Nevada Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

Are you in a position where you need to have documents for either company or person functions nearly every day time? There are a variety of legal record layouts accessible on the Internet, but locating kinds you can rely isn`t straightforward. US Legal Forms gives a huge number of type layouts, such as the Nevada Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans, that happen to be composed to fulfill state and federal needs.

In case you are already informed about US Legal Forms web site and possess your account, just log in. Following that, it is possible to download the Nevada Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans web template.

Should you not have an profile and want to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is for that proper city/state.

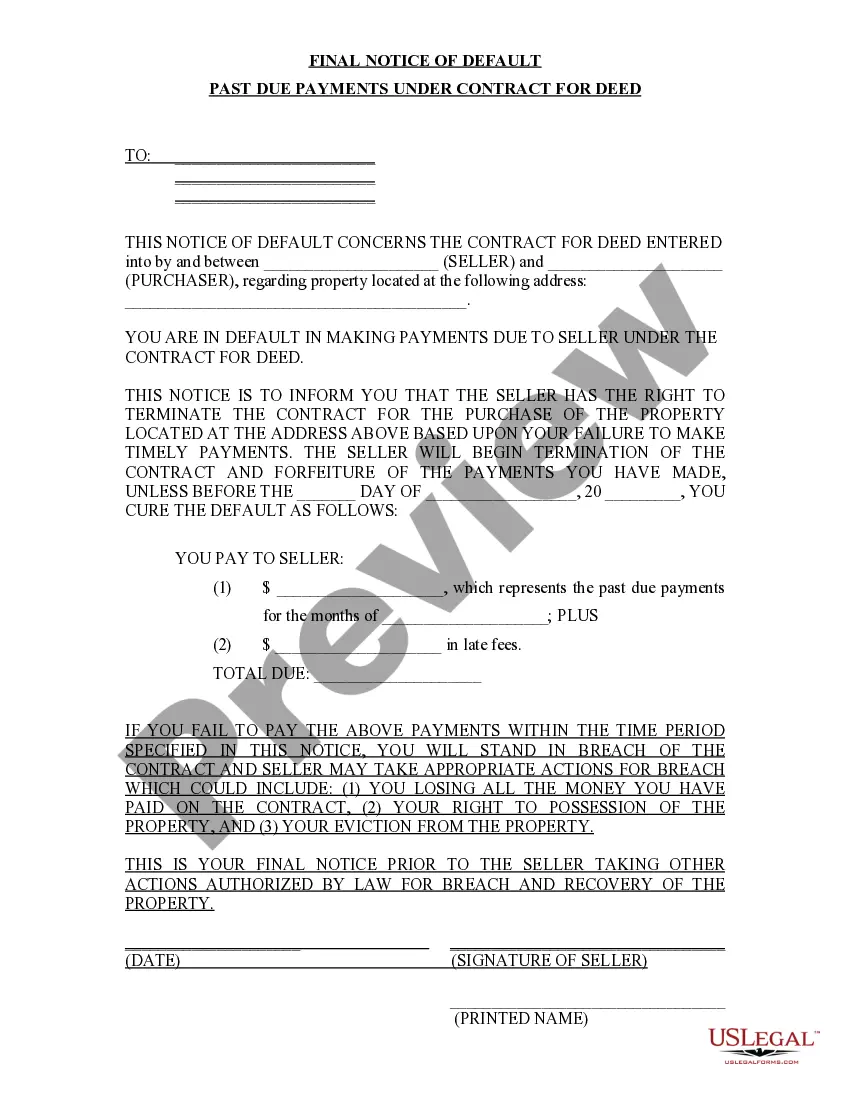

- Make use of the Preview key to check the shape.

- Browse the outline to actually have chosen the appropriate type.

- If the type isn`t what you`re seeking, make use of the Lookup area to find the type that suits you and needs.

- Once you find the proper type, just click Buy now.

- Choose the prices plan you desire, submit the desired information to generate your account, and pay money for your order using your PayPal or credit card.

- Choose a practical data file formatting and download your copy.

Locate each of the record layouts you might have bought in the My Forms food list. You can obtain a extra copy of Nevada Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans any time, if necessary. Just select the needed type to download or printing the record web template.

Use US Legal Forms, by far the most substantial variety of legal types, to save lots of time as well as prevent blunders. The support gives appropriately made legal record layouts that can be used for a range of functions. Make your account on US Legal Forms and begin creating your lifestyle easier.