Title: Nevada Tax Sharing Agreement: Explained and Types Introduction: The state of Nevada employs a tax sharing agreement to ensure fair distribution and allocation of tax revenues among different governmental entities within the state. This comprehensive article examines the key aspects of the Nevada Tax Sharing Agreement, its purpose, benefits, and various types that exist. 1. What is a Nevada Tax Sharing Agreement? A Nevada Tax Sharing Agreement is a binding agreement among the different local governments (counties, cities, municipalities) within the state, which outlines the principles and mechanisms for sharing tax revenues generated within the state. It establishes a method to allocate taxes to ensure each jurisdiction adequately receives funds to support public services and infrastructure. 2. Purpose and Benefits of the Tax Sharing Agreement: — Enhances Fiscal Equity: The agreement fosters fairness by ensuring that all local governments receive a proportionate share of tax revenues based on their contribution to the state's overall revenue. — Encourages Cooperation: Facilitates collaboration and coordination between different governmental entities, promoting efficient use of resources and avoiding unnecessary competition. — Supports Infrastructure Development: By guaranteeing a fair distribution of tax funds, the agreement enables local governments to invest in infrastructure projects, public services, education, healthcare, and more. — Stimulates Economic Growth: Equitable tax sharing encourages economic development across the state, attracting businesses, creating jobs, and bolstering the overall economy. 3. Types of Nevada Tax Sharing Agreement: While the fundamental purpose is the same, there are distinct types of tax sharing agreements in Nevada based on the specific jurisdictions involved. Some common types include: — County-Level Tax Sharing: This agreement involves revenue sharing between different counties within Nevada. It ensures that taxes collected within a county are appropriately distributed based on predefined factors, such as population or taxable business activities. — City-Municipality Tax Sharing: This agreement focuses on revenue sharing among cities and municipalities within a particular county. It enables fair distribution of tax funds generated within each jurisdiction, considering their specific needs and contributions. — Regional Tax Sharing: This comprehensive agreement involves revenue sharing at a regional level, encompassing multiple counties, cities, and municipalities. It promotes collaboration across a broader area, ensuring balanced development and efficient regional resource allocation. In conclusion, the Nevada Tax Sharing Agreement plays a crucial role in the fair distribution of tax revenues within the state. By promoting equity, cooperation, and economic growth, it facilitates the development of robust public services, infrastructure, and overall prosperity. The various types of tax sharing agreements, such as county-level, city-municipality, and regional, cater to the unique needs and characteristics of Nevada's diverse jurisdictions.

