Nevada Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Nevada Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

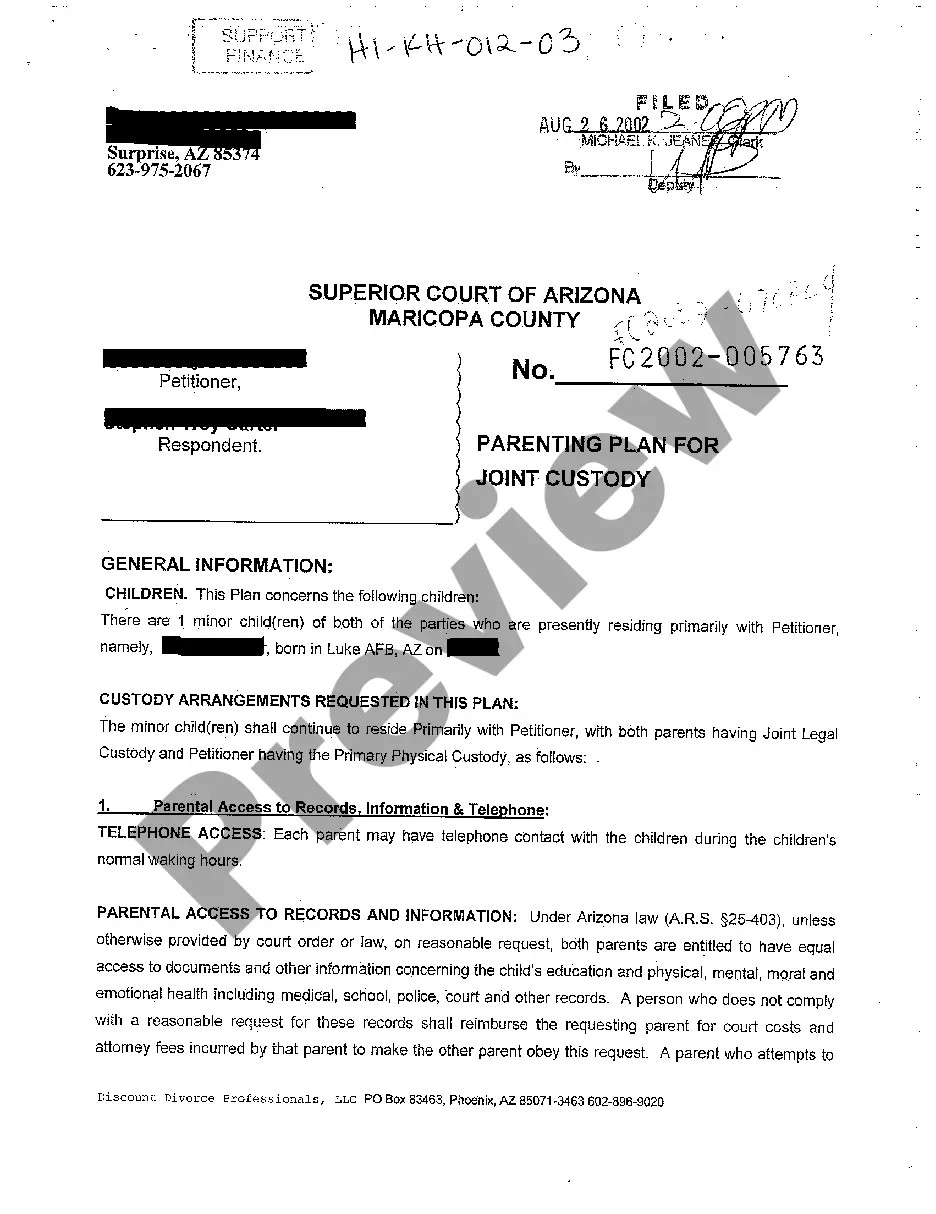

Have you been within a placement the place you require paperwork for possibly enterprise or individual functions virtually every day? There are plenty of legal papers themes available on the net, but finding kinds you can depend on is not simple. US Legal Forms delivers a huge number of develop themes, just like the Nevada Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, that are created to meet state and federal needs.

Should you be already familiar with US Legal Forms site and get an account, merely log in. Next, it is possible to download the Nevada Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself template.

Should you not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for your correct town/county.

- Take advantage of the Review switch to examine the form.

- Look at the information to actually have chosen the appropriate develop.

- In case the develop is not what you`re searching for, use the Look for discipline to obtain the develop that meets your needs and needs.

- When you find the correct develop, just click Purchase now.

- Pick the prices strategy you would like, fill in the desired information and facts to create your money, and pay money for the transaction using your PayPal or charge card.

- Decide on a practical document format and download your duplicate.

Find each of the papers themes you possess purchased in the My Forms menus. You may get a more duplicate of Nevada Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself any time, if needed. Just click the essential develop to download or printing the papers template.

Use US Legal Forms, probably the most substantial selection of legal types, to save lots of some time and stay away from blunders. The support delivers skillfully manufactured legal papers themes that you can use for a variety of functions. Produce an account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Nevada statute of limitations on debt explained The statute of limitations is the period within which a debt collector can sue you for a delinquent debt. After this time has elapsed, the debt collector can't file a lawsuit against you.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Nevada Statute of Limitations on Credit Cards Under Nevada laws, the statute of limitations for credit card debt is 4 years. This means that if a creditor does not file a lawsuit against you to recover outstanding balances within 4 years, they lose their right to sue you.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

In Nevada, the statute of limitations for suing to collect oral contract debts is four years and six years for written contracts. Nevada law states that the clock on the statute of limitations starts on the date of the last transaction, the last item charged or the last credit given.