Nevada Approval of Standby Equity Agreement with copy of agreement

Description

How to fill out Approval Of Standby Equity Agreement With Copy Of Agreement?

Are you currently in the situation where you need paperwork for either business or individual reasons just about every day? There are tons of authorized file themes available online, but locating kinds you can rely isn`t simple. US Legal Forms provides a large number of type themes, like the Nevada Approval of Standby Equity Agreement with copy of agreement, which can be published in order to meet state and federal specifications.

In case you are already familiar with US Legal Forms internet site and possess your account, basically log in. After that, you are able to download the Nevada Approval of Standby Equity Agreement with copy of agreement design.

Should you not offer an profile and want to begin to use US Legal Forms, adopt these measures:

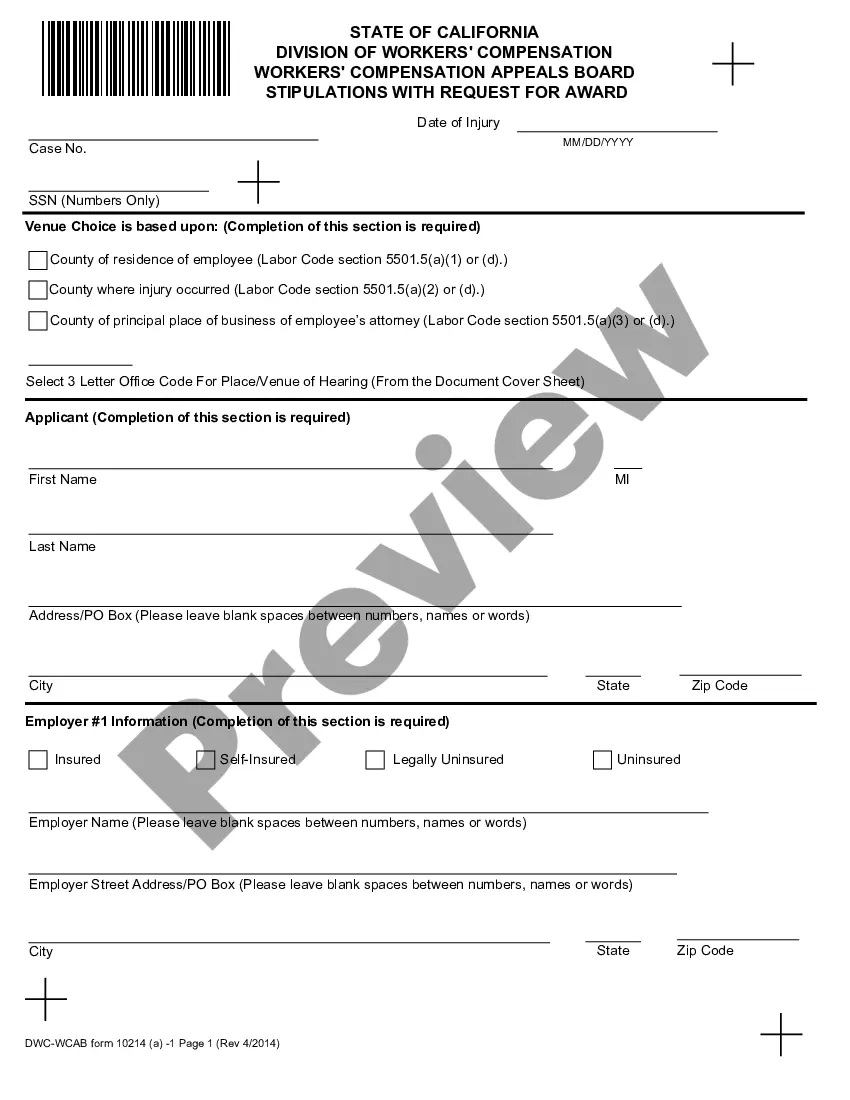

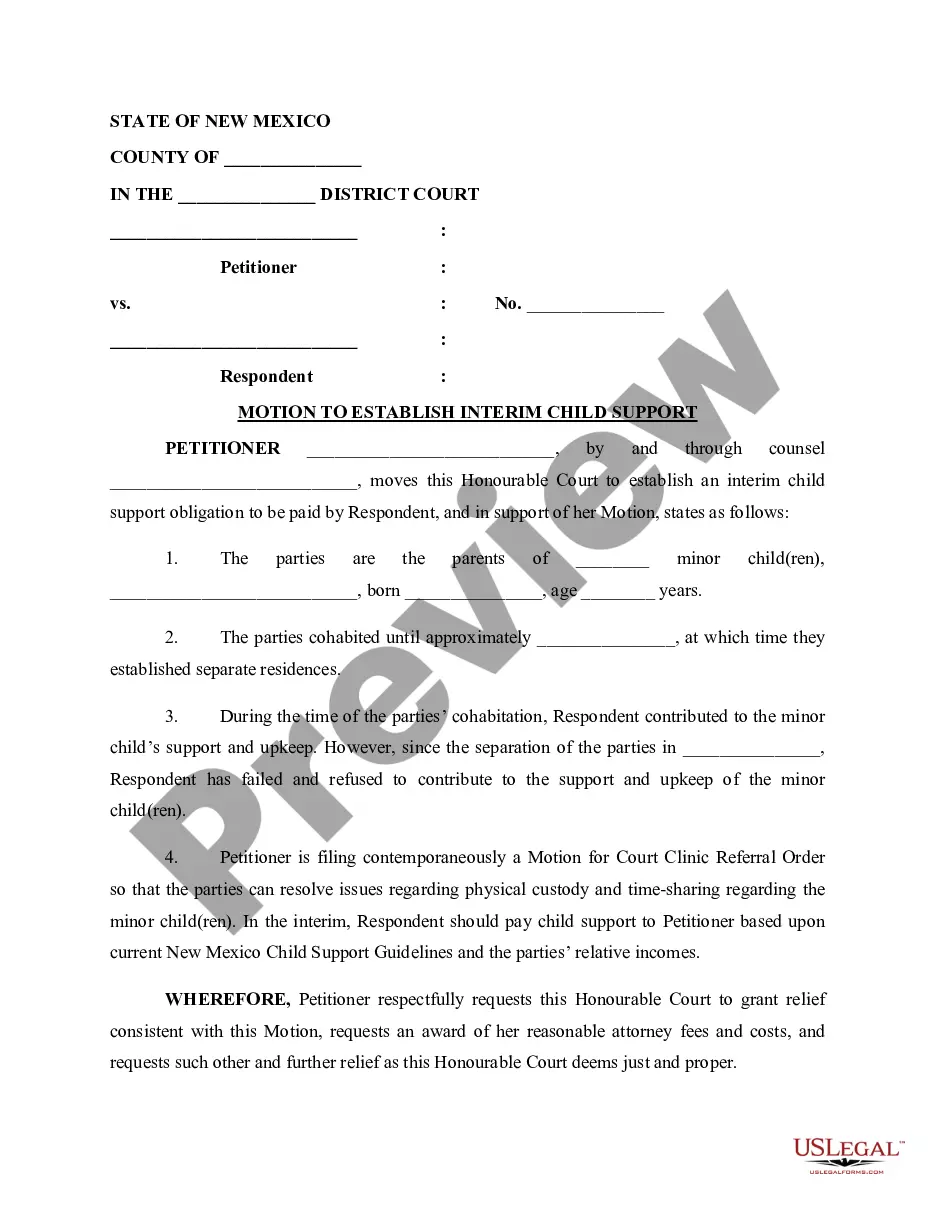

- Discover the type you want and make sure it is for your right city/region.

- Take advantage of the Preview button to examine the form.

- Look at the information to actually have selected the right type.

- In case the type isn`t what you are looking for, make use of the Search field to discover the type that meets your requirements and specifications.

- Whenever you get the right type, click on Acquire now.

- Pick the pricing program you would like, fill in the required information to create your money, and pay money for the transaction with your PayPal or Visa or Mastercard.

- Choose a practical file format and download your version.

Locate all the file themes you possess bought in the My Forms menus. You can aquire a additional version of Nevada Approval of Standby Equity Agreement with copy of agreement whenever, if needed. Just select the necessary type to download or produce the file design.

Use US Legal Forms, the most considerable selection of authorized varieties, to conserve efforts and steer clear of errors. The services provides professionally produced authorized file themes which you can use for an array of reasons. Create your account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

A contingent liquidity facility provided to district housing associates to support the issuance of tax-exempt floating rate securities (Variable Rate Demand Obligations) issued to support affordable housing.

A standby equity purchase agreement is a contract between a company and investor that allows the latter to purchase shares of company stock at a set price. The standby equity purchase agreement is typically used when a company is planning to go public or is seeking to raise additional funds through a private placement.

In a SEDA contract, a publicly traded company arranges to raise additional capital by selling new stock without making a public seasoned equity offering. A financial entity agrees to privately purchase a defined maximum of shares to be offered in specified lots (tranches) over a specified period.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.