Title: Nevada Transfer Agreement: Deutsche Telekom AG and NAB Nordamerika Beteiligungs Holding GmbH Keywords: Nevada Transfer Agreement, Deutsche Telekom AG, NAB Nordamerika Beteiligungs Holding GmbH, Transfer of Shares, Qualified Subsidiaries. Introduction: The Nevada Transfer Agreement between Deutsche Telekom AG (TAG) and NAB Nordamerika Beteiligungs Holding GmbH (NAB) lays out the terms and conditions for the transfer of shares from TAG to one or more qualified subsidiaries. This agreement facilitates the strategic consolidation and expansion of TAG's business holdings in Nevada and ensures regulatory compliance. Types of Nevada Transfer Agreements: 1. Asset Transfer Agreement: This type of agreement allows TAG to transfer specific assets, such as shares, intellectual property rights, or real estate properties, to its qualified subsidiaries in Nevada. The agreement defines the rights, responsibilities, and obligations of both parties regarding the transfer and subsequent ownership of these assets. 2. Equity Transfer Agreement: This agreement focuses on the transfer of shares or equity interests from TAG to qualified subsidiaries, enabling the subsidiaries to become direct stakeholders in the designated entities. It outlines the procedures for the transfer, including legal requirements, valuations, and approval processes by relevant regulatory bodies. 3. Stock Purchase Agreement: This agreement represents a specific type of equity transfer, wherein TAG agrees to transfer a predetermined number of shares of a target company to its qualified subsidiaries. It involves negotiations on the purchase price, the structure of the transaction, representations and warranties, and any rights or restrictions associated with the transferred shares. Key Elements of the Nevada Transfer Agreement: 1. Parties involved: The agreement clearly identifies the parties involved, i.e., Deutsche Telekom AG and NAB Nordamerika Beteiligungs Holding GmbH. 2. Purpose: The agreement outlines the purpose of the transfer, which is to consolidate TAG's business operations in Nevada and strengthen its subsidiaries' ownership structure. 3. Transfer of shares: It details how the transfer of shares will be executed, including the number of shares, valuation methodology, and any conditions precedent or subsequent. 4. Qualified subsidiaries: The agreement introduces the concept of "qualified subsidiaries," defining the criteria that a subsidiary must meet to be eligible for receiving the transferred shares. 5. Consideration: The agreement specifies the consideration to be paid by the qualified subsidiaries to TAG for the transferred shares, whether in cash, securities, or other negotiated forms. 6. Regulatory compliance: The agreement ensures compliance with all applicable laws, regulations, and approvals required for the transfer of shares within the Nevada jurisdiction. 7. Representations and warranties: Both parties provide representations and warranties to establish the accuracy of the information provided and to safeguard their interests. Conclusion: The Nevada Transfer Agreement between Deutsche Telekom AG and NAB Nordamerika Beteiligungs Holding GmbH regarding the transfer of shares to one or more qualified subsidiaries enables TAG to streamline its business operations while maintaining control and strategic expansion possibilities. The agreement's structure may vary depending on the type of transfer, such as asset transfer, equity transfer, or stock purchase. The agreement provides a legally binding framework ensuring compliance with regulatory requirements and safeguards the rights and obligations of the involved parties.

