Nevada Adjustments refer to the legal modifications or changes in the capital structure of a Nevada-based company, particularly during the process of reorganization or restructuring. These adjustments are undertaken to ensure compliance with legal requirements and to protect the interests of shareholders, creditors, and other stakeholders. Below, we will delve into various types of Nevada Adjustments commonly encountered during reorganization or capital structure changes, discussing their significance and relevant keywords. 1. Stock Split: A Nevada Adjustment that involves dividing existing shares into multiple shares, typically to increase liquidity and decrease the stock price. Keywords: stock split, increased liquidity, adjustment in number of shares. 2. Reverse Stock Split: This Nevada Adjustment consolidates existing shares into a smaller number of shares, often utilized to meet listing requirements or enhance the company's perceived value. Keywords: reverse stock split, consolidation of shares, increased stock price. 3. Conversion of Debt into Equity: This Nevada Adjustment entails converting outstanding debt obligations into equity, usually new shares of the company's stock. It helps reduce the debt burden, strengthen the balance sheet, and offer creditors an opportunity to benefit from potential upside. Keywords: debt-to-equity conversion, balance sheet strengthening, creditor participation. 4. Dilution Protection: A Nevada Adjustment implemented to protect existing shareholders' ownership percentage by issuing them additional shares proportionate to any newly issued shares, preventing dilution of their stake. Keywords: dilution protection, anti-dilution measures, shareholder rights. 5. Preferred Stock Conversion: This Nevada Adjustment involves converting preferred stock into common stock, often used to simplify the capital structure, increase flexibility, or favor certain shareholders. Keywords: preferred stock conversion, simplifying capital structure, increased flexibility. 6. Bond Restructuring: A Nevada Adjustment aimed at modifying the terms of existing bonds, typically to provide the issuer more financial flexibility, negotiate better interest rates, or extend the maturity date. Keywords: bond restructuring, modified bond terms, improved financial flexibility. 7. Mergers and Acquisitions: In case of reorganization or capital structure changes involving mergers or acquisitions, various adjustment mechanisms may apply, such as share swaps or cash offers, to align the interests of the involved parties. Keywords: mergers and acquisitions, share swaps, cash offers, alignment of interests. 8. Reverse Takeovers: In some situations, a Nevada company may undergo a reverse takeover, wherein a private business acquires a publicly-traded company, resulting in adjustments to the capital structure to accommodate the new ownership dynamics. Keywords: reverse takeovers, private-public company merger, capital structure adjustments. Throughout the process of reorganization or changes in the capital structure in Nevada, it is crucial to seek legal and financial advice to ensure compliance with state regulations and maximization of stakeholder value. Implementing appropriate Nevada Adjustments enables companies to navigate these transformations effectively and protect the interests of all parties involved.

Nevada Adjustments in the event of reorganization or changes in the capital structure

