts in a way that allows them to regain financial stability and avoid the severe consequences associated with bankruptcy. Keywords: Nevada, Restructuring Agreement, financial restructuring, debt obligations, terms and conditions, financial contracts, financial distress, debt repayment, bankruptcy proceedings, debtors, creditors, reorganize, outstanding debts, financial stability, severe consequences. Types of Nevada Restructuring Agreement may vary based on the specific circumstances and needs of the parties involved. Some commonly observed types include: 1. Debt Restructuring Agreement: This form of Nevada Restructuring Agreement involves modifying the terms and conditions of existing debt, such as extending the loan repayment period, reducing interest rates, or forgiving a portion of the debt. It aims to provide debtors with a manageable repayment plan while ensuring creditors receive a reasonable chance of recovering their funds. 2. Corporate Restructuring Agreement: This type of Nevada Restructuring Agreement focuses on the financial reorganization and revitalization of a distressed company. It involves various strategies, such as asset sales, debt-for-equity swaps, or workforce reduction, to streamline operations, reduce costs, and improve financial performance. 3. Real Estate Restructuring Agreement: In cases where real estate ventures encounter financial hardships, parties involved may enter into a Nevada Restructuring Agreement specifically tailored to address issues within the real estate industry. This agreement could involve renegotiating lease terms, modifying mortgage payments, or seeking alternative financing options to stabilize the real estate investment. 4. Municipal Restructuring Agreement: Occasionally, local governments or municipalities in Nevada may face financial difficulties. In such instances, a Nevada Restructuring Agreement may be negotiated to address budget shortfalls, restructure debts, or develop long-term financial plans, ensuring the provision of essential services to residents. Keywords: Debt Restructuring Agreement, Corporate Restructuring Agreement, Real Estate Restructuring Agreement, Municipal Restructuring Agreement, financial reorganization, distressed company, asset sales, debt-for-equity swaps, workforce reduction, real estate ventures, lease terms, mortgage payments, alternative financing, local governments, municipalities, budget shortfalls, long-term financial plans.

Nevada Restructuring Agreement

Description

How to fill out Nevada Restructuring Agreement?

Are you in the position that you need documents for either business or personal purposes nearly every time? There are plenty of lawful document layouts available online, but finding versions you can depend on is not easy. US Legal Forms provides thousands of develop layouts, much like the Nevada Restructuring Agreement, which can be published in order to meet federal and state requirements.

In case you are previously informed about US Legal Forms internet site and get your account, just log in. After that, you are able to down load the Nevada Restructuring Agreement format.

If you do not offer an accounts and would like to start using US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for your right metropolis/state.

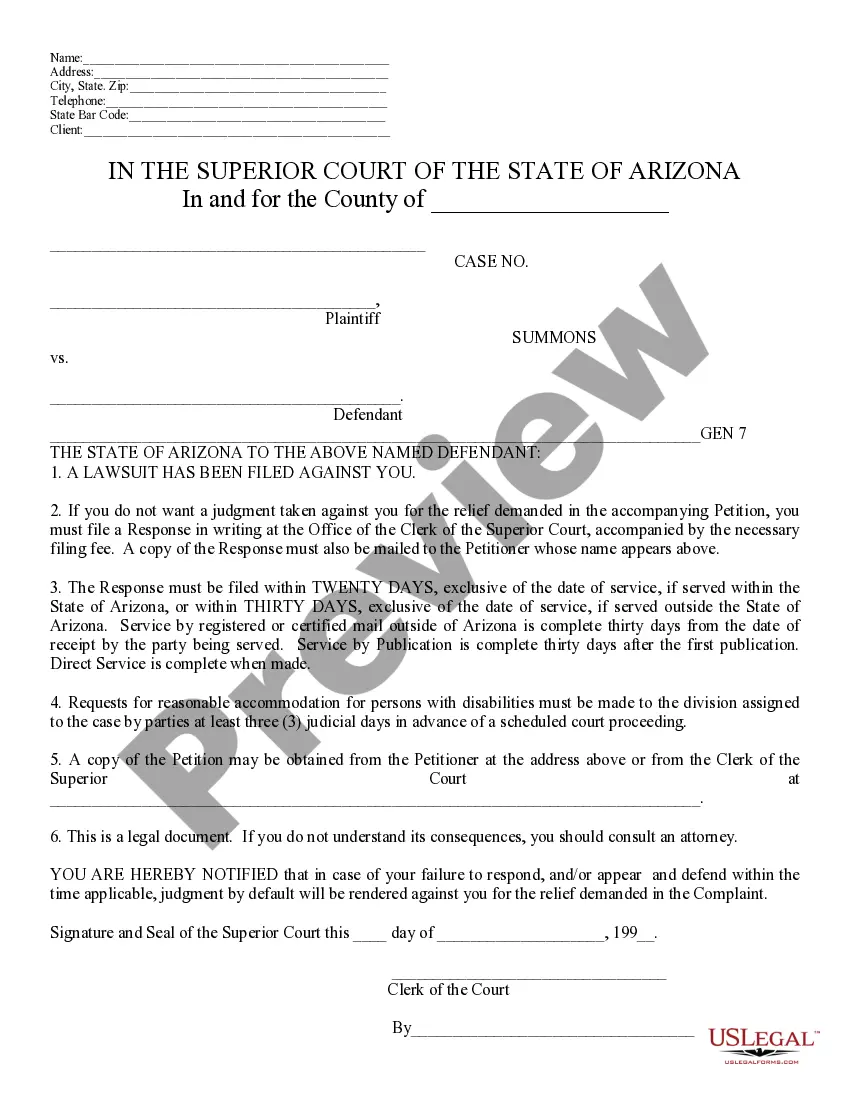

- Use the Review key to review the shape.

- See the information to actually have chosen the proper develop.

- When the develop is not what you`re searching for, use the Search area to obtain the develop that suits you and requirements.

- If you discover the right develop, just click Acquire now.

- Select the rates strategy you would like, fill in the required details to produce your money, and pay for the transaction making use of your PayPal or credit card.

- Choose a hassle-free data file file format and down load your copy.

Get all of the document layouts you may have bought in the My Forms menus. You can get a more copy of Nevada Restructuring Agreement any time, if needed. Just go through the needed develop to down load or print the document format.

Use US Legal Forms, probably the most considerable collection of lawful kinds, to save some time and avoid mistakes. The assistance provides skillfully made lawful document layouts which can be used for a selection of purposes. Generate your account on US Legal Forms and commence generating your daily life a little easier.