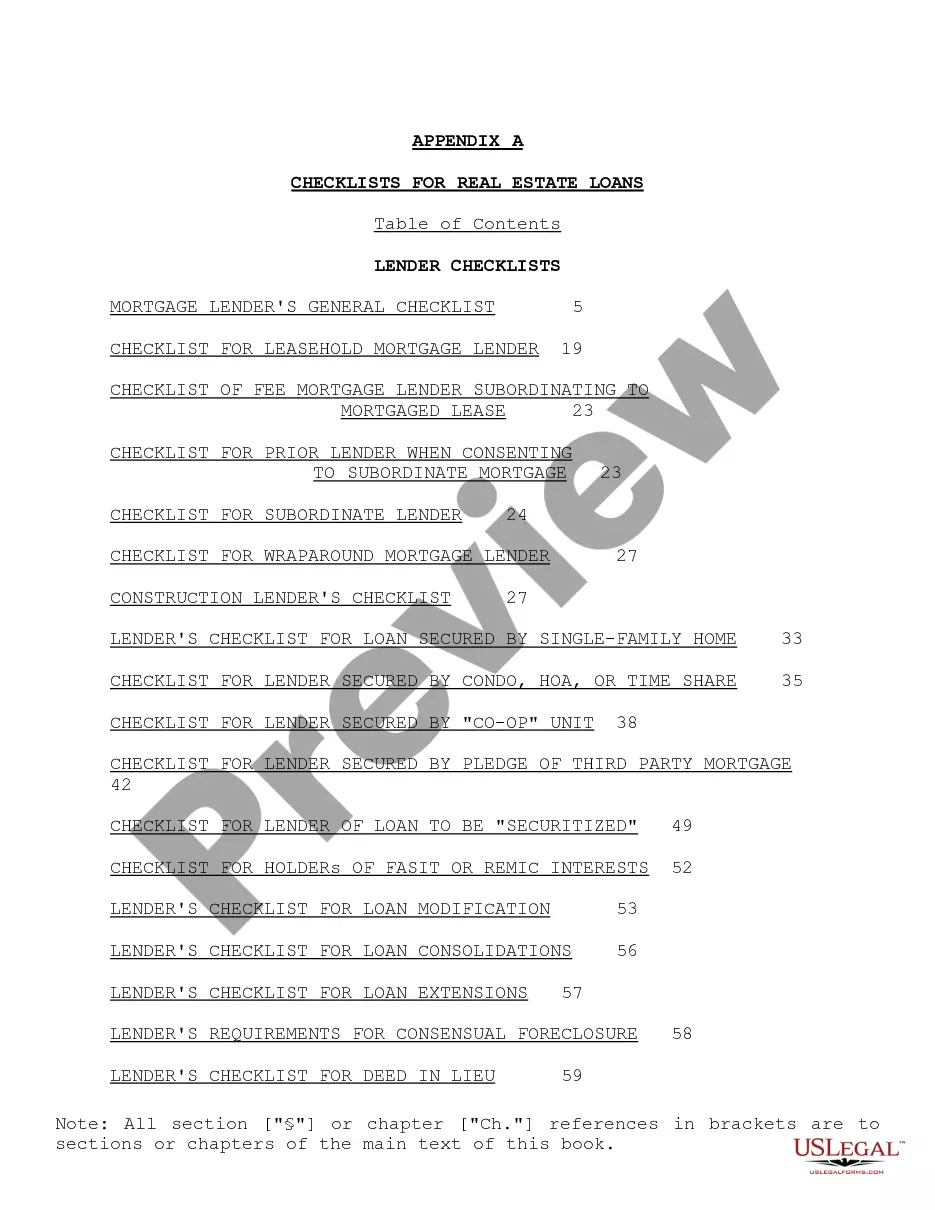

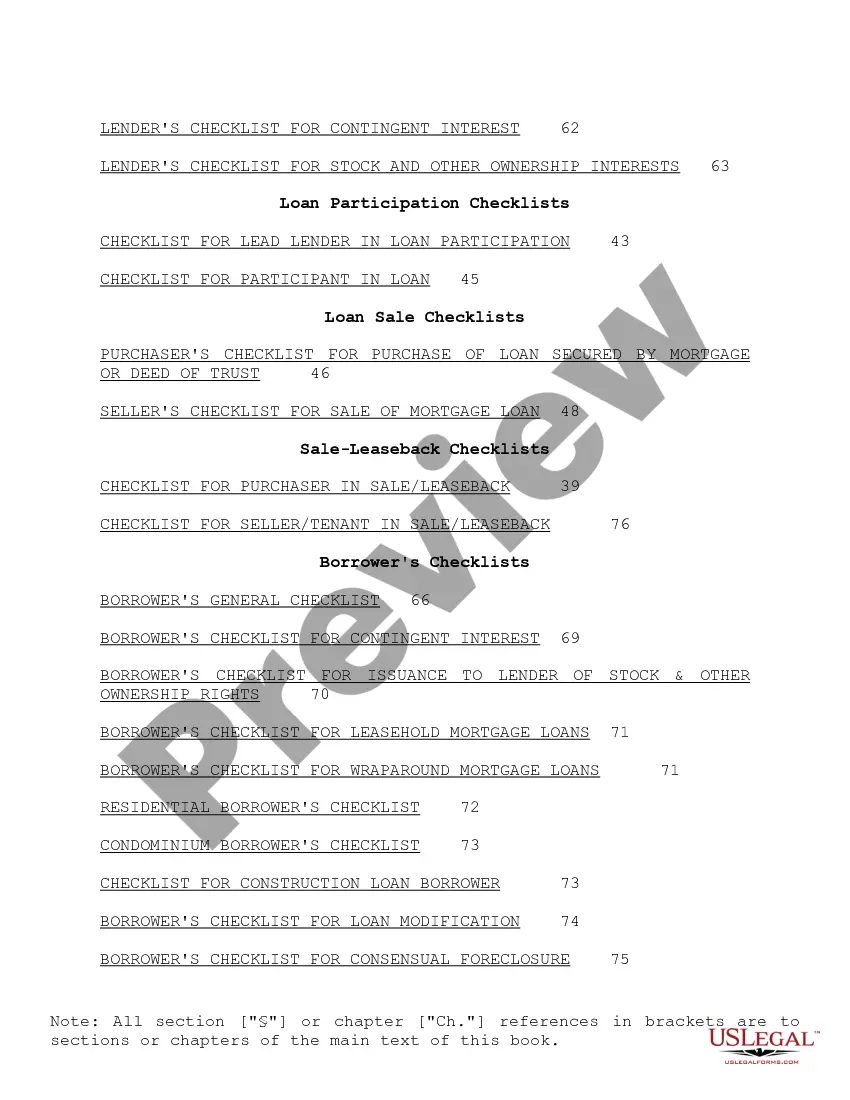

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

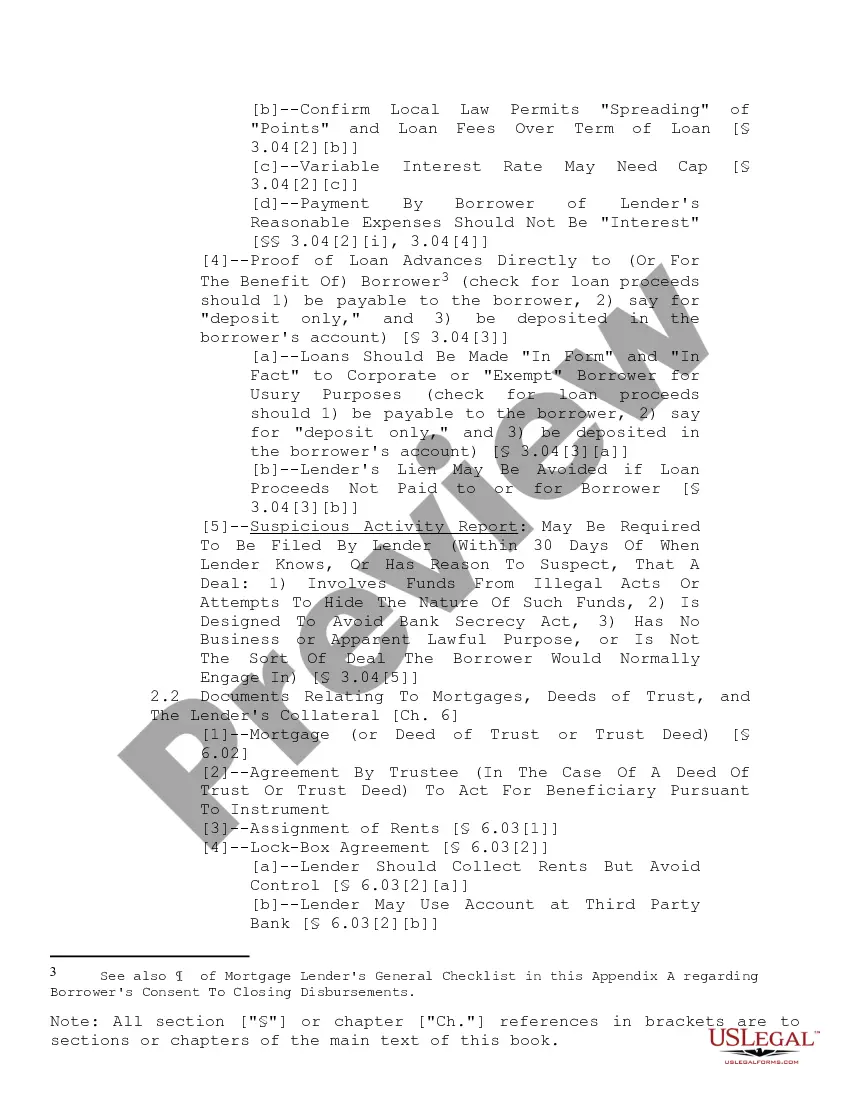

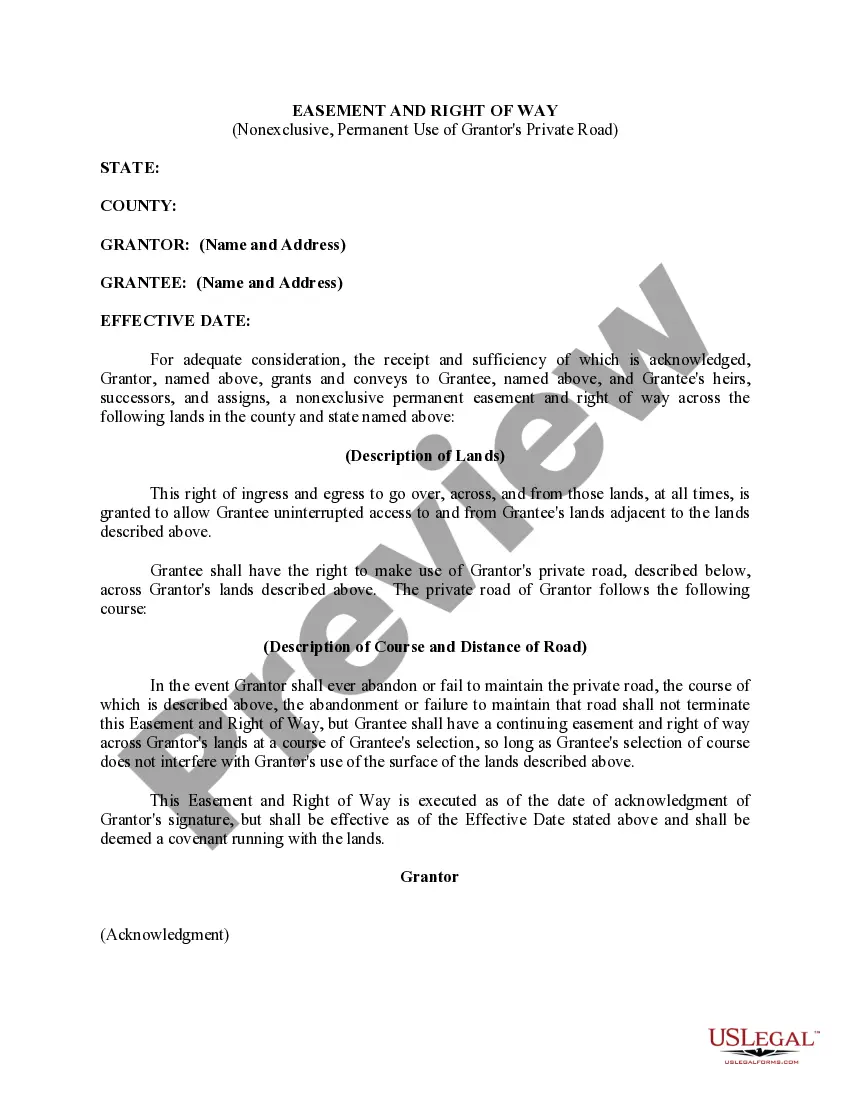

Nevada Checklist for Real Estate Loans: A Comprehensive Guide When it comes to obtaining a real estate loan in Nevada, there are various crucial steps and documents that need to be considered. A checklist serves as a valuable tool to ensure that each aspect of the loan application process is completed thoroughly and efficiently. In this article, we will provide a detailed description of the Nevada Checklist for Real Estate Loans, including the essential keywords related to the topic. 1. Loan Application Documents: — Loan application for— - Personal identification documents (driver's license, passport) — Social Security Number (SSN— - Employment verification and income documents (pay stubs, employment contract) — Tax returns (previous two years— - Bank statements (recent months) — Asset documentation (investment accounts, real estate owned) — Divorce decree (if applicable— - Gift documentation (if down payment is sourced from a gift) — Other loan obligations (auto loans, student loans) 2. Credit and Financial History: — Credireportor— - Credit score - Debt-to-income ratio (DTI) — Proof of monthly expenses (utility bills, credit card statements) — Proof of rental payment history (if applicable) — Bankruptcy or foreclosure history (if applicable) 3. Property Information and Appraisal: — Propertaddresses— - Purchase agreement or contract — Property appraisal report and/or inspection report — Title searcreportor— - Property insurance details 4. Insurance and Taxes: — Homeowner's insurancpoliceic— - Flood insurance policy (if applicable) — Escrow account