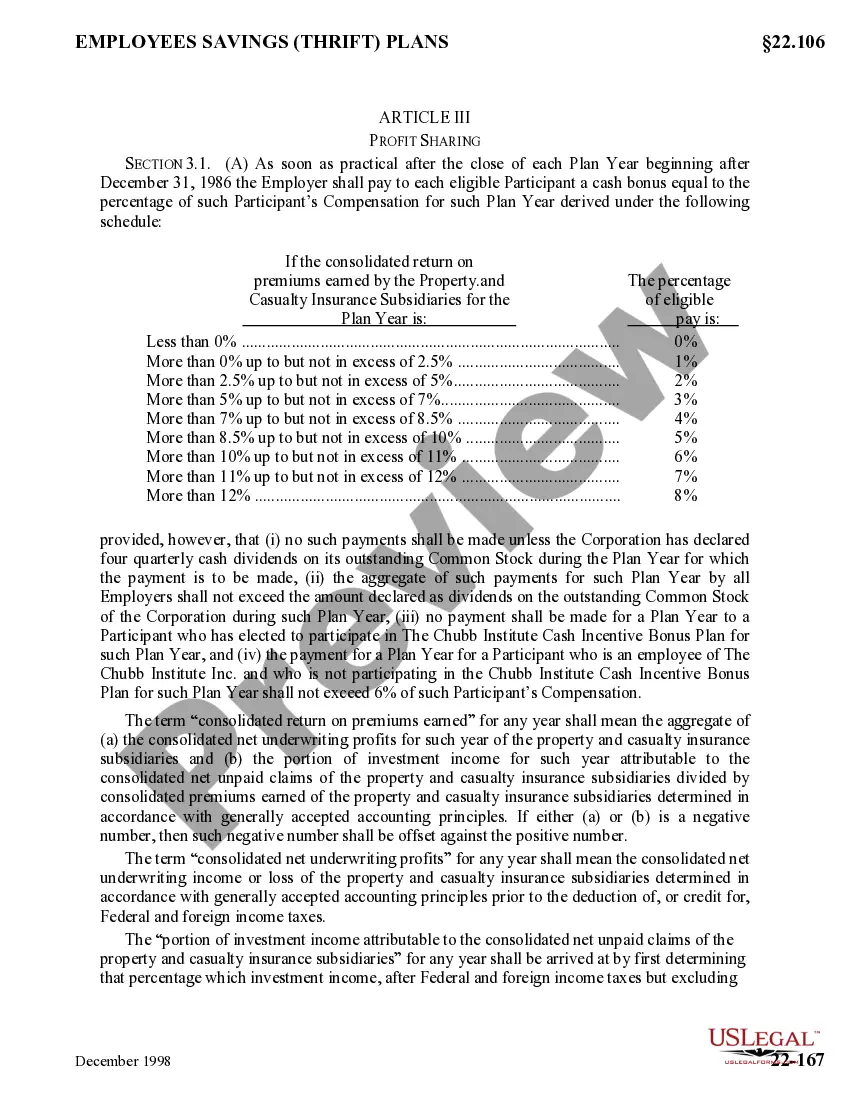

Title: Understanding Nevada Profit Sharing Plan: Types and Benefits Explained Introduction: A Nevada Profit Sharing Plan serves as a beneficial retirement savings tool for employees, encouraging long-term financial stability while promoting company growth. This article will delve into the various types of Nevada Profit Sharing Plans and their associated advantages, highlighting the key aspects and features of each. 1. Nevada Traditional Profit Sharing Plan: The Nevada Traditional Profit Sharing Plan is the most common type, allowing employers to allocate a portion of the company's profits to employees' retirement accounts. Employers have the flexibility to determine the contribution amount each year, often based on a percentage of annual profits or business performance. The contributions made by the employer are typically tax-deductible until they are distributed to employees. 2. Nevada Safe Harbor Profit Sharing Plan: The Nevada Safe Harbor Profit Sharing Plan is designed to provide greater benefits to highly compensated employees while ensuring compliance with IRS nondiscrimination testing requirements. In this type of plan, employers are obligated to contribute a certain percentage of eligible employees' compensation, regardless of their level of participation. This ensures that all employees receive a fair share, reducing the risk of plan discrimination. 3. Nevada New Comparability Profit Sharing Plan: The Nevada New Comparability Profit Sharing Plan is ideal for companies aiming to maximize benefits for selected employees or specific groups. It allows employers to divide employees into different classes or categories, each having different contribution levels. This allocation is based on a comparison of benefits as a percentage of compensation, providing flexibility in distributing contributions based on a desired formula. 4. Nevada Age-Weighted Profit Sharing Plan: The Nevada Age-Weighted Profit Sharing Plan aims to benefit employees based on their age and years of service. As employees advance in age, their retirement contributions tend to be higher, enabling them to catch up on retirement savings. Employers can adjust contributions based on actuarial calculations, benefiting older employees nearing retirement and compensating for earlier years of lower contributions. Benefits of Nevada Profit Sharing Plans: — Enhanced Employee Motivation: Profit sharing plans act as a powerful tool to motivate employees by aligning their financial well-being with the company's success. This encourages a sense of ownership and dedication among employees. — Tax Advantages: Contributions made by employers are tax-deductible, while they grow tax-deferred within employees' retirement accounts until distribution. — Flexible Contributions: Employers have the flexibility to determine contribution levels annually, adapting to the company's financial performance. — Retirement Savings: Nevada Profit Sharing Plans act as an additional retirement savings vehicle, supplementing traditional 401(k) plans or pensions. — Employee Retention and Recruitment: Offering a profit sharing plan helps attract and retain top talent, contributing to a more competitive and robust workforce. In summary, Nevada Profit Sharing Plans provide a multitude of advantages for both employers and employees. From traditional plans to safe harbor, new comparability, and age-weighted plans, businesses have the flexibility to choose the option that best aligns with their goals and workforce dynamics. These plans promote retirement savings, tax benefits, and employee engagement, driving long-term success for businesses and financial security for employees.

Nevada Profit Sharing Plan

Description

How to fill out Nevada Profit Sharing Plan?

Are you within a placement in which you need to have files for sometimes company or individual reasons virtually every time? There are plenty of lawful file web templates accessible on the Internet, but locating kinds you can rely on isn`t straightforward. US Legal Forms provides 1000s of type web templates, much like the Nevada Profit Sharing Plan, which can be published to satisfy state and federal needs.

Should you be presently familiar with US Legal Forms internet site and get an account, just log in. After that, you can acquire the Nevada Profit Sharing Plan template.

Should you not offer an account and need to start using US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for your correct town/county.

- Make use of the Preview switch to review the shape.

- Read the explanation to actually have selected the appropriate type.

- If the type isn`t what you are trying to find, utilize the Look for industry to get the type that fits your needs and needs.

- Whenever you discover the correct type, click Purchase now.

- Select the costs program you need, complete the required details to produce your money, and buy an order with your PayPal or charge card.

- Select a convenient paper formatting and acquire your duplicate.

Locate every one of the file web templates you may have purchased in the My Forms food list. You can aquire a extra duplicate of Nevada Profit Sharing Plan anytime, if required. Just select the required type to acquire or print out the file template.

Use US Legal Forms, one of the most extensive assortment of lawful varieties, to conserve time and avoid errors. The assistance provides appropriately created lawful file web templates which you can use for a variety of reasons. Produce an account on US Legal Forms and start producing your lifestyle a little easier.