Nevada Designation of Rights, Privileges and Preferences of Preferred Stock

Description

How to fill out Designation Of Rights, Privileges And Preferences Of Preferred Stock?

You are able to devote time on the Internet attempting to find the legitimate papers design that meets the federal and state demands you want. US Legal Forms provides thousands of legitimate forms that happen to be examined by specialists. You can actually acquire or print out the Nevada Designation of Rights, Privileges and Preferences of Preferred Stock from our assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Obtain switch. Following that, it is possible to complete, revise, print out, or signal the Nevada Designation of Rights, Privileges and Preferences of Preferred Stock. Each and every legitimate papers design you get is the one you have eternally. To get one more backup of the acquired form, go to the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site initially, keep to the basic recommendations listed below:

- Very first, make sure that you have chosen the correct papers design for your area/metropolis of your choice. See the form description to make sure you have selected the correct form. If offered, take advantage of the Preview switch to appear throughout the papers design also.

- If you want to get one more edition from the form, take advantage of the Search industry to get the design that meets your requirements and demands.

- When you have identified the design you would like, simply click Purchase now to continue.

- Pick the rates strategy you would like, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal accounts to purchase the legitimate form.

- Pick the format from the papers and acquire it to the product.

- Make adjustments to the papers if required. You are able to complete, revise and signal and print out Nevada Designation of Rights, Privileges and Preferences of Preferred Stock.

Obtain and print out thousands of papers templates using the US Legal Forms Internet site, that offers the biggest collection of legitimate forms. Use skilled and status-distinct templates to deal with your organization or specific requires.

Form popularity

FAQ

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the customarily specified rate that preferred dividends are paid to preferred shareholders, as well as an additional dividend based on some predetermined condition.

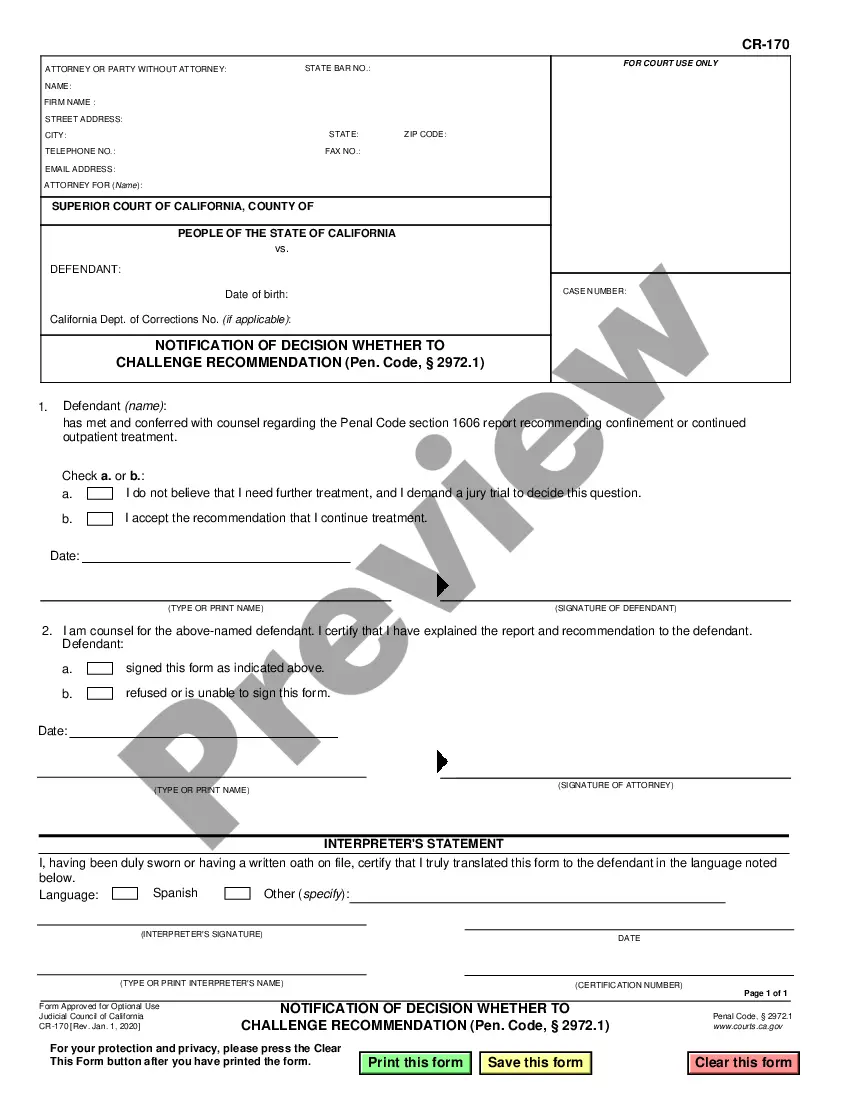

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

Ergo, preference shareholders hold preferential rights over common shareholders when it comes to sharing profits. Consequently, if a company lands into bankruptcy, preference shareholders are issued dividends first or have the first right to the company's assets before common stock investors.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

Preference shares, also known as preferred shares, are a type of security that offers characteristics similar to both common shares and a fixed-income security. The holders of preference shares are typically given priority when it comes to any dividends that the company pays.

In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. Straight preferreds are issued in perpetuity (although some are subject to call by the issuer, under certain conditions) and pay a stipulated dividend rate to the holder.

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed ...

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

Without the voting rights, preferred stockholders are not considered owners of the company. Common shareholders, on the other hand, own a percentage of the company depending on how many shares they own.