Title: Nevada Letter to Stockholders: Authorization and Sale of Preferred Stock and Stock Transfer Restriction to Protect Tax Benefits Keywords: Nevada, letter to stockholders, authorization, sale, preferred stock, stock transfer restriction, tax benefits. Introduction: Dear Nevada Stockholders, We are writing this letter to provide you with detailed information regarding the authorization and sale of preferred stock and the implementation of stock transfer restriction measures aimed at protecting our valuable tax benefits. This letter will outline the various types of Nevada letters to stockholders regarding these matters, emphasizing their significance and benefits. Types of Nevada Letters to Stockholders: 1. Letter of Intent for Authorization and Sale of Preferred Stock: This letter highlights the intention to authorize and sell preferred stock to new or existing stockholders. It provides an overview of the proposed terms and conditions, including redemption rights, dividend preferences, and conversion provisions. By issuing preferred stock, we aim to strengthen our financial position and support future growth opportunities. 2. Private Placement Offering Letter: This type of letter elaborates on the private placement offering of preferred stock. It outlines the terms, pricing, and deadlines for interested stockholders who wish to participate in this investment opportunity. Our goal is to offer select stockholders the chance to invest in our preferred stock, thereby increasing our capital base and reinforcing our tax benefits. 3. Stock Transfer Restriction Letter: The stock transfer restriction letter specifically addresses the implementation of restrictions on stock transfers. Enacted to safeguard our tax benefits, these restrictions prevent the transfer of stock to individuals or entities that could potentially jeopardize the qualification of our tax advantages. This letter clarifies the rationale behind such restrictions and emphasizes the importance of complying with them for the benefit of all stockholders. Benefits of Preferred Stock Authorization and Sale: — Improved Financial Position: The sale of preferred stock provides an injection of capital, enhancing our financial stability and enabling us to pursue strategic initiatives and growth opportunities. — Additional Funding Source: By offering preferred stock to stockholders, we establish an alternative funding avenue for future capital needs, reducing reliance on external sources and potential dilution of common stockholder equity. — Increased Flexibility: Preferred stock issuance allows us to customize terms and conditions to better suit the needs of investors while ensuring dividend payment consistency. — Attractiveness to Investors: Offering preferred stock may attract new investors and incentivize existing stockholders to further invest in our company, potentially fueling our growth. Importance of Stock Transfer Restriction to Protect Tax Benefits: — Tax Advantages: Implementing stock transfer restrictions protects the tax benefits our company qualifies for under Nevada law, promoting tax efficiency and preserving shareholder value. — Consistent Shareholder Base: By controlling the transfer of stock, we maintain a stable shareholder base, potentially improving governance and facilitating long-term planning. — Guarding Against Risk: Restricting stock transfers minimizes the risk of ownership falling into ineligible hands, safeguarding our ability to claim tax benefits and preventing potential legal and financial complications. Conclusion: These Nevada letters to stockholders regarding the authorization and sale of preferred stock and the introduction of stock transfer restriction measures exemplify our commitment to maximizing shareholder value while ensuring compliance with tax regulations. By leveraging preferred stock issuance and implementing transfer restrictions, we can fortify our financial position, attract investors, and diligently protect our valuable tax benefits. We appreciate your continued support and trust in our collective pursuit of growth and sustainability. Sincerely, [Your Company's Name]

