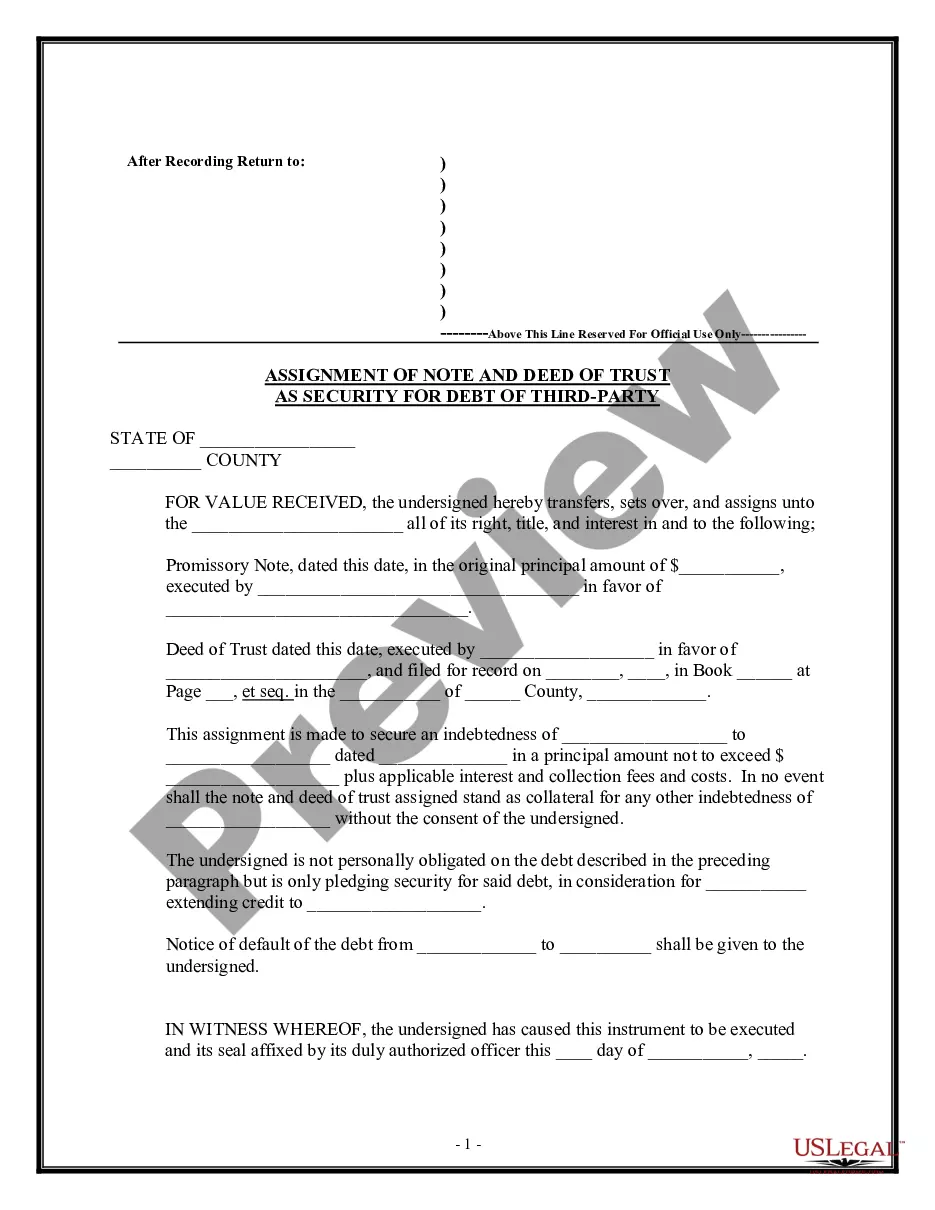

Nevada Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

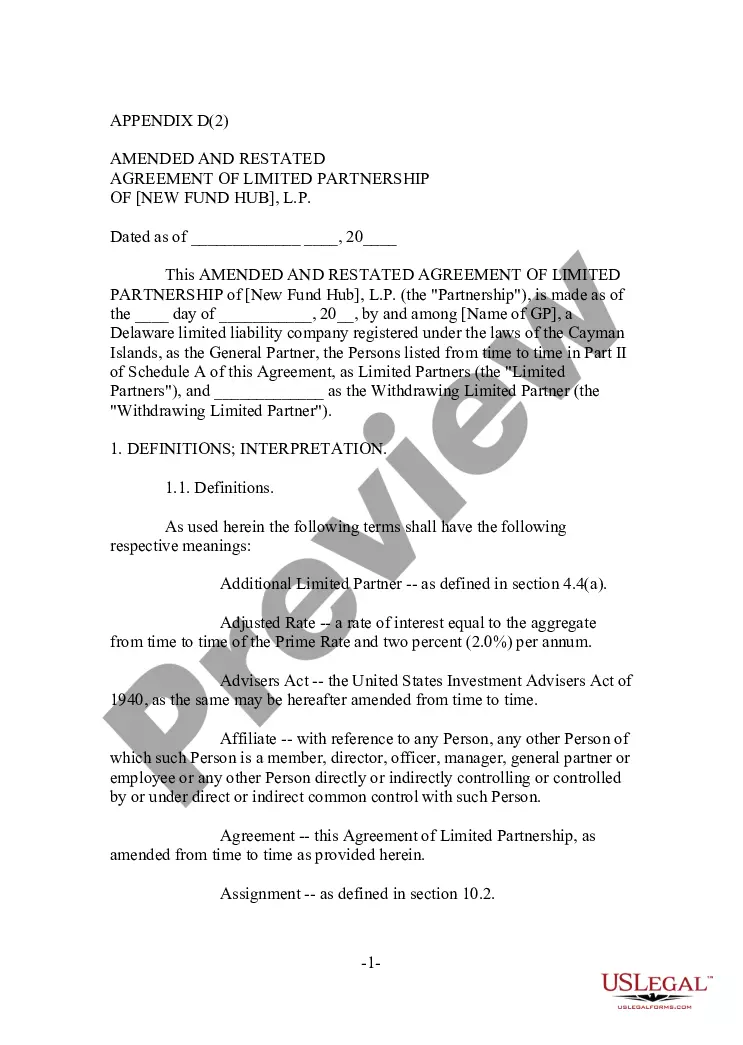

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

If you wish to complete, obtain, or produce lawful record layouts, use US Legal Forms, the largest selection of lawful varieties, which can be found on the web. Utilize the site`s easy and hassle-free search to discover the documents you want. Various layouts for enterprise and personal functions are sorted by classes and states, or keywords. Use US Legal Forms to discover the Nevada Assignment of Note and Deed of Trust as Security for Debt of Third Party in a handful of click throughs.

In case you are currently a US Legal Forms consumer, log in for your bank account and click the Down load button to find the Nevada Assignment of Note and Deed of Trust as Security for Debt of Third Party. You can even accessibility varieties you previously saved inside the My Forms tab of the bank account.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that correct city/region.

- Step 2. Utilize the Preview option to look over the form`s content material. Don`t neglect to read the information.

- Step 3. In case you are unhappy with all the develop, make use of the Lookup field on top of the display screen to locate other versions from the lawful develop design.

- Step 4. Upon having located the shape you want, select the Buy now button. Pick the prices prepare you like and add your qualifications to sign up for the bank account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal bank account to finish the deal.

- Step 6. Select the formatting from the lawful develop and obtain it on your product.

- Step 7. Comprehensive, change and produce or signal the Nevada Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Each and every lawful record design you get is the one you have for a long time. You have acces to each and every develop you saved in your acccount. Select the My Forms portion and choose a develop to produce or obtain again.

Compete and obtain, and produce the Nevada Assignment of Note and Deed of Trust as Security for Debt of Third Party with US Legal Forms. There are millions of professional and express-distinct varieties you can utilize for your personal enterprise or personal demands.

Form popularity

FAQ

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt. The note lays out all the terms of the loan (repayment, interest, penalties, etc.).

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.