Nevada Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

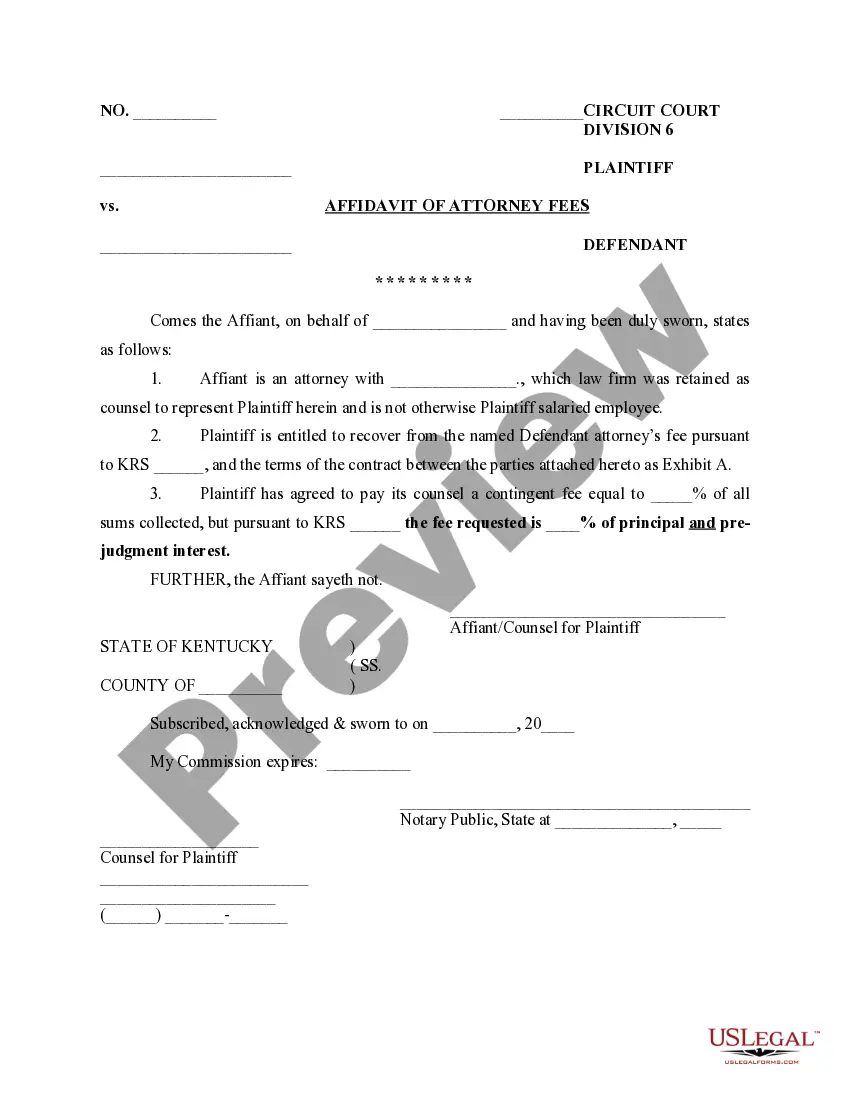

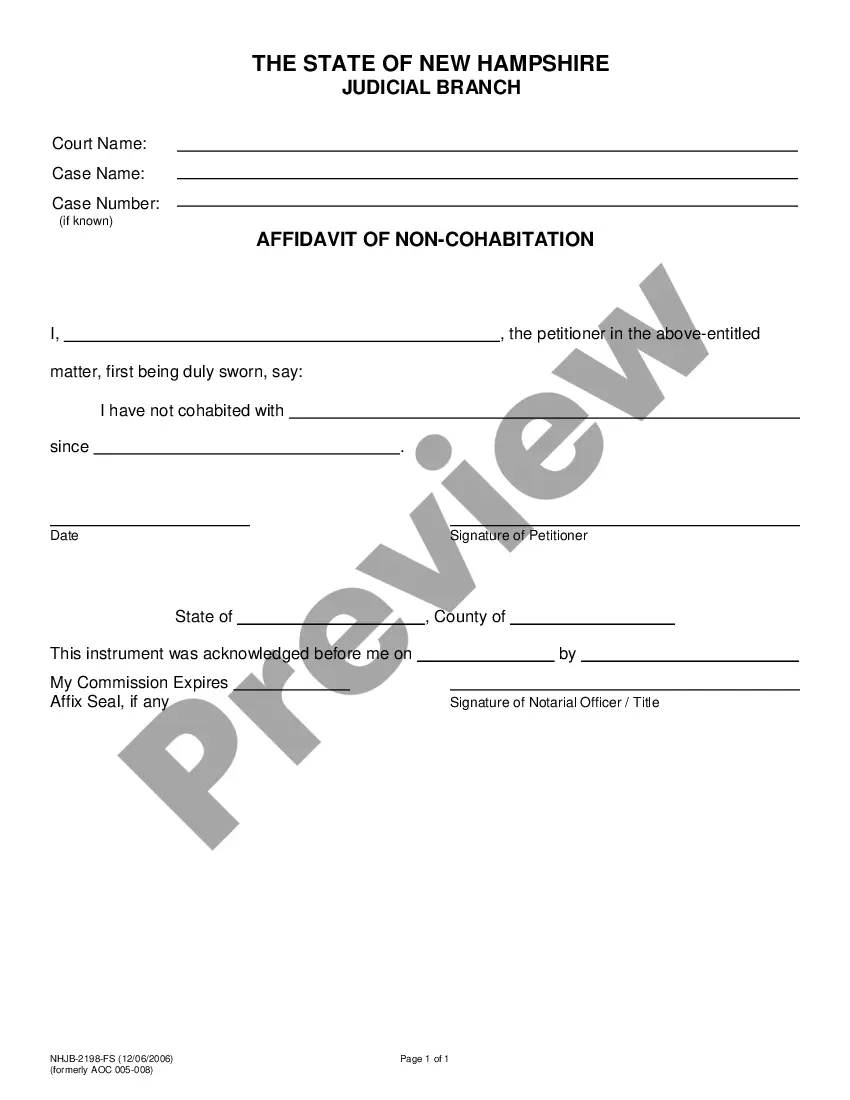

How to fill out Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

If you wish to complete, obtain, or print legitimate record templates, use US Legal Forms, the most important selection of legitimate kinds, that can be found on-line. Take advantage of the site`s basic and handy research to discover the paperwork you need. A variety of templates for organization and individual reasons are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Nevada Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds in a handful of click throughs.

In case you are presently a US Legal Forms client, log in for your bank account and click on the Obtain key to obtain the Nevada Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds. You may also access kinds you previously acquired within the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the appropriate area/country.

- Step 2. Take advantage of the Preview method to check out the form`s articles. Don`t neglect to learn the information.

- Step 3. In case you are not happy with the type, use the Search field near the top of the monitor to find other types from the legitimate type design.

- Step 4. Once you have identified the form you need, click the Purchase now key. Opt for the pricing program you choose and include your references to sign up for an bank account.

- Step 5. Process the purchase. You should use your bank card or PayPal bank account to finish the purchase.

- Step 6. Pick the format from the legitimate type and obtain it on the system.

- Step 7. Full, change and print or sign the Nevada Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Each legitimate record design you purchase is the one you have forever. You have acces to every single type you acquired in your acccount. Select the My Forms portion and select a type to print or obtain yet again.