Nevada Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries

Description

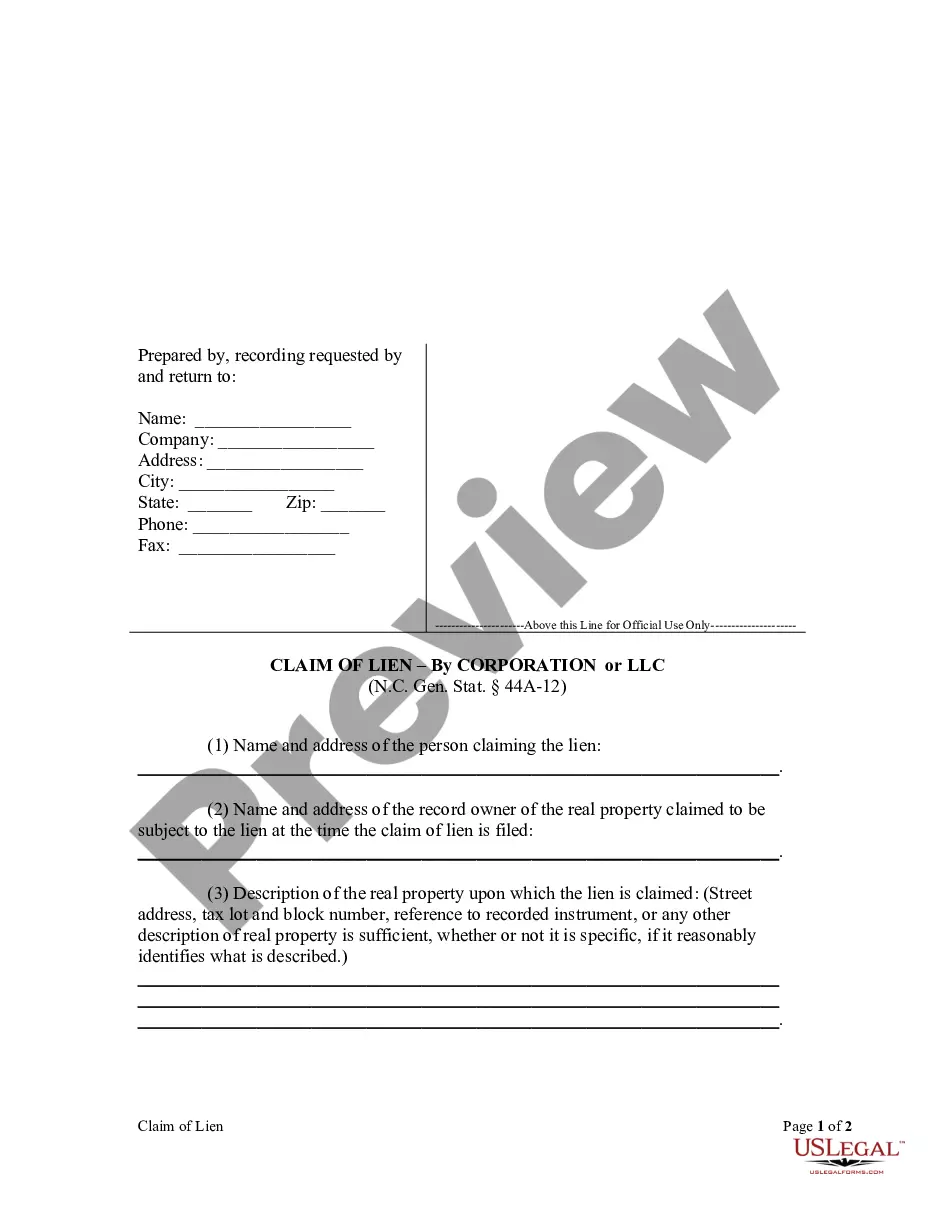

How to fill out Nevada Transfer Agreement Between Deutsche Telecom AG And NAB Nordamerika Beteiligungs Holding GMBH Regarding Transfer Of Shares To One Or More Qualified Subsidiaries?

It is possible to spend several hours on-line looking for the legitimate record design that suits the state and federal specifications you will need. US Legal Forms provides a large number of legitimate forms which are examined by experts. It is possible to download or print out the Nevada Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries from our support.

If you have a US Legal Forms bank account, it is possible to log in and click on the Acquire switch. Following that, it is possible to comprehensive, edit, print out, or signal the Nevada Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries. Each and every legitimate record design you get is your own property forever. To acquire another copy for any obtained type, visit the My Forms tab and click on the related switch.

If you are using the US Legal Forms site the very first time, adhere to the simple recommendations below:

- First, make sure that you have chosen the proper record design to the area/metropolis that you pick. See the type explanation to make sure you have picked out the right type. If available, use the Preview switch to search from the record design also.

- If you would like find another version in the type, use the Search industry to find the design that fits your needs and specifications.

- Upon having found the design you want, simply click Buy now to proceed.

- Choose the pricing strategy you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal bank account to pay for the legitimate type.

- Choose the structure in the record and download it to the gadget.

- Make alterations to the record if possible. It is possible to comprehensive, edit and signal and print out Nevada Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries.

Acquire and print out a large number of record layouts making use of the US Legal Forms web site, which offers the largest collection of legitimate forms. Use specialist and express-specific layouts to deal with your company or individual needs.

Form popularity

FAQ

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

The share transfer agreement is a legal document which regulates the transfer of shares between shareholders in a company in a particular location or situation. It serves as a legally binding contract that establishes the rights and responsibilities of the parties involved in the share transfer process.

The following are the core elements of a share transfer agreement : Definition of transfer of shares. Definition of consideration of shares. Date of transfer. Purchase price. Payment. Liability. Creditors. Representations and warranties.

I/ We hereby request the Company to kindly consider my/ our request for transmission of the aforesaid shares in my/ our name on the basis of execution of Affidavit and Indemnity Bond without submitting any of the aforesaid legal documents. Please send the specimen of the said documents to be executed by me/ us.

Hear this out loud PauseThe share transfer agreement is a legal document which regulates the transfer of shares between shareholders in a company in a particular location or situation. It serves as a legally binding contract that establishes the rights and responsibilities of the parties involved in the share transfer process.

NOW, THEREFORE, IT IS HEREBY AGREED as follows: TRANSFER OF SHARES It is agreed that: ... TRANSFER PRICE It is agreed that the Shares shall be transferred for the price of price. ... COST OF TRANSFER It is agreed that the cost of registering the transfer of the Shares (if any) will be borne by the Transferee.