Nevada Letter to Board of Directors Regarding Recapitalization Proposal: Dear Board of Directors of Nevada Corporation, Subject: Recapitalization Proposal I hope this letter finds you in good health. I am writing on behalf of the shareholders of Nevada Corporation to present a recapitalization proposal for your consideration. Recapitalization entails making changes to the corporation's capital structure to optimize its financial position and improve shareholder value. Our recommended plan includes several key aspects designed to achieve these objectives. Below, I will outline our proposal in detail: 1. Rationale for Recapitalization: The existing capital structure of Nevada Corporation may not be aligned with the company's current financial needs or growth prospects. Recapitalization will allow the company to address its capitalization concerns, create a more efficient capital structure, reduce financial risks, and provide greater flexibility for future endeavors. 2. Types of Recapitalization: There are various types of recapitalization strategies, each with distinct characteristics and benefits. The following are some commonly used methods, among others: a) Debt-to-Equity Swap: This approach entails converting a portion of the company's debt obligations (such as loans or bonds) into equity. By reducing the company's debt burden, it can enhance financial stability and possibly improve credit ratings. b) Stock Split: A stock split involves dividing existing shares into multiple shares, thereby reducing the share price while increasing the outstanding shares. This method improves liquidity, affordability, and marketability of the company's stock, attracting a wider investor base. c) Reverse Stock Split: Conversely, a reverse stock split consolidates existing shares into fewer shares, resulting in a higher share price. This method might be employed to meet listing requirements or enhance the perception of the company's stock value. d) Rights Offering: In a rights offering, existing shareholders are granted the right to purchase additional shares at a predetermined price within a specified timeframe. This method allows shareholders to maintain their ownership percentage while infusing additional capital into the company. e) Dividend Recapitalization: Dividend recapitalization involves leveraging the company's existing assets or borrowing to pay a special dividend to shareholders. This can return capital to shareholders and potentially enhance the value of their remaining shares. 3. Detailed Proposal: Based on our analysis and consultations with financial experts, we recommend that Nevada Corporation pursue a combination of debt-to-equity swap and stock split strategies to recapitalize the company. This approach will: a) Convert a portion of the company's debt into equity, strengthening the balance sheet and reducing interest expenses. b) Implement a stock split, which increases liquidity, affordability, and attractiveness of the company's stock. c) Ensure that the proposed recapitalization aligns with the company's long-term goals and specific requirements. Implementing this proposal will require thorough evaluation, financial modeling, and approval from the Board of Directors. We are confident that the chosen recapitalization strategy will maximize shareholder value and position Nevada Corporation for future growth and success. We kindly request your careful consideration of this recapitalization proposal. Furthermore, we believe that by undertaking this endeavor, Nevada Corporation will strengthen its financial position, enhance shareholder value, and achieve its strategic objectives. Thank you for your time and attention. We look forward to discussing this proposal further and working together to drive Nevada Corporation's sustained growth and profitability. Sincerely, [Your Name] [Shareholder of Nevada Corporation]