Be competitive and obtain, and print the Nevada Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds with US Legal Forms. There are many specialist and state-distinct kinds you may use to your organization or individual requirements.

Form popularity

FAQ

A hardcopy complaint form can be requested by contacting Nevada Consumer Affairs by calling 1-844-594-7275.

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: . This this is the unified portal for Banking, NBFC as well as Digital Transactions related grievances.

Office of the Comptroller of the Currency (OCC) Complaint Form. Website: .helpwithmybank.gov. Phone Number: 800 613 6743.

If you make a written complaint, write the word 'complaint' at the top of your letter. This should make sure it goes to the right person. Send copies (not originals) of any documents with the letter. explain your problem calmly but firmly.

Nevada Consumer Affairs: The Office of Nevada Consumer Affairs investigates consumer complaints pertaining to deceptive and fraudulent business practices. Consumers that live in or visit Nevada can contact NCA for assistance in resolving issues involving Nevada-based businesses.

The mission of the Financial Institutions Division is to maintain a financial institutions system for the citizens of Nevada that is safe and sound, protects consumers and defends the overall public interest, and promotes economic development through the efficient, effective and equitable licensing, examination and ...

You can submit your complaint or inquiry online at the FDIC Information and Support Center at . Alternatively, you can submit a complaint via mail to the Consumer Response Unit at 1100 Walnut Street, Box#11, Kansas City, MO 64106.

File a complaint about a financial institution Contact the branch manager, the customer service hotline, or the institution's website. Use this sample complaint letter as a guide to help you explain the problem and how you want the bank to fix it. Provide copies of receipts, checks, or other proof of the transaction.