Nevada Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

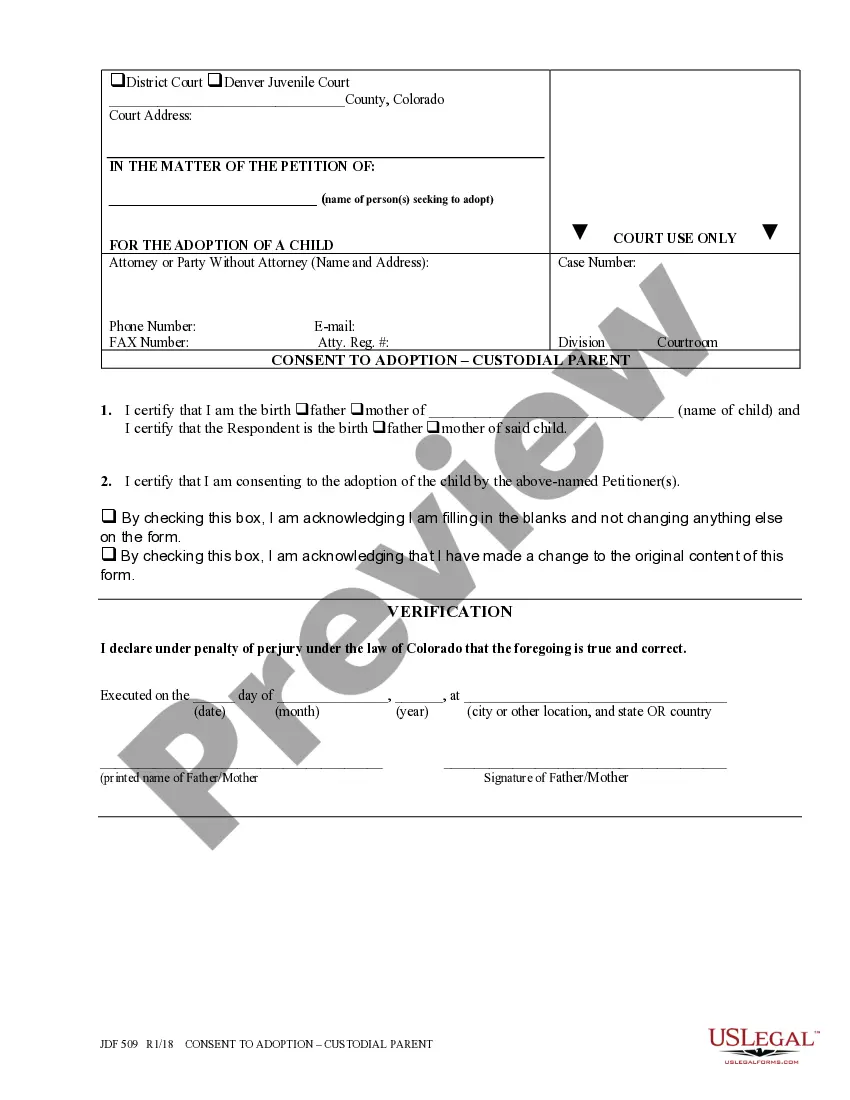

How to fill out Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

You can commit hrs on-line searching for the authorized document template that fits the state and federal requirements you want. US Legal Forms gives thousands of authorized varieties which can be examined by professionals. You can actually obtain or print out the Nevada Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits from your support.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Download key. Next, it is possible to full, edit, print out, or signal the Nevada Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits. Every single authorized document template you get is yours eternally. To get another version of any purchased kind, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms website for the first time, follow the basic directions listed below:

- First, make certain you have chosen the proper document template to the state/metropolis of your liking. See the kind outline to ensure you have selected the appropriate kind. If offered, utilize the Review key to check from the document template too.

- If you would like find another variation of the kind, utilize the Lookup field to obtain the template that meets your requirements and requirements.

- Upon having identified the template you desire, just click Get now to continue.

- Pick the pricing prepare you desire, key in your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal accounts to cover the authorized kind.

- Pick the formatting of the document and obtain it to your product.

- Make alterations to your document if necessary. You can full, edit and signal and print out Nevada Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits.

Download and print out thousands of document templates utilizing the US Legal Forms website, that offers the biggest selection of authorized varieties. Use skilled and condition-particular templates to deal with your small business or person needs.

Form popularity

FAQ

NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; alternative means for participating at meeting. NRS 78.320 Stockholders' meetings: Quorum; consent for actions taken without meeting; alternative means for participating at meeting.

Unless otherwise provided in the articles of incorporation or the bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, ... NRS 78.320 Stockholders' meetings: Quorum; consent for actions taken ... justia.com ? title7 ? chapter78 ? nrs78-320 justia.com ? title7 ? chapter78 ? nrs78-320

"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...

Nevada law contains a provision governing ?acquisition of controlling interest.? This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to ...

A form of unanimous written consent of the board of directors of a Nevada for-profit corporation to be used when the directors take action without a formal board meeting. This Standard Document has integrated notes with important explanations and drafting tips. Unanimous Written Consent of the Board of Directors (NV) - Westlaw westlaw.com ? document ? Unanimo... westlaw.com ? document ? Unanimo...