Nevada Dividend Equivalent Shares, also known as Nevada Dividend Equivalents, are a financial instrument that allows shareholders to receive dividends in the form of additional shares instead of cash payments. This method is commonly used by corporations to reward their shareholders for their investment in the company. By issuing dividend equivalent shares, Nevada-based corporations can provide a tax-efficient way for their shareholders to receive dividends and potentially increase their ownership stake in the company. Nevada Dividend Equivalent Shares are typically offered to shareholders who meet certain eligibility criteria set by the company. These criteria may include holding a minimum number of shares, being a shareholder for a specific period, or fulfilling other predetermined requirements. Upon fulfilling these criteria, eligible shareholders are entitled to receive dividend equivalent shares in proportion to their existing shareholdings. The issuance of Nevada Dividend Equivalent Shares provides several benefits for both the company and the shareholders. For the company, offering dividend equivalent shares can help in conserving cash, as they do not have to make cash payments for dividends. This can be especially beneficial for growing companies that need to reinvest their profits into their business operations. In addition, issuing dividend equivalent shares can help in preserving the liquidity of the company, as cash payments are not required. For shareholders, Nevada Dividend Equivalent Shares present an opportunity to increase their ownership in the company without necessarily investing additional funds. By receiving additional shares instead of cash dividends, shareholders can potentially benefit from the company's future growth and increase their voting rights in the company's decision-making processes. Furthermore, Nevada Dividend Equivalent Shares may come in different types or variations, depending on the company and its specific dividend policies. Some examples of different types could include: 1. Regular Dividend Equivalent Shares: These are the standard dividend equivalent shares offered by the company to eligible shareholders, following predefined criteria. 2. Preferred Dividend Equivalent Shares: Certain companies might offer a preferred class of dividend equivalent shares, granting shareholders specific advantages or preferences, such as priority in receiving dividends or enhanced voting rights. 3. Performance-based Dividend Equivalent Shares: In some cases, companies may issue dividend equivalent shares based on the company's performance, rewarding shareholders for meeting certain performance targets or milestones. It is important to note that the specific types of Nevada Dividend Equivalent Shares may differ among companies and the terms of these shares should be carefully reviewed, as they may vary based on the company's dividend policies and shareholder agreements. Before considering any investment in Nevada Dividend Equivalent Shares, it is advisable to consult with a financial advisor or conduct thorough research to fully understand the potential benefits, risks, and implications associated with this financial instrument.

