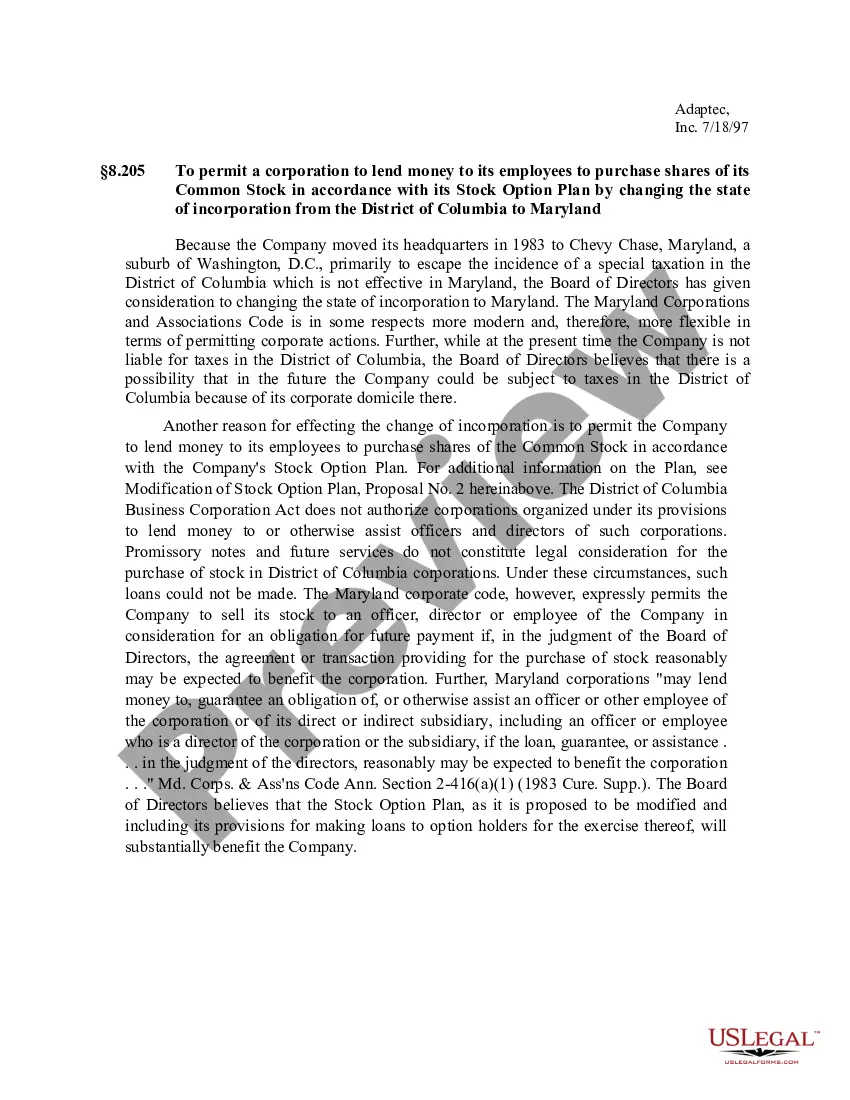

Nevada Changing state of incorporation

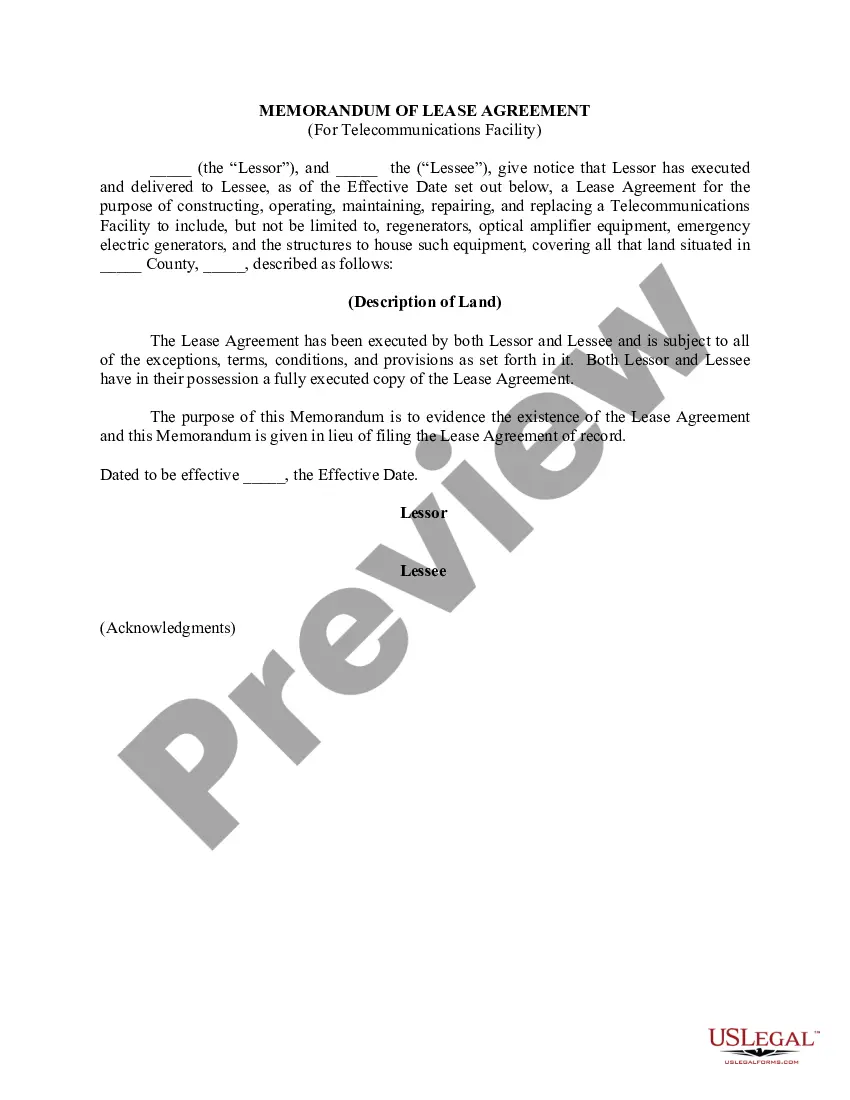

Description

How to fill out Changing State Of Incorporation?

If you need to comprehensive, acquire, or print legitimate papers templates, use US Legal Forms, the greatest variety of legitimate kinds, which can be found on-line. Take advantage of the site`s simple and hassle-free look for to discover the paperwork you require. Various templates for enterprise and person purposes are sorted by types and states, or key phrases. Use US Legal Forms to discover the Nevada Changing state of incorporation within a handful of mouse clicks.

When you are currently a US Legal Forms consumer, log in to the account and then click the Download key to obtain the Nevada Changing state of incorporation. You can even entry kinds you formerly downloaded in the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for that correct town/land.

- Step 2. Make use of the Preview choice to examine the form`s information. Never overlook to read through the description.

- Step 3. When you are not satisfied together with the kind, utilize the Look for discipline near the top of the monitor to find other types in the legitimate kind web template.

- Step 4. After you have found the shape you require, click the Buy now key. Opt for the prices plan you like and include your references to register for an account.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Pick the format in the legitimate kind and acquire it on your system.

- Step 7. Complete, edit and print or indicator the Nevada Changing state of incorporation.

Each and every legitimate papers web template you buy is your own property permanently. You might have acces to each kind you downloaded in your acccount. Go through the My Forms portion and choose a kind to print or acquire yet again.

Compete and acquire, and print the Nevada Changing state of incorporation with US Legal Forms. There are many skilled and express-certain kinds you can utilize for your personal enterprise or person requires.

