Nevada Proposal Approval of Nonqualified Stock Option Plan

Description

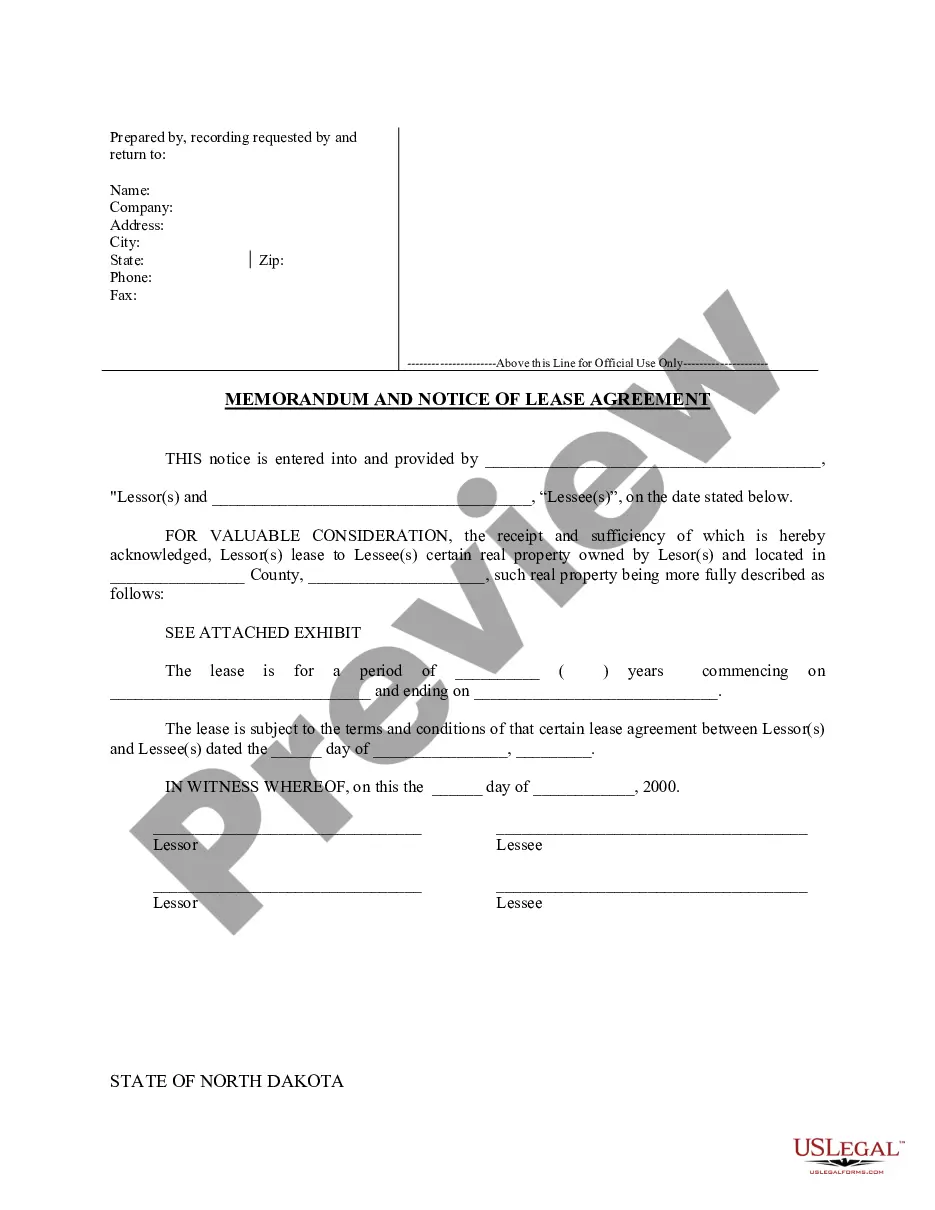

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

Have you been within a placement the place you will need paperwork for sometimes organization or individual functions almost every time? There are a lot of authorized papers templates available on the net, but getting kinds you can depend on is not effortless. US Legal Forms delivers 1000s of type templates, just like the Nevada Proposal Approval of Nonqualified Stock Option Plan, that are published in order to meet federal and state needs.

Should you be previously informed about US Legal Forms site and get an account, merely log in. Next, you may down load the Nevada Proposal Approval of Nonqualified Stock Option Plan format.

If you do not provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Find the type you need and ensure it is for the proper city/county.

- Take advantage of the Preview option to analyze the shape.

- See the information to ensure that you have selected the appropriate type.

- If the type is not what you are searching for, make use of the Lookup field to discover the type that fits your needs and needs.

- If you obtain the proper type, just click Acquire now.

- Opt for the prices plan you desire, submit the necessary information and facts to create your account, and pay for the order utilizing your PayPal or credit card.

- Decide on a convenient file format and down load your backup.

Get each of the papers templates you might have purchased in the My Forms menus. You can aquire a extra backup of Nevada Proposal Approval of Nonqualified Stock Option Plan at any time, if possible. Just go through the essential type to down load or print out the papers format.

Use US Legal Forms, one of the most considerable selection of authorized forms, in order to save efforts and prevent blunders. The support delivers appropriately manufactured authorized papers templates which you can use for a selection of functions. Produce an account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Board Approval The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders.

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.