Nevada Dividend Equivalent Shares

Description

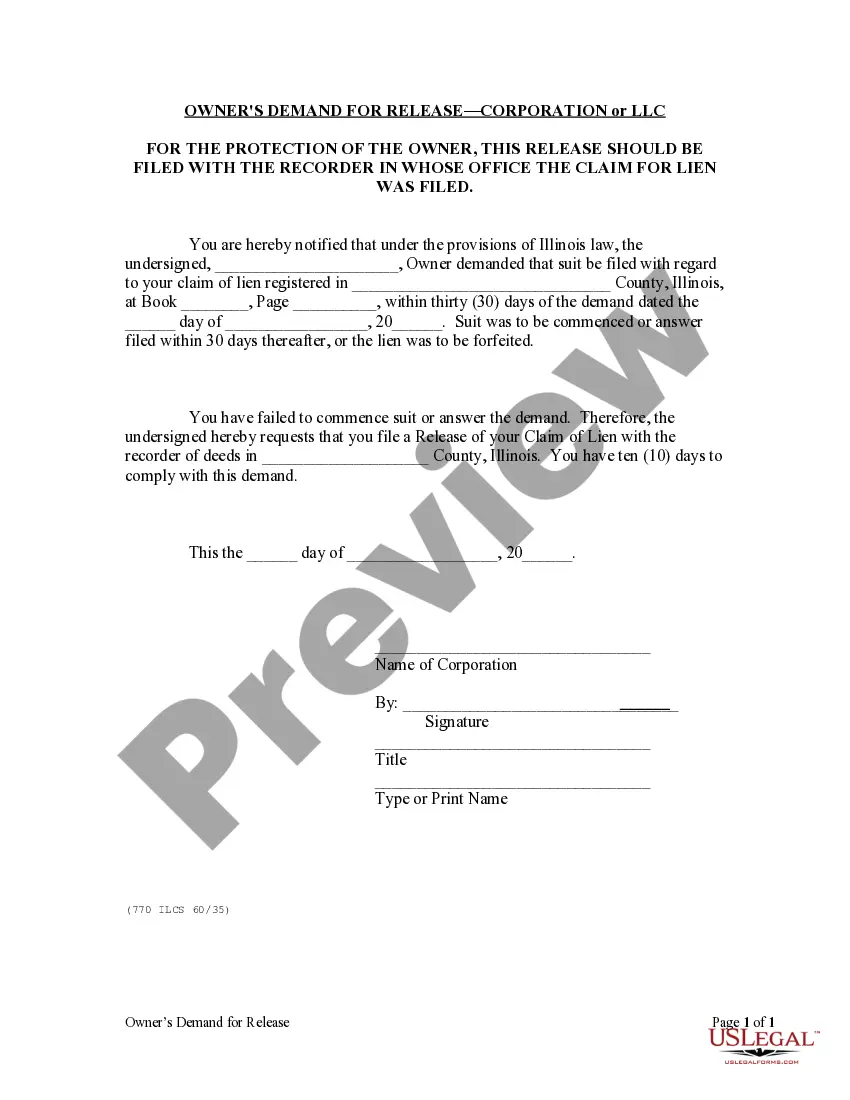

How to fill out Nevada Dividend Equivalent Shares?

Have you been within a situation in which you need paperwork for sometimes business or personal reasons just about every day time? There are plenty of legitimate document layouts available on the net, but discovering types you can trust is not simple. US Legal Forms delivers a large number of type layouts, much like the Nevada Dividend Equivalent Shares, which are created to satisfy state and federal requirements.

When you are currently informed about US Legal Forms internet site and get a merchant account, basically log in. After that, you may download the Nevada Dividend Equivalent Shares template.

Unless you offer an bank account and want to start using US Legal Forms, adopt these measures:

- Find the type you will need and ensure it is for your right metropolis/area.

- Make use of the Review switch to analyze the shape.

- Browse the outline to actually have selected the appropriate type.

- If the type is not what you`re trying to find, utilize the Look for discipline to discover the type that fits your needs and requirements.

- When you get the right type, just click Purchase now.

- Opt for the prices plan you would like, complete the required information and facts to produce your bank account, and purchase your order making use of your PayPal or Visa or Mastercard.

- Pick a convenient data file file format and download your duplicate.

Find all the document layouts you might have purchased in the My Forms food selection. You can obtain a additional duplicate of Nevada Dividend Equivalent Shares any time, if possible. Just click the necessary type to download or printing the document template.

Use US Legal Forms, by far the most extensive assortment of legitimate forms, in order to save efforts and avoid blunders. The support delivers skillfully produced legitimate document layouts that can be used for a selection of reasons. Generate a merchant account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Unless otherwise provided in the articles of incorporation or the bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, ...

Holders of RSUs have no voting rights nor do they receive any dividends paid. Some companies may elect to pay dividend equivalents. For example, they may let dividends accrue and allocate those funds to cover some of the taxes due at vesting. Usually, vesting halts if the employee is terminated.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

A form of unanimous written consent of the board of directors of a Nevada for-profit corporation to be used when the directors take action without a formal board meeting. This Standard Document has integrated notes with important explanations and drafting tips.

Chapter 78 Private Corporations. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method.

The Nevada Revised Statutes (NRS) are all the current codified laws of the State of Nevada. Nevada law consists of the Constitution of Nevada (the state constitution) and Nevada Revised Statutes. The Nevada Supreme Court interprets the law and constitution of Nevada.

NRS 78.138 - Directors and officers: Fiduciary duties; exercise of powers; presumptions and considerations; liability to corporation, stockholders and creditors. 1. The fiduciary duties of directors and officers are to exercise their respective powers in good faith and with a view to the interests of the corporation.