Nevada Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.

Description

How to fill out Plan Of Merger And Reorganization By And Among Digital Insight Corp., Black Transitory Corp. And NFront, Inc.?

Discovering the right legitimate file web template might be a have difficulties. Of course, there are tons of themes available on the net, but how will you obtain the legitimate form you need? Utilize the US Legal Forms website. The service offers 1000s of themes, including the Nevada Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc., which can be used for business and private needs. Every one of the kinds are checked by experts and fulfill state and federal specifications.

When you are presently registered, log in for your account and click the Down load switch to have the Nevada Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.. Make use of account to search with the legitimate kinds you might have purchased formerly. Go to the My Forms tab of your account and get an additional backup from the file you need.

When you are a brand new consumer of US Legal Forms, here are straightforward instructions for you to stick to:

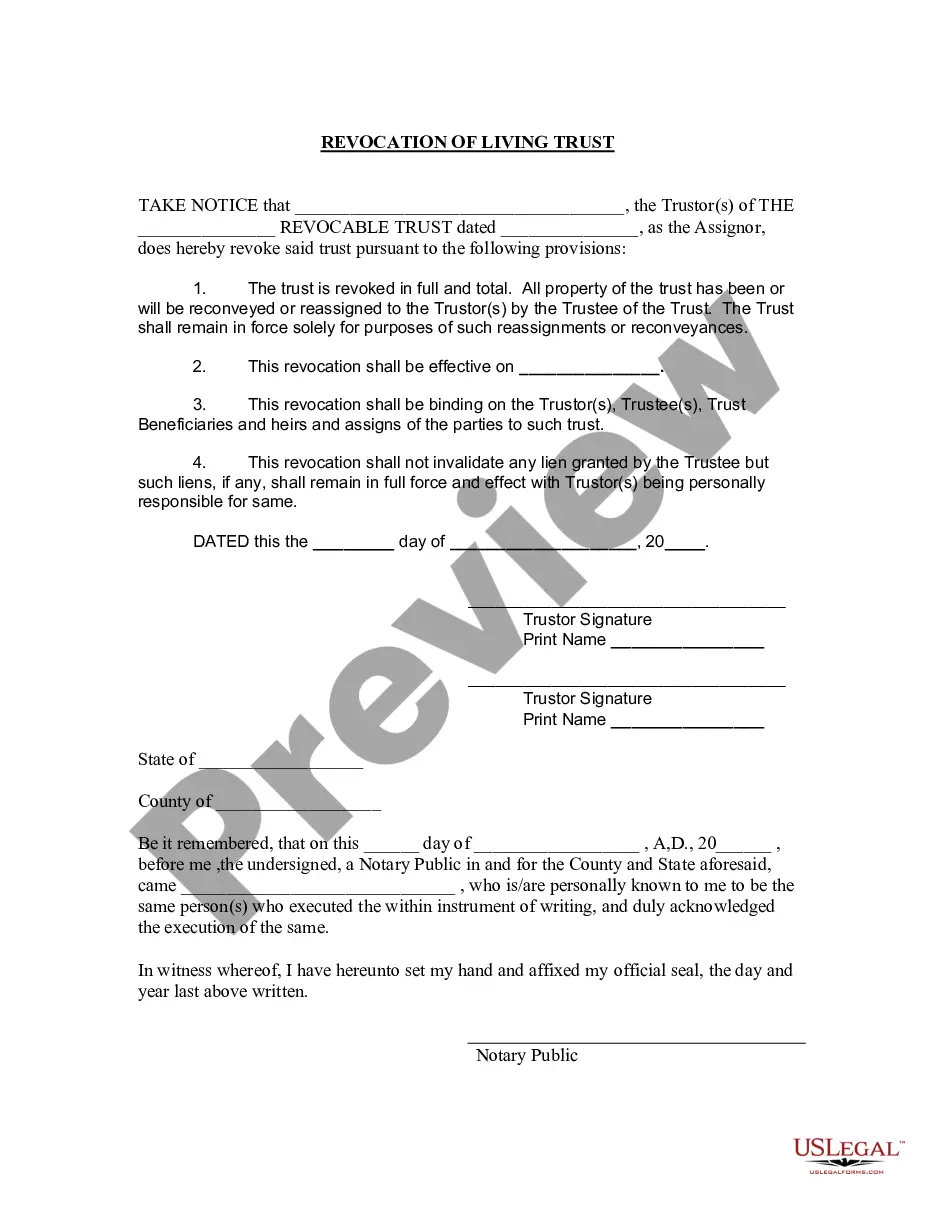

- Very first, ensure you have chosen the appropriate form for the metropolis/region. It is possible to look through the shape making use of the Preview switch and browse the shape description to ensure this is basically the right one for you.

- In the event the form fails to fulfill your preferences, make use of the Seach area to find the appropriate form.

- When you are sure that the shape is proper, go through the Acquire now switch to have the form.

- Opt for the pricing plan you desire and enter in the essential details. Create your account and pay for the order using your PayPal account or charge card.

- Pick the submit file format and down load the legitimate file web template for your gadget.

- Complete, modify and print and indicator the obtained Nevada Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc..

US Legal Forms may be the greatest library of legitimate kinds in which you will find various file themes. Utilize the service to down load appropriately-made documents that stick to express specifications.