Nevada Approval of Restricted Share Plan for Directors is a legal process that allows companies to implement a compensation plan specifically designed for directors through the issuance of restricted shares. This plan is subject to the approval of the Nevada Secretary of State and complies with the state's regulations and laws. The Nevada Approval of Restricted Share Plan for Directors aims to reward and incentivize board members by granting them a stake in the company's performance and long-term success. Restricted shares are stocks that come with certain conditions and limitations, primarily focusing on vesting schedules and predetermined release dates. To initiate the Nevada Approval of Restricted Share Plan for Directors, the company must submit the plan to the Nevada Secretary of State for review and obtain their official approval. This ensures compliance with the state's requirements and proper governance in the implementation of the plan. Once approved, the company can move forward with granting restricted shares to the directors as outlined in the plan. The plan often includes a detailed breakdown of the number of shares to be granted, vesting conditions, and any performance metrics aligned with the company's objectives. By linking director compensation to the company's performance, this plan encourages directors to make decisions that positively impact the organization and its shareholders. Different types of Nevada Approval of Restricted Share Plans for Directors may exist based on the specific needs and circumstances of the company. These could include: 1. Performance-Based Restricted Share Plan: This type of plan ties the release of restricted shares to specific performance goals or key performance indicators (KPIs) established by the company. Directors must meet or exceed these targets to earn the full allocation of shares. 2. Time-Based Restricted Share Plan: This plan grants directors a predetermined number of shares that vest over a specific period, often staggered over several years. This incentivizes directors to remain committed to the company's goals and long-term success. 3. Equity Incentive Plan for Directors: This broader plan not only includes restricted shares but also provides other equity-based incentives such as stock options or stock appreciation rights (SARS). Directors can choose the type of equity award that suits them best, promoting flexibility and alignment with individual preferences. All these variations of the Nevada Approval of Restricted Share Plan for Directors require careful consideration and thoughtful structuring to ensure they comply with Nevada state laws and regulations. It is essential for companies to consult legal professionals experienced in corporate governance and compensation matters during the preparation and submission process of these plans.

