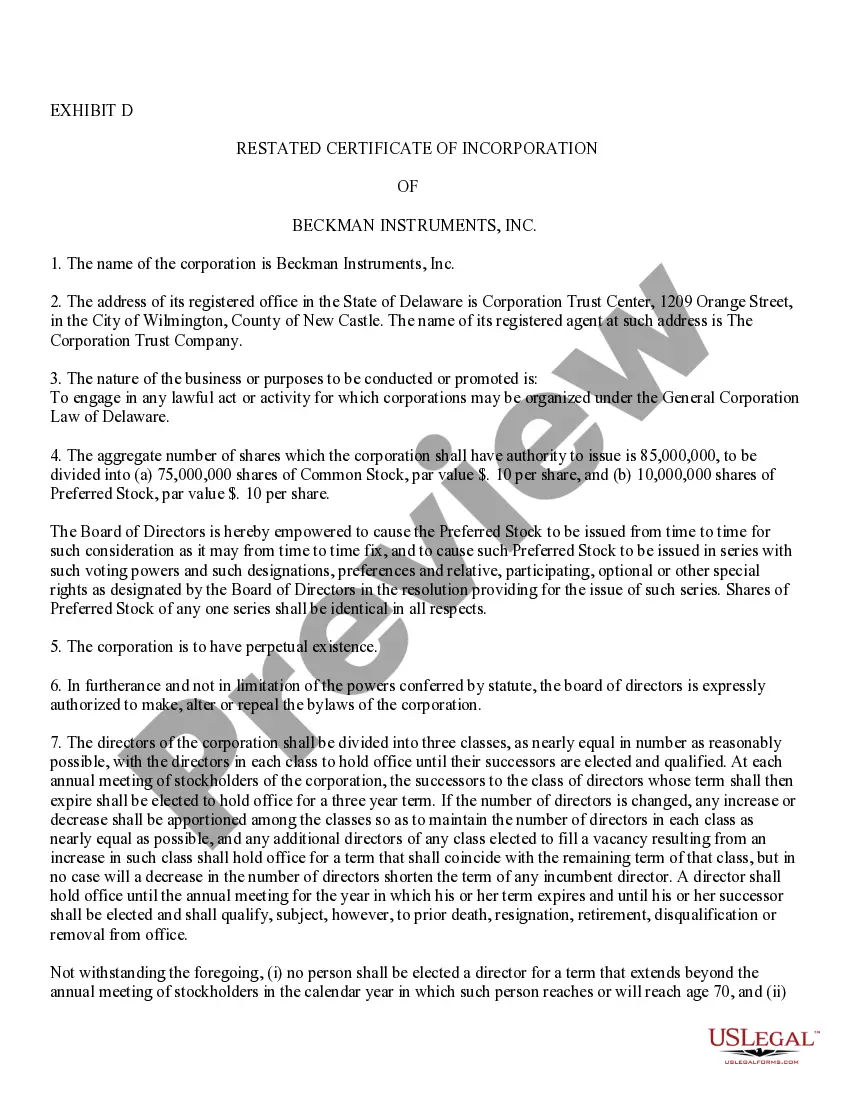

Nevada Approval of Amendments to Restated Certificate of Incorporation with Amendment: A Comprehensive Guide for Businesses Introduction: In the state of Nevada, businesses operating as corporations are required to file various legal documents to comply with the state's regulations. One such crucial document is the Approval of Amendments to Restated Certificate of Incorporation with Amendment. This article aims to provide a detailed description of this process, highlighting its significance, requirements, and different types available for businesses in Nevada. Key Keywords: Nevada, Approval of Amendments, Restated Certificate of Incorporation, Amendment, Business, Corporations. 1. What is the Approval of Amendments to Restated Certificate of Incorporation with Amendment? The Approval of Amendments to Restated Certificate of Incorporation with Amendment is a legal procedure that allows Nevada corporations to modify or update their existing Restated Certificate of Incorporation. This document represents the core governing document of a corporation, outlining its purpose, structure, and essential provisions. 2. Why is the Approval of Amendments important? Amendments to the Restated Certificate of Incorporation may be necessary due to various reasons, such as changing the corporate name, updating the registered agent's information, altering the number of authorized shares, or making changes to the corporation's purpose. Approval of Amendments ensures that these modifications are recorded and recognized by the state, offering legal protection and legitimacy to the business. 3. What are the requirements for filing the Approval of Amendments? To successfully file the Approval of Amendments to Restated Certificate of Incorporation with Amendment, businesses need to comply with the following requirements: a) Preparation of the Amendment: The corporation must draft a clear and concise amendment document, precisely stating the changes proposed for the Restated Certificate of Incorporation. b) Board Approval: The amendment must be approved by the corporation's board of directors. This approval may require holding a board meeting and documenting the decision in the meeting minutes. c) Shareholder Approval: In some cases, certain amendments may require the approval of the corporation's shareholders. This typically applies to significant changes like alterations to the corporation's purpose or a merger with another business entity. d) Filing and Fees: The approved amendment document, along with the necessary filing fees, must be submitted to the Nevada Secretary of State. The filing fees can vary depending on the nature and complexity of the amendments proposed. 4. Different Types of Nevada Approval of Amendments to Restated Certificate of Incorporation with Amendment: Nevada offers several types of Approval of Amendments to Restated Certificate of Incorporation, primarily based on the nature and extent of the changes being made. Here are some common types: a) Name Change Amendment: This type of amendment is filed when a corporation wishes to change its legal name. It must be supported by the appropriate board and shareholder resolutions. b) Share Increase or Decrease Amendment: When a corporation wants to modify the number of authorized shares, either by increasing or decreasing it, this amendment type should be filed. It requires proper board and shareholder approvals as per Nevada law. c) Registered Agent Amendment: If there is a need to change the registered agent or their address, this amendment should be filed. It ensures that the state has updated contact information for legal correspondence. Conclusion: Understanding the Approval of Amendments to Restated Certificate of Incorporation with Amendment is essential for Nevada corporations seeking to make changes to their governing documents. By complying with the requirements and procedures outlined by the state, businesses can ensure that their amendments are legally recognized and valid. Whether it's a name change, share modification, or registered agent amendment, businesses should carefully navigate this process to maintain legal compliance and protect their interests in the state of Nevada.

