Nevada Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report

Description

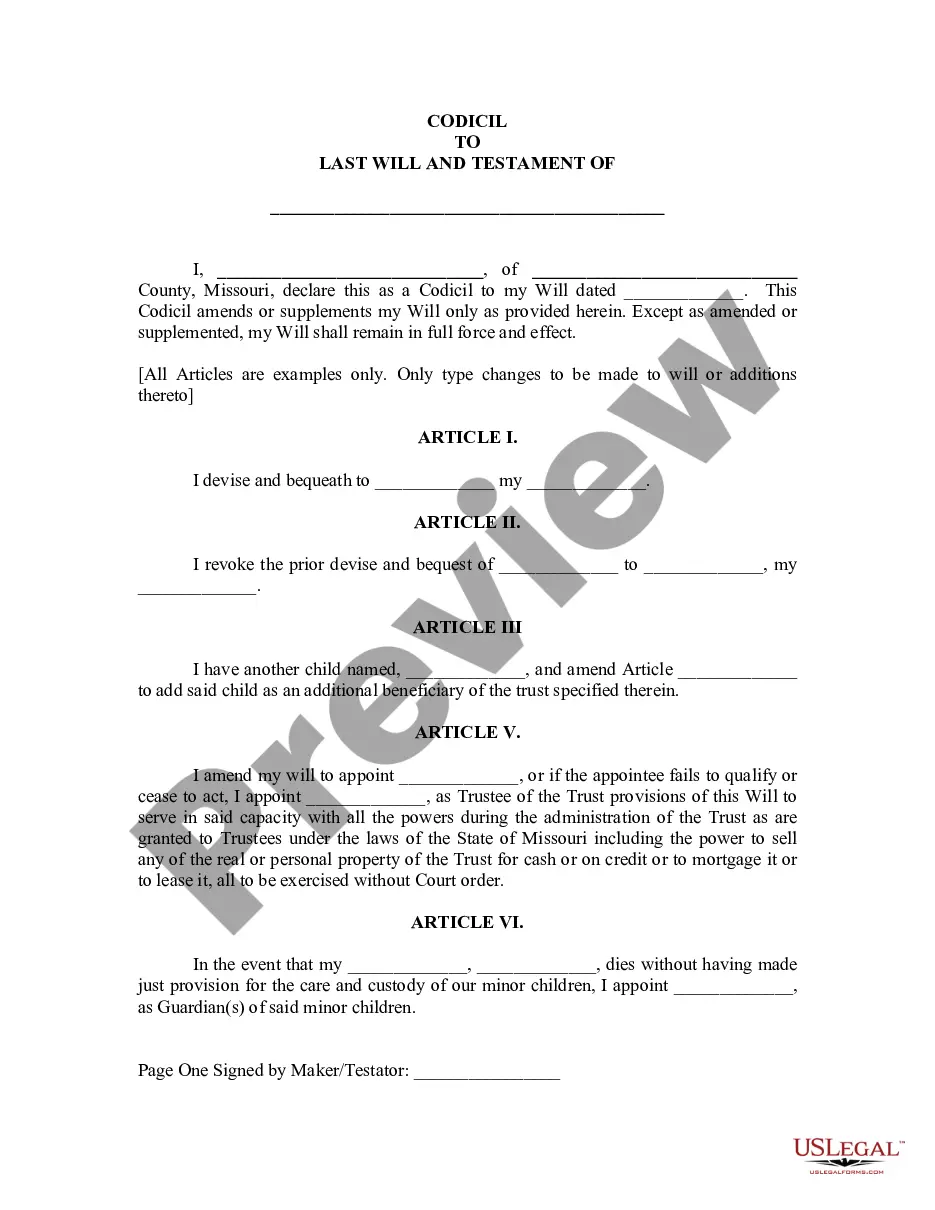

How to fill out Proposal To Consider And Approve Offer To Exchange Outstanding Shares And Amend Certificate Of Designations, Preferences And Rights With Fairness Opinion Report?

Have you been in the placement that you need to have papers for either organization or specific purposes almost every day? There are a lot of authorized document themes available on the Internet, but discovering versions you can rely is not effortless. US Legal Forms gives 1000s of develop themes, like the Nevada Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report, which can be written to satisfy federal and state demands.

In case you are currently informed about US Legal Forms web site and possess a free account, merely log in. Next, you may obtain the Nevada Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report web template.

Unless you provide an account and would like to start using US Legal Forms, follow these steps:

- Discover the develop you need and make sure it is for your right town/state.

- Make use of the Review switch to check the shape.

- See the outline to ensure that you have chosen the correct develop.

- In the event the develop is not what you are looking for, make use of the Research discipline to get the develop that suits you and demands.

- If you obtain the right develop, simply click Purchase now.

- Opt for the prices prepare you want, complete the specified info to generate your money, and buy your order utilizing your PayPal or credit card.

- Select a hassle-free file formatting and obtain your backup.

Get every one of the document themes you have purchased in the My Forms menus. You can aquire a additional backup of Nevada Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report whenever, if necessary. Just click the necessary develop to obtain or produce the document web template.

Use US Legal Forms, one of the most substantial collection of authorized kinds, in order to save time as well as prevent errors. The services gives skillfully manufactured authorized document themes that can be used for a range of purposes. Make a free account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...

The Board of Directors of the Company have the right to reverse split the stock of the Company in ance with the Nevada Revised Statutes (NRS Section 78.207) to effect a reverse stock split of the Common Stock and the By Laws of the Company do not preclude the Board of Directors from taking such action.

NRS 78.138 - Directors and officers: Fiduciary duties; exercise of powers; presumptions and considerations; liability to corporation, stockholders and creditors. 1. The fiduciary duties of directors and officers are to exercise their respective powers in good faith and with a view to the interests of the corporation.

Nevada law contains a provision governing ?acquisition of controlling interest.? This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to ...

NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method.