The Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that outlines the terms and conditions for a specific type of mortgage-backed security issued by Ameriquest Mortgage Securities, Inc. in the state of Nevada. This trust agreement serves as the governing instrument for the trust where the mortgage loans are pooled together and converted into tradable securities. One type of Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. is the residential mortgage-backed security (RMBS). It involves the securitization of residential mortgage loans from borrowers in Nevada, which are then bundled together and sold as investment products to investors. This type of trust agreement helps provide liquidity to the mortgage market and allows investors to gain exposure to a diversified pool of residential mortgages. Another type of Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. is the commercial mortgage-backed security (CMOS). This involves the pooling and securitization of commercial mortgage loans, typically for properties in Nevada such as office buildings, shopping centers, or industrial facilities. Investors can purchase these securities, which offer a way to invest in the commercial real estate market without directly owning individual properties. The Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. typically includes provisions related to the responsibilities and duties of the trustee, who acts as a fiduciary for the investors. It outlines the distribution of principal and interest payments from the underlying mortgage loans to the investors, as well as the rights and remedies available in case of defaults or other issues. These agreements may also include provisions for the creation of different classes or tranches of securities with varying levels of risk and return. Overall, the Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. is a crucial legal document that facilitates the securitization of mortgage loans in Nevada, enabling investors to participate in the mortgage market and potentially earn returns from the income generated by the underlying loans.

Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

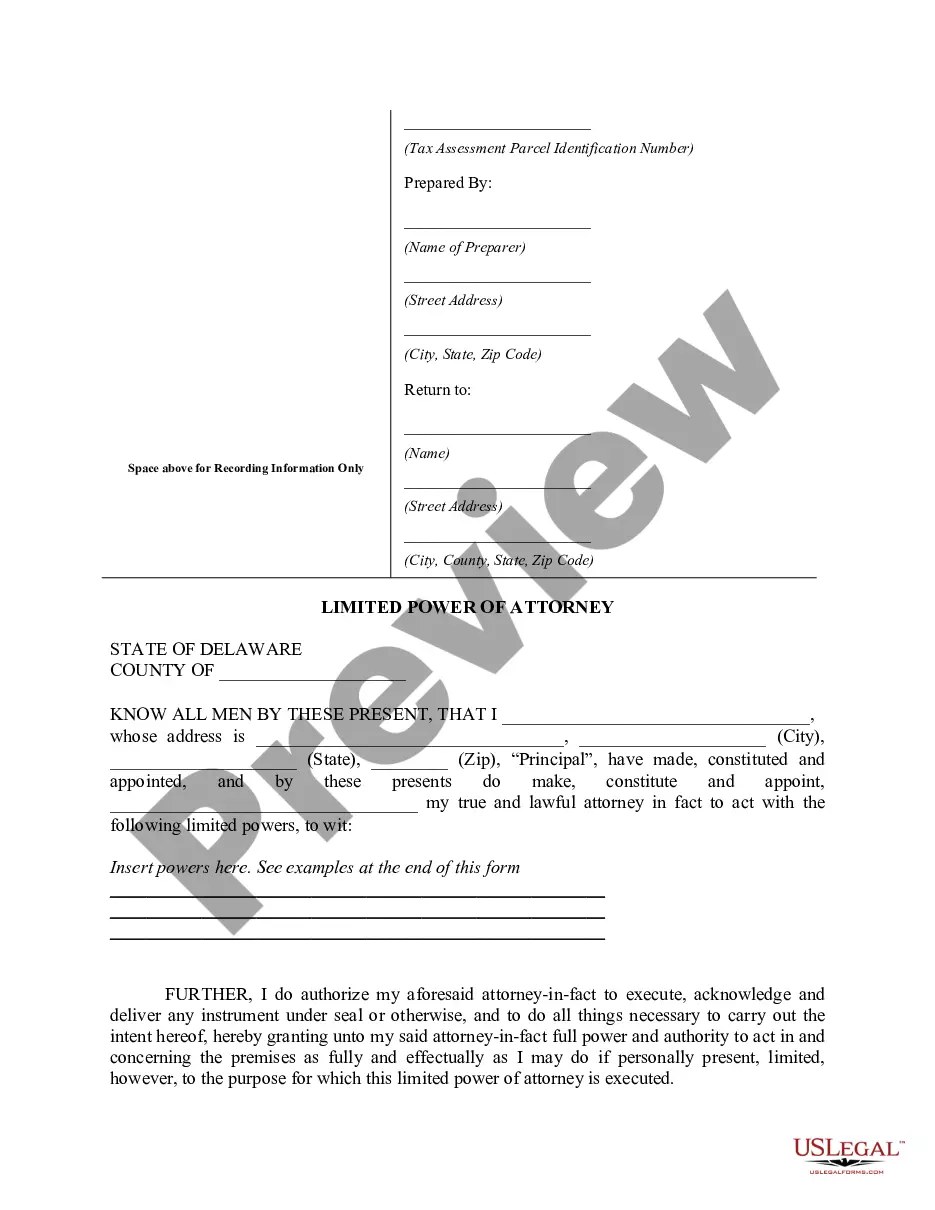

How to fill out Nevada Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

US Legal Forms - one of several largest libraries of legal types in the USA - gives a wide range of legal document layouts you may download or print out. Using the website, you may get a large number of types for company and person purposes, categorized by classes, says, or key phrases.You will discover the most recent versions of types such as the Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. in seconds.

If you have a monthly subscription, log in and download Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. through the US Legal Forms collection. The Down load option can look on every single type you perspective. You gain access to all formerly saved types within the My Forms tab of your own profile.

If you want to use US Legal Forms initially, allow me to share straightforward instructions to help you get started off:

- Make sure you have selected the best type for your personal area/county. Go through the Review option to examine the form`s content material. See the type information to ensure that you have chosen the right type.

- When the type does not suit your specifications, utilize the Lookup area near the top of the monitor to get the one who does.

- When you are happy with the form, confirm your decision by simply clicking the Buy now option. Then, pick the prices strategy you prefer and offer your qualifications to register to have an profile.

- Method the transaction. Utilize your bank card or PayPal profile to complete the transaction.

- Find the file format and download the form on your gadget.

- Make alterations. Load, change and print out and indicator the saved Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc..

Every single format you included with your account does not have an expiration date which is your own for a long time. So, if you would like download or print out one more backup, just proceed to the My Forms section and then click on the type you need.

Get access to the Nevada Trust Agreement of Ameriquest Mortgage Securities, Inc. with US Legal Forms, one of the most considerable collection of legal document layouts. Use a large number of specialist and express-certain layouts that satisfy your organization or person demands and specifications.

Form popularity

FAQ

On September 9, 2007, Argent Mortgage was sold to Citi for an undisclosed amount. Argent was renamed Citi Residential Lending. Citi Residential Lending operated for several months before it was shut down. On September 10, 2007, Ameriquest stopped accepting loan applications.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.