The Nevada Stock Appreciation Rights Plan (SARS) of The Todd-AO Corporation is a compensation program designed to incentivize and reward employees for their contributions to the company's growth and success. SARS is a type of equity-based compensation plan that grants employees the opportunity to receive a cash payment equal to the appreciation in the company's stock price over a specified period. Under the Nevada SARS Plan, eligible employees are granted SARS as a form of additional compensation. This SARS provides employees with the right to receive a cash payment or stock equivalent based on the increase in the company's stock price between the grant date and the exercise date. The exercise price is typically set at the fair market value of the stock on the grant date. The Todd-AO Corporation offers different types of Nevada Stock Appreciation Rights Plans to cater to varying employee needs and goals. Some key types include: 1. Performance-Based SARS: This SARS is tied to specific performance goals or targets set by the company. Employees are granted SARS with the opportunity to earn a cash payment based on the achievement of these predetermined performance metrics. This type of SARS plan allows employees to align their efforts with the company's objectives and share in its success. 2. Time-Based SARS: Time-based SARS are granted to employees based on their tenure with the company. This SARS typically vest over a predetermined period, such as three to five years. Once fully vested, employees have the option to exercise their SARS and receive a cash payment or stock equivalent based on the appreciation in the company's stock price. 3. Restricted SARS: Restricted SARS are subject to certain restrictions or conditions. These conditions may include a requirement to meet specific performance targets, continued employment with the company, or a limit on the number of SARS that can be exercised at any given time. Restricted SARS provide an additional layer of motivation for employees to fulfill the predetermined conditions in order to fully benefit from the appreciation in the company's stock price. The Todd-AO Corporation's Nevada Stock Appreciation Rights Plan is a valuable tool for attracting and retaining talented employees. By aligning employee incentives with the company's performance, it encourages individuals to contribute to the long-term growth and profitability of the organization. This equity-based compensation program not only rewards employees for their efforts but also allows them to share in the company's success by reaping the benefits of increased stock value.

Nevada Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

How to fill out Nevada Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Are you presently within a situation that you need to have documents for both business or personal reasons nearly every time? There are tons of lawful papers web templates accessible on the Internet, but getting versions you can trust is not easy. US Legal Forms gives a huge number of develop web templates, much like the Nevada Stock Appreciation Rights Plan of The Todd-AO Corporation, that are composed to fulfill federal and state specifications.

When you are already knowledgeable about US Legal Forms web site and also have a merchant account, just log in. Following that, you can down load the Nevada Stock Appreciation Rights Plan of The Todd-AO Corporation design.

Should you not have an profile and wish to begin using US Legal Forms, abide by these steps:

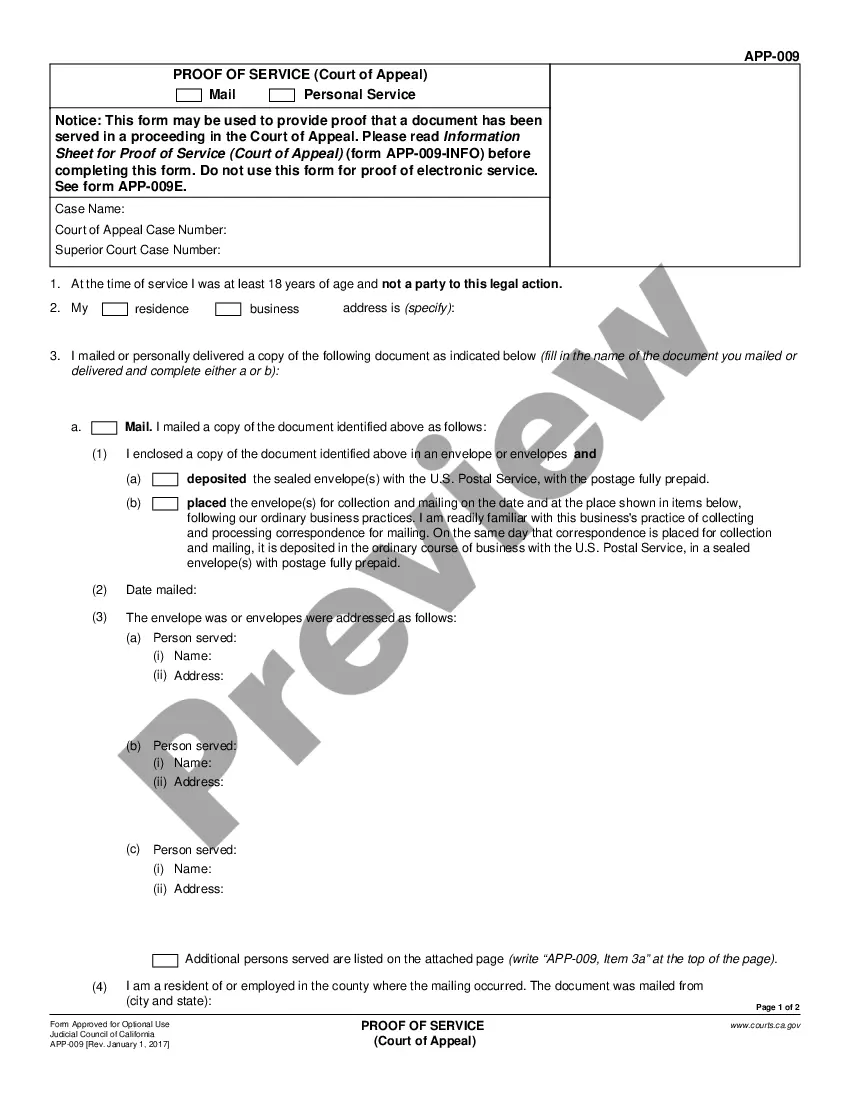

- Obtain the develop you want and make sure it is for your right town/area.

- Make use of the Review button to check the form.

- See the explanation to actually have selected the right develop.

- In case the develop is not what you are looking for, make use of the Research industry to obtain the develop that suits you and specifications.

- If you discover the right develop, click on Purchase now.

- Pick the pricing program you want, submit the specified details to generate your money, and purchase your order using your PayPal or Visa or Mastercard.

- Choose a practical paper structure and down load your backup.

Find each of the papers web templates you might have bought in the My Forms menu. You can obtain a additional backup of Nevada Stock Appreciation Rights Plan of The Todd-AO Corporation any time, if necessary. Just select the required develop to down load or print out the papers design.

Use US Legal Forms, one of the most extensive selection of lawful kinds, to conserve efforts and stay away from mistakes. The assistance gives skillfully created lawful papers web templates which you can use for a range of reasons. Produce a merchant account on US Legal Forms and initiate making your daily life easier.