Nevada Approval of Amendments to Restated Certificate of Incorporation with Amendment: A Comprehensive Guide for Businesses Introduction: In the state of Nevada, businesses operating as corporations are required to file various legal documents to comply with the state's regulations. One such crucial document is the Approval of Amendments to Restated Certificate of Incorporation with Amendment. This article aims to provide a detailed description of this process, highlighting its significance, requirements, and different types available for businesses in Nevada. Key Keywords: Nevada, Approval of Amendments, Restated Certificate of Incorporation, Amendment, Business, Corporations. 1. What is the Approval of Amendments to Restated Certificate of Incorporation with Amendment? The Approval of Amendments to Restated Certificate of Incorporation with Amendment is a legal procedure that allows Nevada corporations to modify or update their existing Restated Certificate of Incorporation. This document represents the core governing document of a corporation, outlining its purpose, structure, and essential provisions. 2. Why is the Approval of Amendments important? Amendments to the Restated Certificate of Incorporation may be necessary due to various reasons, such as changing the corporate name, updating the registered agent's information, altering the number of authorized shares, or making changes to the corporation's purpose. Approval of Amendments ensures that these modifications are recorded and recognized by the state, offering legal protection and legitimacy to the business. 3. What are the requirements for filing the Approval of Amendments? To successfully file the Approval of Amendments to Restated Certificate of Incorporation with Amendment, businesses need to comply with the following requirements: a) Preparation of the Amendment: The corporation must draft a clear and concise amendment document, precisely stating the changes proposed for the Restated Certificate of Incorporation. b) Board Approval: The amendment must be approved by the corporation's board of directors. This approval may require holding a board meeting and documenting the decision in the meeting minutes. c) Shareholder Approval: In some cases, certain amendments may require the approval of the corporation's shareholders. This typically applies to significant changes like alterations to the corporation's purpose or a merger with another business entity. d) Filing and Fees: The approved amendment document, along with the necessary filing fees, must be submitted to the Nevada Secretary of State. The filing fees can vary depending on the nature and complexity of the amendments proposed. 4. Different Types of Nevada Approval of Amendments to Restated Certificate of Incorporation with Amendment: Nevada offers several types of Approval of Amendments to Restated Certificate of Incorporation, primarily based on the nature and extent of the changes being made. Here are some common types: a) Name Change Amendment: This type of amendment is filed when a corporation wishes to change its legal name. It must be supported by the appropriate board and shareholder resolutions. b) Share Increase or Decrease Amendment: When a corporation wants to modify the number of authorized shares, either by increasing or decreasing it, this amendment type should be filed. It requires proper board and shareholder approvals as per Nevada law. c) Registered Agent Amendment: If there is a need to change the registered agent or their address, this amendment should be filed. It ensures that the state has updated contact information for legal correspondence. Conclusion: Understanding the Approval of Amendments to Restated Certificate of Incorporation with Amendment is essential for Nevada corporations seeking to make changes to their governing documents. By complying with the requirements and procedures outlined by the state, businesses can ensure that their amendments are legally recognized and valid. Whether it's a name change, share modification, or registered agent amendment, businesses should carefully navigate this process to maintain legal compliance and protect their interests in the state of Nevada.