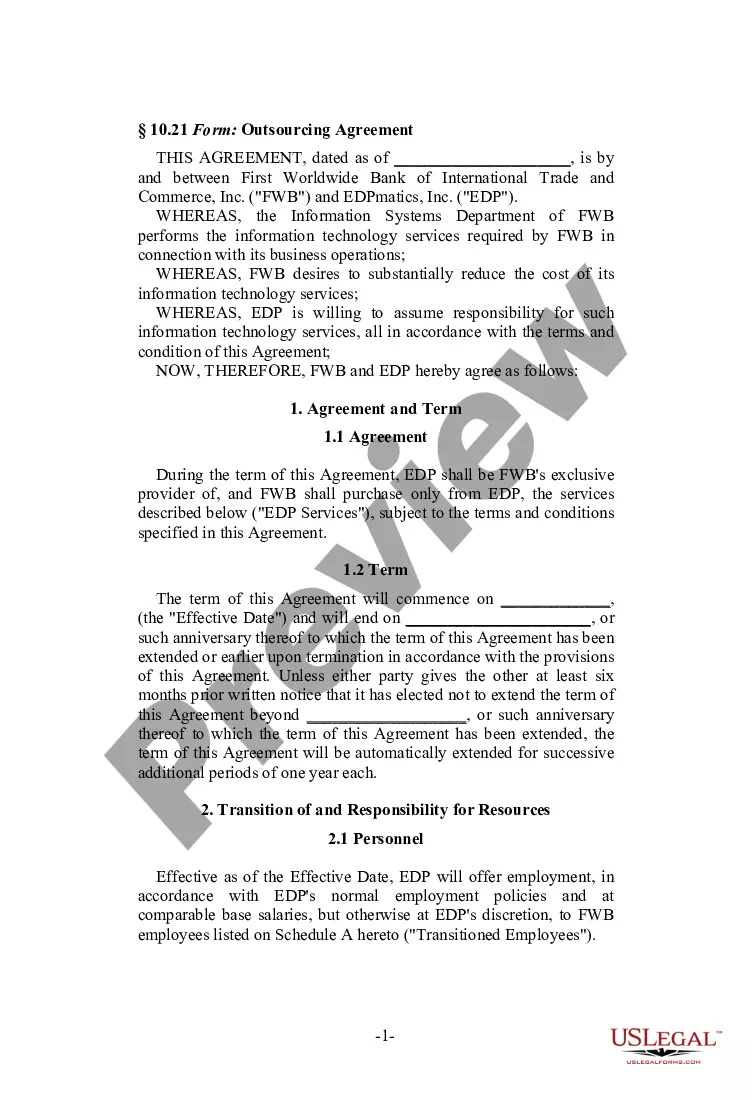

Nevada Approval of Company Employee Stock Purchase Plan is a legal authorization required for companies to establish a program allowing employees to purchase company stocks at a discounted rate. This plan serves as a beneficial incentive for employees to invest in their employer's company. The Nevada Approval of Company Employee Stock Purchase Plan outlines the specific terms and conditions under which employees can participate in the stock purchase program. It includes the eligibility criteria for employees, the maximum amount of shares they can purchase, the discount rate at which they can buy the stocks, and the duration of the plan. There are various types of Nevada Approval of Company Employee Stock Purchase Plans available, tailored to suit different company structures and employee needs: 1. Standard Employee Stock Purchase Plan: This type of plan allows all eligible employees to participate, typically offering them the opportunity to purchase company stocks at a discounted price. The plan may have specific enrollment periods and predetermined contribution limits. 2. Qualified Employee Stock Purchase Plan (ESPN): A Qualified ESPN is designed to meet the requirements of Internal Revenue Code Section 423. It provides additional tax advantages to employees, allowing them to purchase company stocks through payroll deductions without being subject to immediate taxation on the discount. 3. Non-Qualified Employee Stock Purchase Plan: Non-Qualified plans don't meet the requirements of Internal Revenue Code Section 423, thus offering less favorable tax treatment. However, employees can still purchase company stocks at a discount. 4. Rolling Employee Stock Purchase Plan: This type of plan often rolls over its offerings, allowing employees to continually participate in the program by purchasing new shares as they become available. It offers an ongoing stock purchasing opportunity, typically tied to a set schedule. 5. Employer Matching Employee Stock Purchase Plan: Some companies may offer a matching program where they contribute an additional percentage of the employee's contribution towards purchasing company stocks. This encourages employees to invest even more in the company. The Nevada Approval of Company Employee Stock Purchase Plan provides a transparent framework for companies to engage their employees in wealth creation and harness their loyalty to the organization. By offering discounted access to company stocks, employees have the opportunity to benefit from the potential appreciation of these stocks, while also motivating them to actively contribute to the company's success. Note: It is important to consult with legal and financial professionals to ensure compliance with Nevada state laws and regulations when establishing and implementing a Company Employee Stock Purchase Plan.