details for property taxes 5. Loan Disclosures and Approval Documents: — Loan Estimate (LE— - Truth in Lending Act (TILL) disclosure — Closing Disclosure (CD— - Promissory note — Deed of Trust or Mortgag— - Hazard Disclosure Statement — Loan approval letter 6. Additional Copies and Information: — All documents in duplicate or as requested by the lender — Additional documentation requested by the underwriter or loan officer Different Types of Nevada Checklist for Real Estate Loans: 1. Conventional Loan Checklist: This checklist outlines the requirements specific to obtaining a conventional loan for real estate in Nevada. It includes standard documentation necessary for loan approval from conventional lenders such as banks or credit unions. 2. FHA Loan Checklist: The checklist for Federal Housing Administration (FHA) loans in Nevada include additional documents required by the FHA. These loans are insured by the government and have specific guidelines to qualify for the loan. 3. VA Loan Checklist: This checklist pertains to loans guaranteed by the U.S. Department of Veterans Affairs (VA). It highlights the necessary documents for active-duty military, veterans, and eligible surviving spouses who seek real estate loans in Nevada. 4. USDA Loan Checklist: The United States Department of Agriculture (USDA) provides loans for rural property purchases. This checklist covers the specific documentation demanded for USDA loans, including proof of income, property eligibility, and residency. In conclusion, the Nevada Checklist for Real Estate Loans encompasses several important documents and requirements for obtaining various types of loans in the state. It is crucial for borrowers to gather and submit all the necessary paperwork to ensure a smooth and successful loan application