Nevada Approval of Restricted Share Plan for Directors with Copy of Plan

Description

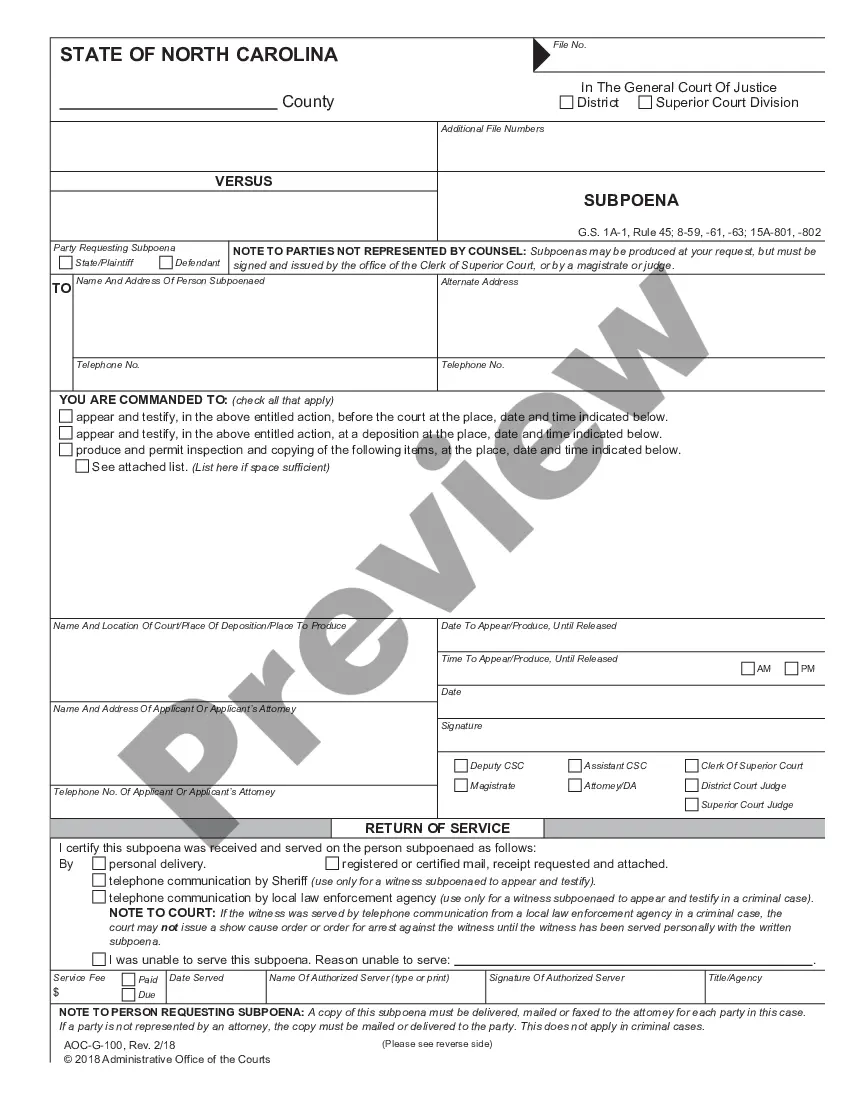

How to fill out Nevada Approval Of Restricted Share Plan For Directors With Copy Of Plan?

Are you currently inside a position that you require paperwork for either company or personal reasons virtually every time? There are a lot of authorized papers layouts accessible on the Internet, but getting ones you can depend on is not simple. US Legal Forms offers 1000s of develop layouts, much like the Nevada Approval of Restricted Share Plan for Directors with Copy of Plan, which can be written to fulfill state and federal demands.

If you are already familiar with US Legal Forms website and get an account, simply log in. Following that, you can obtain the Nevada Approval of Restricted Share Plan for Directors with Copy of Plan design.

Unless you come with an bank account and wish to start using US Legal Forms, adopt these measures:

- Obtain the develop you need and ensure it is to the correct town/area.

- Use the Review option to analyze the shape.

- Browse the outline to actually have chosen the appropriate develop.

- When the develop is not what you`re looking for, make use of the Lookup discipline to obtain the develop that suits you and demands.

- When you find the correct develop, just click Acquire now.

- Select the costs strategy you would like, fill in the specified information to create your account, and pay money for an order with your PayPal or bank card.

- Decide on a practical data file format and obtain your duplicate.

Find all of the papers layouts you have purchased in the My Forms food list. You can get a further duplicate of Nevada Approval of Restricted Share Plan for Directors with Copy of Plan anytime, if possible. Just go through the needed develop to obtain or print the papers design.

Use US Legal Forms, by far the most considerable collection of authorized varieties, to conserve some time and prevent errors. The service offers professionally manufactured authorized papers layouts that can be used for a range of reasons. Produce an account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

Unless the articles of incorporation or the bylaws provide for a greater or lesser proportion, a majority of the board of directors of the corporation then in office, at a meeting duly assembled, is necessary to constitute a quorum for the transaction of business, and the act of directors holding a majority of the ...

Chapter 78 Private Corporations. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method.

Nevada law contains a provision governing ?acquisition of controlling interest.? This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to ...

NRS 78.138 - Directors and officers: Fiduciary duties; exercise of powers; presumptions and considerations; liability to corporation, stockholders and creditors. 1. The fiduciary duties of directors and officers are to exercise their respective powers in good faith and with a view to the interests of the corporation.

As provided under Nevada Revised Statutes 119A. 410, the purchaser of a time share may cancel, by written notice, the contract of sale until midnight of the fifth calendar day following the date of execution of the contract. The contract of sale must include a statement of this right.

The Nevada Business Corporation Act allows businesses to be formed to conduct any lawful business. The act allows for a corporation to serve a purpose aside from those stated in the articles of corporations.

"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...