Description

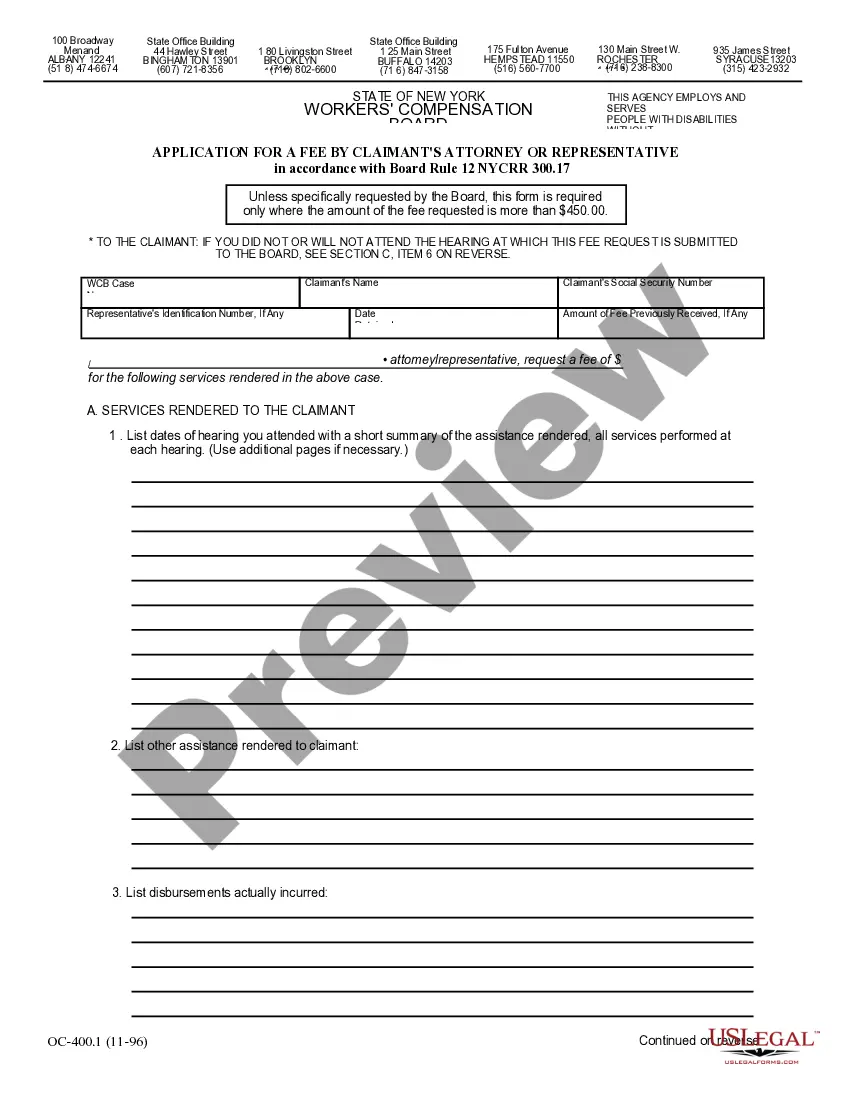

How to fill out Nevada Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

US Legal Forms - one of several greatest libraries of authorized types in the United States - gives an array of authorized file templates you can download or produce. Using the website, you will get a huge number of types for enterprise and person reasons, sorted by categories, says, or keywords.You will discover the newest types of types such as the Nevada Adjustments in the event of reorganization or changes in the capital structure within minutes.

If you have a membership, log in and download Nevada Adjustments in the event of reorganization or changes in the capital structure from your US Legal Forms catalogue. The Acquire key will show up on each develop you see. You have accessibility to all previously acquired types within the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed below are easy directions to help you started off:

- Make sure you have picked out the proper develop for the area/region. Click on the Review key to review the form`s articles. See the develop explanation to ensure that you have selected the appropriate develop.

- In case the develop doesn`t match your needs, utilize the Lookup industry towards the top of the display to get the the one that does.

- In case you are content with the form, affirm your choice by clicking the Purchase now key. Then, opt for the rates plan you favor and offer your accreditations to register to have an bank account.

- Approach the deal. Use your charge card or PayPal bank account to complete the deal.

- Select the format and download the form on your system.

- Make changes. Fill up, change and produce and indication the acquired Nevada Adjustments in the event of reorganization or changes in the capital structure.

Every single format you included with your account does not have an expiration day which is yours permanently. So, if you would like download or produce yet another copy, just go to the My Forms portion and click on in the develop you want.

Get access to the Nevada Adjustments in the event of reorganization or changes in the capital structure with US Legal Forms, one of the most extensive catalogue of authorized file templates. Use a huge number of expert and express-distinct templates that meet your small business or person requirements and needs.

Form popularity

FAQ

Under Nevada Revised Statutes (NRS) 200.571, "harassment" is used as a very broad legal rubric that takes in such diverse offenses as threatening to cause bodily injury on another person, to damage another person's property, to restrain or physically confine ("falsely imprison") another person, or even to commit an ...

NRS stands for Nevada Revised Statutes. NRS stands for Nevada Revised Statutes. The NRS is a compilation of all the current state laws in Nevada.

An oppressor can be found guilty of a crime under N.R.S. 197.200 if, while pretending to be acting under official authority, the oppressor arrests or detains any person against that person's will.

The National Response System (NRS) is a mechanism routinely and effectively used to respond to a wide range of oil and hazardous substance releases. It is a multi-layered system involving individuals and teams from tribal, local, state, and federal agencies, as well as industry and other organizations.

Section 163.556 of the Nevada Revised Statutes authorizes a trustee to decant a trust that has a Nevada situs, is governed by Nevada law, or that is administered under Nevada law.

Nevada Revised Statutes (NRS) are laws that are enacted by the legislature. The primary laws that govern real estate are listed below. Changes to these laws may only be made through legislative action. You can follow changes to these laws by visiting the Nevada Legislature website.

Pursuant to Title 7 of the Nevada Revised Statutes and for the purposes of the State Business License, ?business? means any person, except a natural person that performs a service or engages in a trade for profit, any natural person who performs a service or engages in a trade for profit and is required to file with ...

Chapter 0PRELIMINARY CHAPTERTITLE 6?JUSTICE COURTS AND CIVIL PROCEDURE THEREINChapter 64General ProvisionsChapter 65PartiesChapter 66Place of Trial251 more rows ?