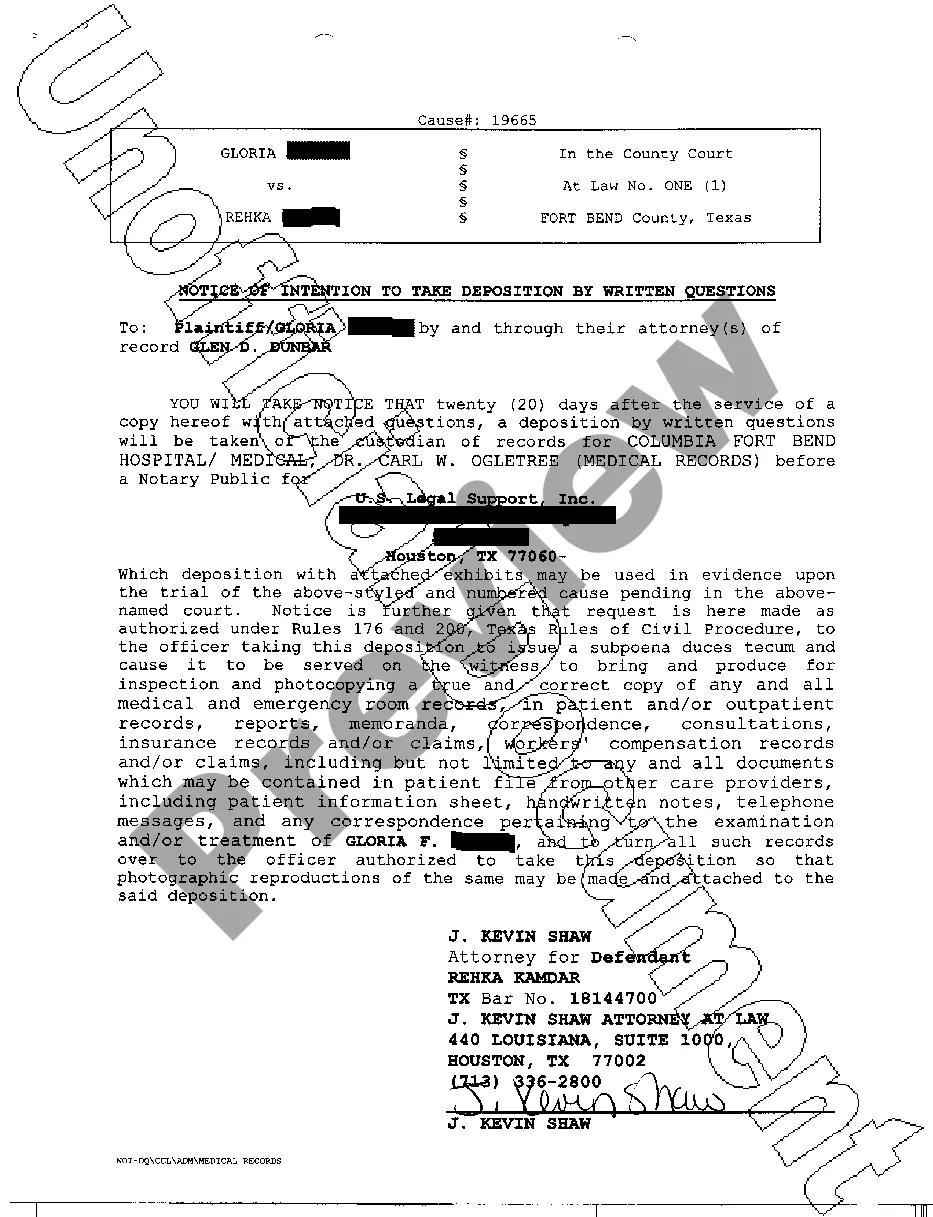

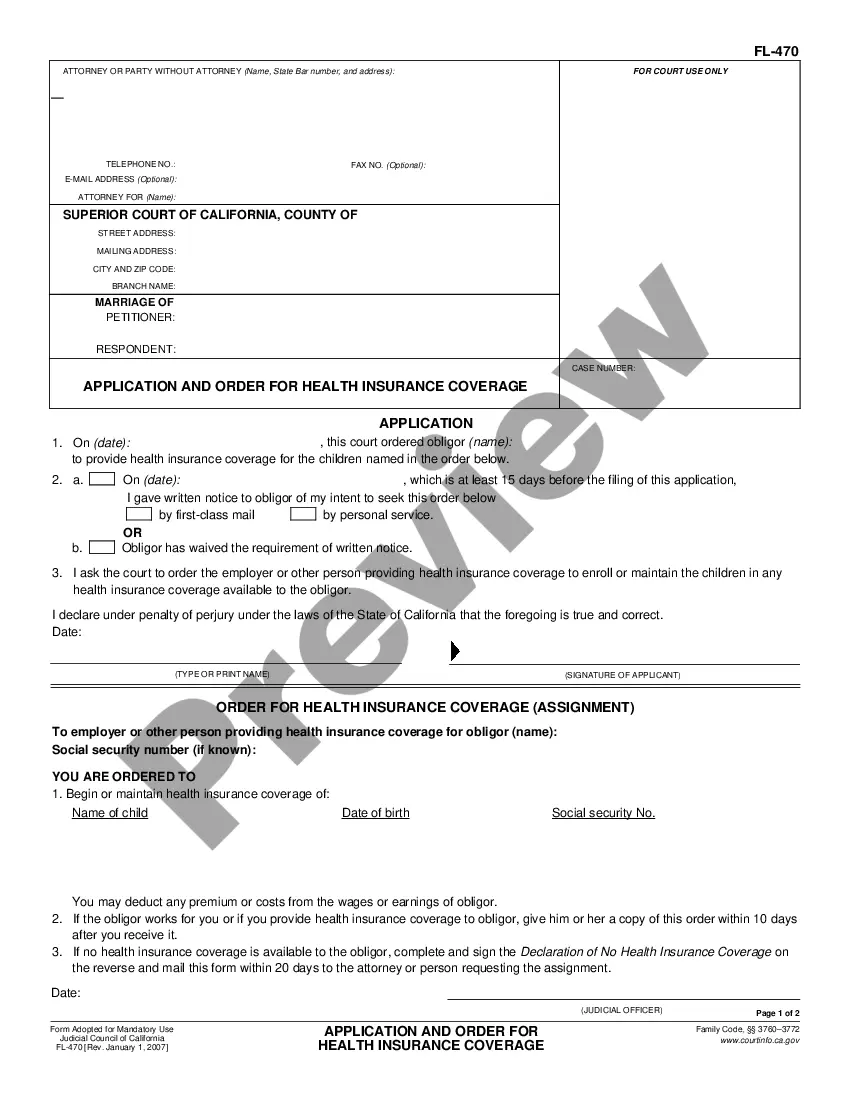

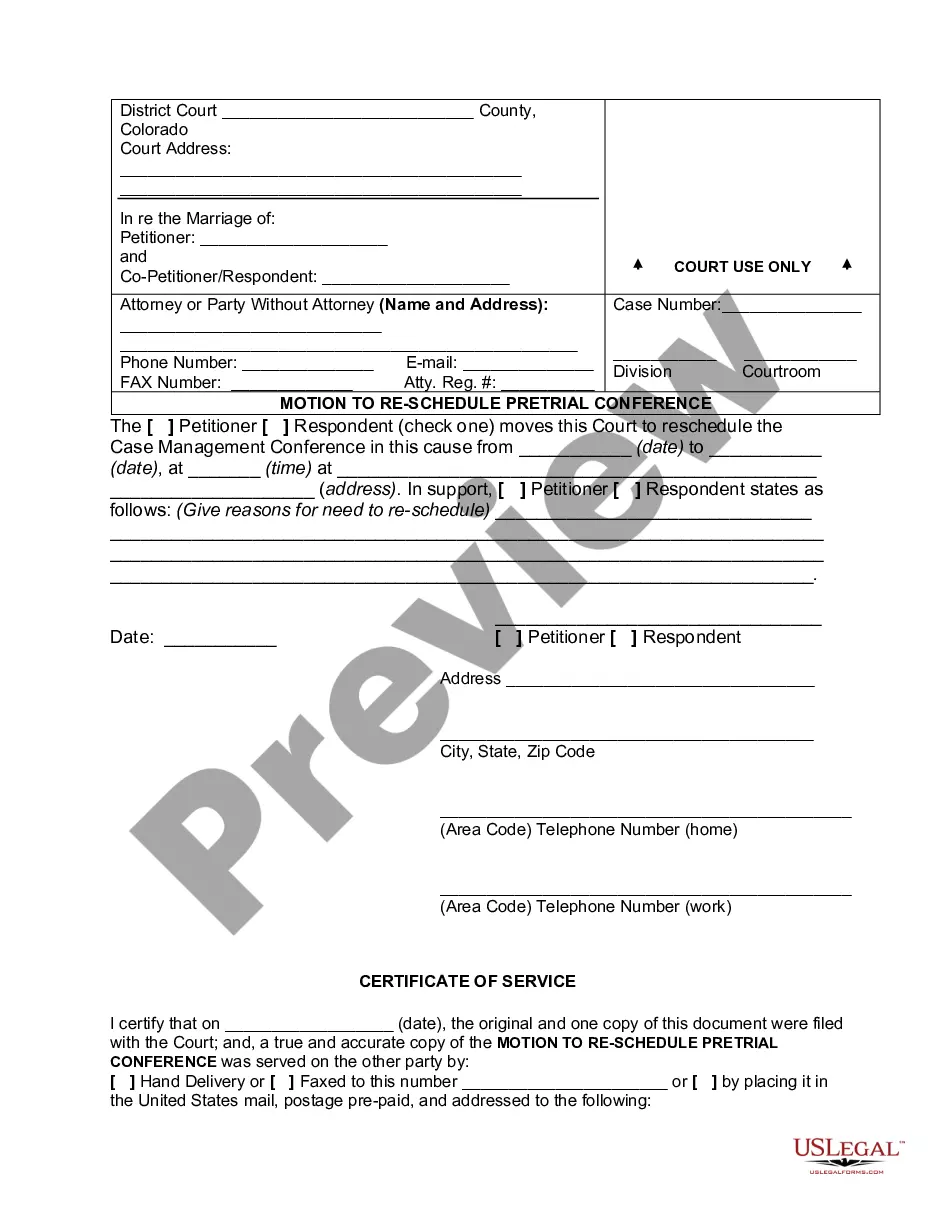

Nevada Letter to Board of Directors regarding recapitalization proposal

Description

How to fill out Nevada Letter To Board Of Directors Regarding Recapitalization Proposal?

If you wish to full, obtain, or print legal record layouts, use US Legal Forms, the largest assortment of legal varieties, that can be found on the web. Utilize the site`s simple and handy research to find the files you will need. Different layouts for business and specific functions are categorized by categories and says, or keywords. Use US Legal Forms to find the Nevada Letter to Board of Directors regarding recapitalization proposal with a number of click throughs.

In case you are already a US Legal Forms buyer, log in in your bank account and then click the Download key to obtain the Nevada Letter to Board of Directors regarding recapitalization proposal. You can even access varieties you previously downloaded from the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the correct metropolis/nation.

- Step 2. Use the Review choice to check out the form`s content material. Do not neglect to see the information.