process. By adhering to the checklist, borrowers can confidently navigate the real estate loan process in Nevada.Nevada Checklist for Real Estate Loans: A Comprehensive Guide When it comes to obtaining a real estate loan in Nevada, there are various crucial steps and documents that need to be considered. A checklist serves as a valuable tool to ensure that each aspect of the loan application process is completed thoroughly and efficiently. In this article, we will provide a detailed description of the Nevada Checklist for Real Estate Loans, including the essential keywords related to the topic. 1. Loan Application Documents: — Loan application for— - Personal identification documents (driver's license, passport) — Social Security Number (SSN— - Employment verification and income documents (pay stubs, employment contract) — Tax returns (previous two years— - Bank statements (recent months) — Asset documentation (investment accounts, real estate owned) — Divorce decree (if applicable— - Gift documentation (if down payment is sourced from a gift) — Other loan obligations (auto loans, student loans) 2. Credit and Financial History: — Credireportor— - Credit score - Debt-to-income ratio (DTI) — Proof of monthly expenses (utility bills, credit card statements) — Proof of rental payment history (if applicable) — Bankruptcy or foreclosure history (if applicable) 3. Property Information and Appraisal: — Propertaddresses— - Purchase agreement or contract — Property appraisal report and/or inspection report — Title searcreportor— - Property insurance details 4. Insurance and Taxes: — Homeowner's insurancpoliceic— - Flood insurance policy (if applicable) — Escrow account details for property taxes 5. Loan Disclosures and Approval Documents: — Loan Estimate (LE— - Truth in Lending