Form popularity

FAQ

To start a Nevada LLC, it costs $425 to file your Articles of Organization with the Nevada Secretary of State. If you pay by credit card, you'll be charged a 2.5% fee, which works out to $436. That $436 fee includes the price you pay for your business license and for filing your initial list of members and managers.

A Nevada LLC domestication changes an out-of-state LLC into a Nevada LLC. This article discusses Nevada LLC domestications. A Nevada conversion can either change a Nevada LLC into an out-of-state LLC or change an entity's business type.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To start a corporation in Nevada, you must file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The Articles of Incorporation and supporting documents costs $725 in combined fees.

If your business is registered as a limited liability company (LLC) or corporation, you'll need to file paperwork to officially change your name with the state. Completing a business name change in Nevada requires most LLCs and corporations to file a Certificate of Amendment with the Nevada Secretary of State.

To make amendments to your Nevada corporation, you file the completed Certificate of Amendment form and provide it to the Secretary of State by mail, fax, email or in person, along with the filing fee.

How can I change my business address in Nevada? If you included your business address in your articles of organization, when you change your business address, you'll need to file an Certificate of Amendment to Articles of Organization with the Nevada Secretary of State and pay a $175 filing fee.

Moving Your Business Entity To Nevada Registering as a Foreign LLC. ... Dissolving the home LLC and establishing a new Nevada LLC. ... Domesticate your Entity in Nevada. ... Operate in both the home state and Nevada. ... Dissolve the home entity and form a new corporation in Nevada. ... Register a new corporation and merge the entities.