Nevada Tax Sharing Agreement

Description

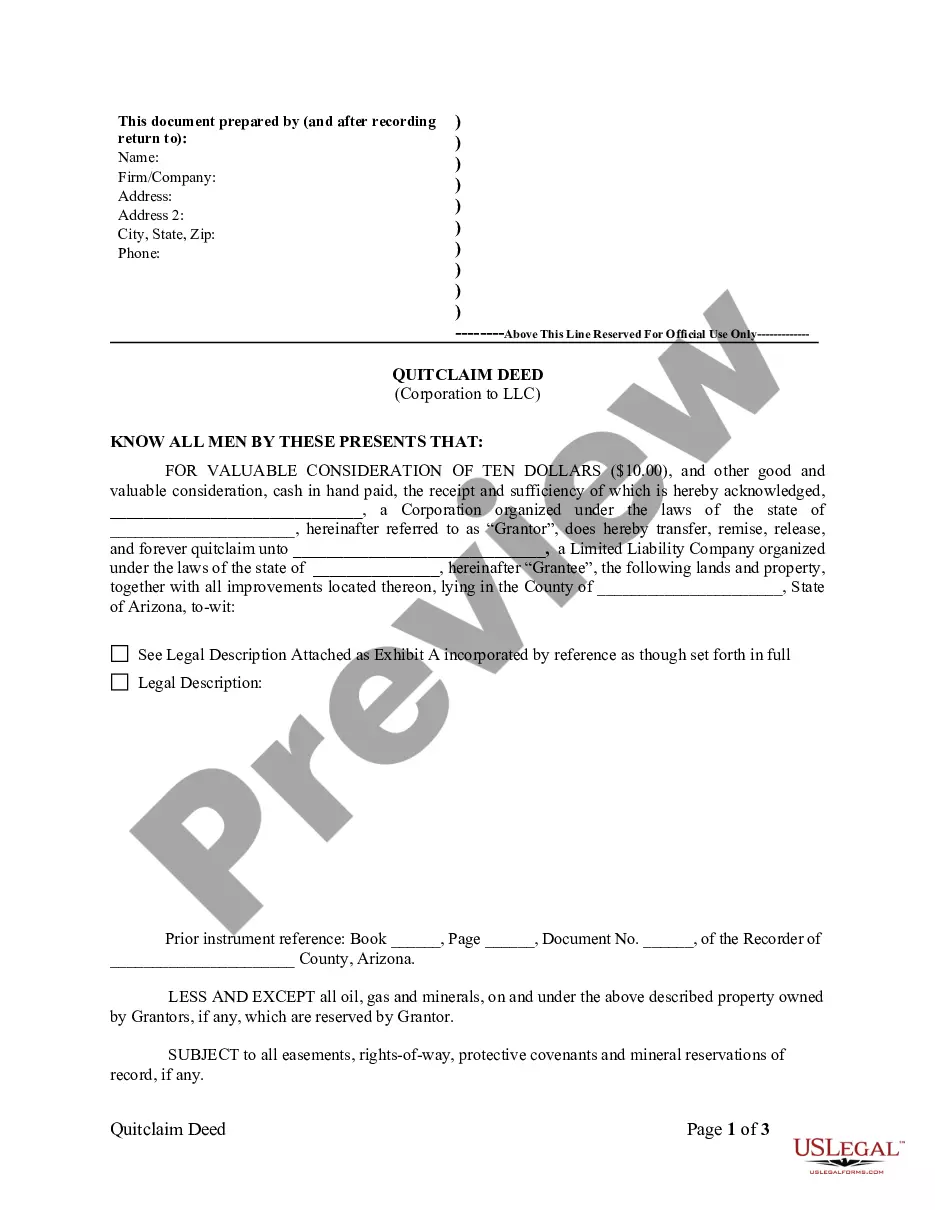

How to fill out Nevada Tax Sharing Agreement?

Choosing the right lawful papers web template can be quite a struggle. Of course, there are tons of themes available online, but how will you obtain the lawful kind you need? Utilize the US Legal Forms website. The services offers thousands of themes, such as the Nevada Tax Sharing Agreement, that you can use for company and personal needs. Each of the types are checked out by specialists and fulfill federal and state requirements.

Should you be presently registered, log in in your accounts and click the Obtain option to get the Nevada Tax Sharing Agreement. Make use of accounts to appear from the lawful types you might have acquired in the past. Visit the My Forms tab of the accounts and acquire one more backup from the papers you need.

Should you be a fresh user of US Legal Forms, here are simple recommendations that you can comply with:

- First, make certain you have selected the correct kind for your area/state. It is possible to look through the shape while using Review option and look at the shape information to ensure this is basically the right one for you.

- In case the kind will not fulfill your requirements, utilize the Seach industry to discover the correct kind.

- Once you are certain the shape is suitable, go through the Buy now option to get the kind.

- Opt for the rates strategy you need and enter in the needed info. Build your accounts and buy your order utilizing your PayPal accounts or credit card.

- Choose the file formatting and down load the lawful papers web template in your product.

- Full, modify and print and indication the acquired Nevada Tax Sharing Agreement.

US Legal Forms is definitely the greatest library of lawful types that you can find different papers themes. Utilize the company to down load professionally-manufactured papers that comply with condition requirements.

Form popularity

FAQ

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Under the proposed rule, banks that file tax returns as part of a consolidated tax filing group would be required to enter into tax allocation agreements with their holding companies and other members of their consolidated group.

Broadly, tax sharing agreements: prevent joint and several liability arising by ?reasonably? allocating the group's income tax liability to group members.

Tax allocation agreements are often used by the members of a consolidated group in order to determine how to allocate and distribute such funds.

Most Nevada LLCs are pass-through tax entities. This means the reporting responsibility flows through to the individual LLC owners. And Nevada doesn't have state-level income tax and they don't require Partnership Returns.

Broadly, tax sharing agreements: prevent joint and several liability arising by ?reasonably? allocating the group's income tax liability to group members.

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

Key Takeaways. Comprehensive tax allocation is an analysis that companies use to identify discrepancies between their accounting for business purposes and their accounting for tax purposes. Most of the discrepancies result from differences between the periods used for financial reporting and tax filing.