The Nevada Restricted Stock Plan of Guilford Mills, Inc. is an employee benefit program offered by the company to its employees in the state of Nevada. This plan allows eligible employees to acquire shares of restricted stock in Guilford Mills, Inc. as a means of incentivizing and rewarding their contribution to the company's success. Under this plan, the employees are granted a specific number of restricted stock units (RSS) that represent a certain number of shares in Guilford Mills, Inc. The RSS are subject to a vesting period, during which the employee needs to fulfill certain conditions, such as continued employment or achievement of performance goals, in order to receive the full benefits associated with the granted shares. The Nevada Restricted Stock Plan of Guilford Mills, Inc. aims to align the interests of the employees with those of the company's shareholders, as the value of the shares is tied to the company's performance in the market. By providing employees with a stake in the company's success, this plan incentivizes them to work towards enhancing Guilford Mills, Inc.'s growth and profitability. The plan includes several key features and benefits, such as: 1. Vesting Period: The RSS granted to employees vest over a period of time, typically ranging from one to four years. This ensures that employees stay with the company and remain committed to achieving long-term goals. 2. Restricted Stock: The shares acquired through the plan are restricted, meaning there are certain limitations on their transferability or sale until certain conditions are met. This helps to ensure that employees maintain a long-term focus on the company's performance. 3. Stock Ownership: Participating employees become shareholders of Guilford Mills, Inc., which provides them with the rights and privileges associated with ownership, such as voting rights on important company matters. 4. Dividends and Distributions: Employees are entitled to receive dividends and other distributions on their restricted shares, subject to the plan's terms and conditions. This allows employees to benefit from the company's financial success even before their shares fully vest. The Nevada Restricted Stock Plan of Guilford Mills, Inc. may have different variations or types based on eligibility criteria, grant sizes, or specific vesting schedules. Some possible variations could include: 1. Executive Restricted Stock Plan: A separate plan designed specifically for executives or senior management, offering a larger number of shares and potentially different vesting criteria. 2. Performance-Based Restricted Stock Plan: A plan that ties the vesting of the shares to the achievement of certain predetermined performance goals or targets set by the company. 3. Employee Stock Purchase Plan (ESPN): While not specifically a restricted stock plan, an ESPN enables employees to purchase company stock at a discounted price, providing them with an opportunity to acquire shares and potentially benefit from their future growth. In conclusion, the Nevada Restricted Stock Plan of Guilford Mills, Inc. is an employee benefit program that grants eligible employees restricted stock units, subject to vesting criteria. This plan aligns the interests of employees with the company's performance, encourages long-term commitment, and provides employees with ownership rights and potential financial benefits. These features aim to motivate employees to contribute to Guilford Mills, Inc.'s growth and success while fostering a sense of ownership and loyalty.

Nevada Restricted Stock Plan of Guilford Mills, Inc.