Act (TILL) disclosure — Closing Disclosure (CD— - Promissory note — Deed of Trust or Mortgag— - Hazard Disclosure Statement — Loan approval letter 6. Additional Copies and Information: — All documents in duplicate or as requested by the lender — Additional documentation requested by the underwriter or loan officer Different Types of Nevada Checklist for Real Estate Loans: 1. Conventional Loan Checklist: This checklist outlines the requirements specific to obtaining a conventional loan for real estate in Nevada. It includes standard documentation necessary for loan approval from conventional lenders such as banks or credit unions. 2. FHA Loan Checklist: The checklist for Federal Housing Administration (FHA) loans in Nevada include additional documents required by the FHA. These loans are insured by the government and have specific guidelines to qualify for the loan. 3. VA Loan Checklist: This checklist pertains to loans guaranteed by the U.S. Department of Veterans Affairs (VA). It highlights the necessary documents for active-duty military, veterans, and eligible surviving spouses who seek real estate loans in Nevada. 4. USDA Loan Checklist: The United States Department of Agriculture (USDA) provides loans for rural property purchases. This checklist covers the specific documentation demanded for USDA loans, including proof of income, property eligibility, and residency. In conclusion, the Nevada Checklist for Real Estate Loans encompasses several important documents and requirements for obtaining various types of loans in the state. It is crucial for borrowers to gather and submit all the necessary paperwork to ensure a smooth and successful loan application process. By adhering to the checklist, borrowers can confidently navigate the real estate loan process in Nevada.