Nevada Recapitalization Agreement is a legal contract that outlines the process of restructuring the financial operations of a company, organization, or government entity based in the state of Nevada. This agreement is aimed at improving the financial stability, liquidity, and long-term viability of the entity by addressing issues related to debt, cash flow, investment, and capital structure. The Nevada Recapitalization Agreement focuses on achieving financial stability through various methods, including debt restructuring, asset divestitures, equity financing, or a combination of these strategies. It involves negotiating with creditors, shareholders, and other stakeholders to reach a mutually beneficial solution that addresses the financial challenges faced by the entity. Keywords: 1. Nevada Recapitalization Agreement: This keyword specifies the topic of the content, emphasizing the legal agreement that is utilized for financial restructuring purposes in Nevada. 2. Restructuring: This term highlights the main objective of the agreement, which is to reorganize and realign the financial operations of the entity to enhance its sustainability and profitability. 3. Financial stability: This keyword underlines the ultimate goal of the Nevada Recapitalization Agreement, which is to ensure the entity's ability to meet financial obligations and thrive in the long term. 4. Liquidity: This keyword emphasizes the importance of improving the entity's cash flow and ability to meet short-term financial obligations. 5. Viability: This keyword signifies the intent of the recapitalization process to establish a solid foundation for the entity's long-term success and growth. Different types of Nevada Recapitalization Agreements: 1. Debt Restructuring Agreement: This type of recapitalization agreement focuses primarily on reorganizing the entity's outstanding debts, such as negotiating new terms, extending payment periods, reducing interest rates, or even writing off a portion of the debt. 2. Equity Financing Agreement: This type of recapitalization agreement involves the injection of fresh equity capital into the entity by attracting new investors, issuing new shares, or converting existing debt into equity, aiming to improve the entity's capital structure and financial position. 3. Asset Divestiture Agreement: In certain cases, recapitalization may involve selling off non-core or underperforming assets of the entity to generate funds that can be utilized to strengthen its financial position. 4. Hybrid Recapitalization Agreement: Sometimes, a combination of debt restructuring, equity financing, and asset divestitures may be utilized in a comprehensive recapitalization approach, tailored to the specific needs of the entity to achieve the desired financial stability and viability. By leveraging a Nevada Recapitalization Agreement, entities based in Nevada can proactively address financial challenges, strengthen their financial position, and pave the way for sustainable growth in the future.

Nevada Recapitalization Agreement

Description

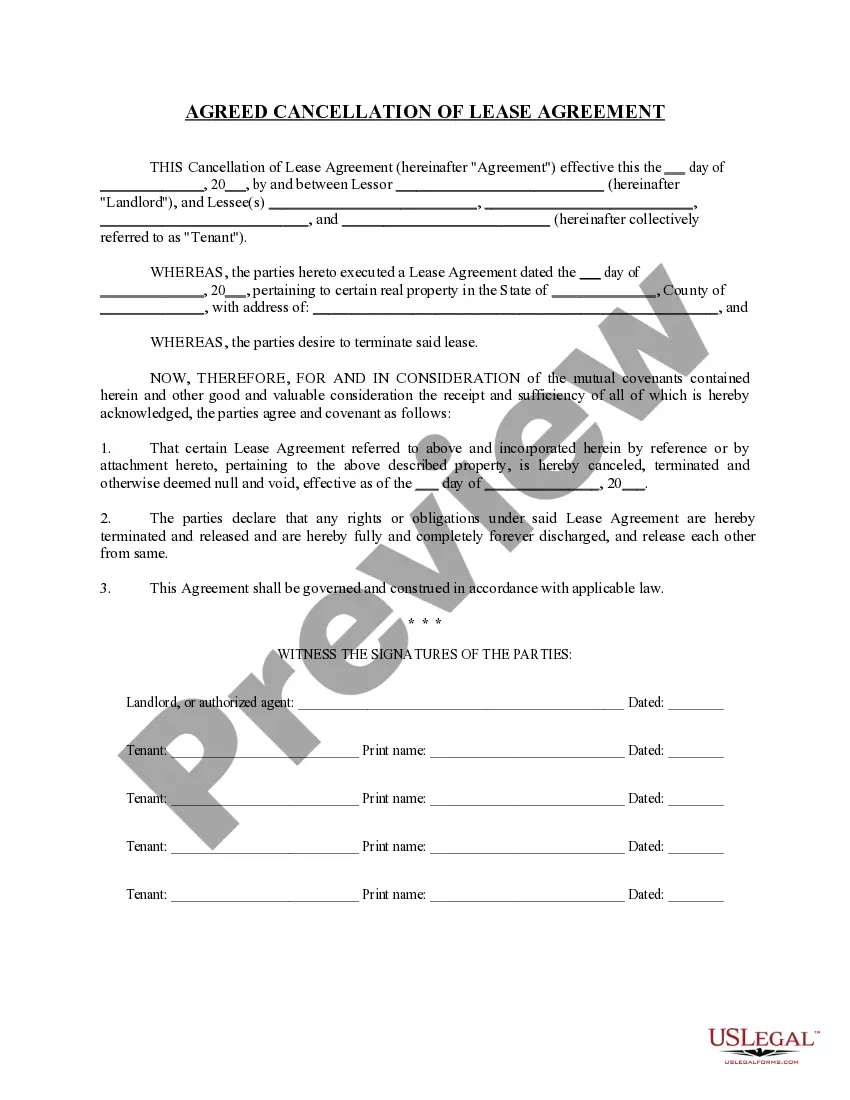

How to fill out Nevada Recapitalization Agreement?

US Legal Forms - one of many most significant libraries of legal varieties in America - gives a variety of legal file layouts you may download or produce. Using the site, you may get a huge number of varieties for company and person reasons, categorized by categories, claims, or keywords.You will find the newest types of varieties much like the Nevada Recapitalization Agreement in seconds.

If you already have a monthly subscription, log in and download Nevada Recapitalization Agreement from your US Legal Forms collection. The Down load switch will appear on every type you look at. You get access to all formerly delivered electronically varieties within the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed below are simple recommendations to help you get started:

- Ensure you have chosen the right type for the city/state. Click on the Preview switch to check the form`s content. Read the type explanation to actually have selected the proper type.

- In case the type does not match your requirements, use the Lookup field towards the top of the display screen to get the one which does.

- If you are satisfied with the form, affirm your selection by clicking the Buy now switch. Then, select the rates program you prefer and supply your references to register to have an profile.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal profile to complete the transaction.

- Select the file format and download the form on your own system.

- Make modifications. Fill up, revise and produce and signal the delivered electronically Nevada Recapitalization Agreement.

Every single web template you included in your account does not have an expiration particular date and it is the one you have eternally. So, if you would like download or produce another copy, just check out the My Forms portion and then click on the type you will need.

Obtain access to the Nevada Recapitalization Agreement with US Legal Forms, by far the most extensive collection of legal file layouts. Use a huge number of professional and state-distinct layouts that fulfill your organization or person needs and requirements.