- Step 3. In case you are unhappy together with the form, utilize the Research industry towards the top of the display to discover other versions from the legal form design.

- Step 4. Upon having discovered the shape you will need, click on the Purchase now key. Opt for the pricing program you like and add your references to sign up to have an bank account.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Select the structure from the legal form and obtain it on your own device.

- Step 7. Comprehensive, revise and print or signal the Nevada Letter to Board of Directors regarding recapitalization proposal.

Each and every legal record design you purchase is yours for a long time. You possess acces to each and every form you downloaded within your acccount. Click the My Forms section and decide on a form to print or obtain yet again.

Contend and obtain, and print the Nevada Letter to Board of Directors regarding recapitalization proposal with US Legal Forms. There are many expert and status-specific varieties you may use for the business or specific requires.

Form popularity

FAQ

How to write a business proposal in 7 steps. Research and outline the parts of your business proposal. Build the title and table of contents. Write your executive summary. Get into the project details. List deliverables, milestones, and budgets. Craft the conclusion and appendix. Edit and professionally polish your proposal.

How to write a proposal letter Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss the budget and how funds will be used. Finish with a call to action and request a follow-up.

5 Steps to Writing A Winning Business Proposal. Clash Graphics. ... Step 1 ? Gather Relevant Information. ... Step 2 ? Define The Project Scope. ... Step 3 ? Draft Your Business Proposal. ... Step 4 ? Editing Your Business Proposal. ... Step 5 ? Submitting Your Proposal.

A business proposal is a document you send to potential customers to persuade them to do business with you. Business proposals are a common and effective way to win business. Research your potential customer before writing a business proposal; customize your proposal to address their needs.

How to Write a Business Proposal Begin with a title page. Explain your why with an executive summary. State the problem or need. Propose a solution. Share your qualifications. Include pricing options. Summarize with a conclusion.

How to write a proposal letter Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss the budget and how funds will be used. Finish with a call to action and request a follow-up.