Description

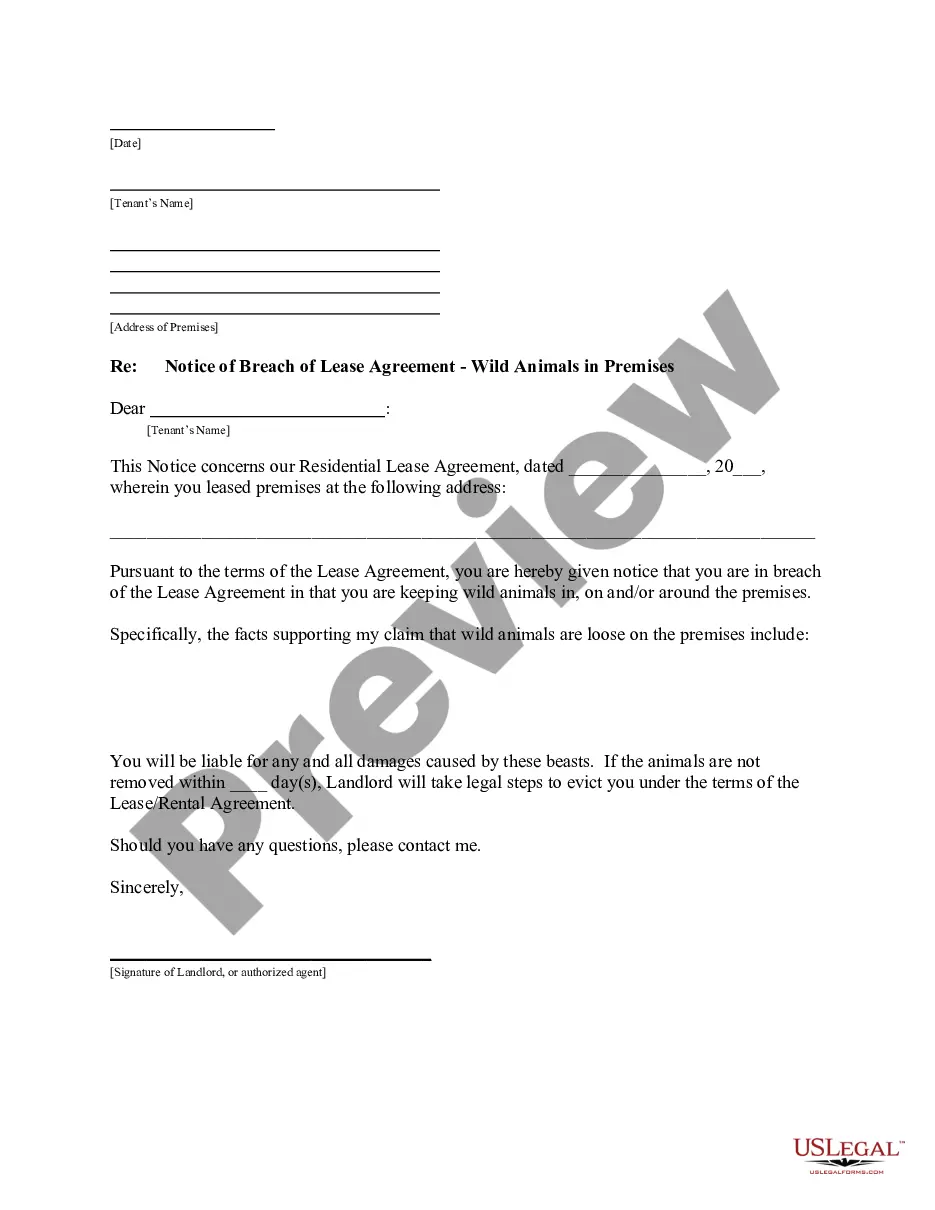

How to fill out Restricted Stock Plan Of Guilford Mills, Inc.?

You are able to devote hours on the web attempting to find the lawful file design that suits the federal and state needs you need. US Legal Forms offers thousands of lawful kinds that are evaluated by specialists. You can actually download or produce the Nevada Restricted Stock Plan of Guilford Mills, Inc. from the assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Download button. Following that, it is possible to total, revise, produce, or sign the Nevada Restricted Stock Plan of Guilford Mills, Inc.. Each and every lawful file design you acquire is the one you have for a long time. To get another copy for any obtained develop, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms web site initially, keep to the basic directions listed below:

- Initial, make sure that you have chosen the right file design for your state/metropolis of your choice. See the develop explanation to ensure you have chosen the appropriate develop. If accessible, utilize the Review button to search with the file design too.

- If you wish to locate another edition from the develop, utilize the Research discipline to find the design that meets your requirements and needs.

- After you have identified the design you would like, just click Get now to move forward.

- Select the pricing program you would like, type your qualifications, and sign up for an account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal bank account to pay for the lawful develop.

- Select the format from the file and download it in your gadget.

- Make adjustments in your file if needed. You are able to total, revise and sign and produce Nevada Restricted Stock Plan of Guilford Mills, Inc..

Download and produce thousands of file web templates using the US Legal Forms website, that provides the most important collection of lawful kinds. Use professional and state-specific web templates to tackle your small business or individual requirements.