Nevada Approval of Company Employee Stock Purchase Plan

Description

How to fill out Approval Of Company Employee Stock Purchase Plan?

Discovering the right legitimate papers web template might be a have difficulties. Naturally, there are a lot of themes available online, but how can you find the legitimate type you want? Use the US Legal Forms website. The service delivers a large number of themes, like the Nevada Approval of Company Employee Stock Purchase Plan, that can be used for organization and private needs. All of the kinds are checked by pros and meet state and federal specifications.

When you are presently authorized, log in to your accounts and click on the Acquire key to find the Nevada Approval of Company Employee Stock Purchase Plan. Make use of accounts to appear throughout the legitimate kinds you may have bought formerly. Go to the My Forms tab of your respective accounts and obtain one more duplicate of your papers you want.

When you are a new consumer of US Legal Forms, allow me to share straightforward recommendations that you can comply with:

- Initially, be sure you have selected the proper type for the metropolis/region. It is possible to look through the form making use of the Preview key and study the form description to ensure it will be the right one for you.

- In case the type will not meet your needs, make use of the Seach discipline to discover the proper type.

- Once you are positive that the form would work, go through the Acquire now key to find the type.

- Select the prices prepare you want and enter in the needed info. Build your accounts and pay money for an order with your PayPal accounts or credit card.

- Opt for the file formatting and obtain the legitimate papers web template to your device.

- Complete, change and printing and indication the attained Nevada Approval of Company Employee Stock Purchase Plan.

US Legal Forms is definitely the greatest library of legitimate kinds for which you can see various papers themes. Use the company to obtain skillfully-manufactured documents that comply with express specifications.

Form popularity

FAQ

Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money.

For many business owners, an ESOP provides a ready market ? their own employees ? of potential buyers of their businesses. Because it is also a ?qualified? retirement plan, an ESOP offers workers tax advantages. Contributions made on their behalf aren't taxed until they withdraw them.

Below are our 10 key steps for creating, building and maintaining an ESPP: Determine the plan's purpose. ... Conduct external and internal research. ... Establish a budget. ... Pick the right components for the company. ... Seek stakeholder buy-in. ... Prepare early for shareholder approval. ... Select a provider. ... Create a robust implementation plan.

To qualify, ESPPs generally have to be available to all full-time employees with a certain amount of time vested in the job. Participants may need to hold their shares for at least one year after the purchase date and two years after the grant date to take advantage of the long-term capital gains rate.

qualified ESPP is a plan that does not meet the IRS requirements for a qualified ESPP, or that offers additional features that are not allowed for a qualified ESPP, such as allowing you to choose the purchase price or the purchase date.

Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today. There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility.

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date).

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

Employee Stock Purchase Plan: Qualified or Non-qualified Now, we can have a look at the key difference between the two types. An ESPP qualified plan is designed and operates ing to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.