Nevada Investment Agreement: A Comprehensive Overview on Purchasing Shares of Common Stock Introduction: When it comes to investing in the stock market, an individual or entity may consider entering into an investment agreement to purchase shares of common stock. In Nevada, various types of investment agreements regarding the purchase of common stock exist, each tailored to suit different types of investors and businesses. This article aims to provide a detailed description of the Nevada Investment Agreement, shedding light on its key provisions, benefits, and any known variations. Key Keywords: Nevada, Investment Agreement, purchase, shares, common stock 1. Nevada Investment Agreement: The Nevada Investment Agreement is a legally binding contract between the seller (issuer) of the common stock and the buyer (investor). It outlines the terms, conditions, and obligations governing the purchase and sale of shares of common stock. The agreement aims to protect the rights of both parties involved and establish a clear understanding of the transaction. 2. Types of Nevada Investment Agreements: a) Straight Common Stock Purchase Agreement: This type of agreement is the most basic and straightforward form of an investment agreement in Nevada. It involves the direct purchase of common stock from the issuer, without any additional terms or conditions attached. b) Preferred Stock Purchase Agreement: Apart from common stock, some companies may offer preferred stock to investors. A preferred stock purchase agreement outlines the terms and conditions specific to the acquisition of preferred shares, which often come with additional rights or preferences over common stock. c) Regulation D Investment Agreement: This investment agreement type is specific to Nevada's compliance with federal securities laws, particularly under Regulation D. It provides exemptions from certain registration requirements for securities offerings made to accredited investors or a limited number of sophisticated non-accredited investors. d) Private Placement Memorandum (PPM): Though not strictly defined as an agreement, a PPM is a document commonly used alongside an investment agreement. It provides detailed information about the company, its financials, risks associated with the investment, and terms of the offering. Investors receive the PPM before signing the investment agreement. 3. Important Provisions: a) Purchase Price and Consideration: The Nevada Investment Agreement specifies the total purchase price and the form of consideration for the shares. It may include cash, marketable securities, promissory notes, or a combination thereof. b) Representations and Warranties: Both the issuer and investor make various representations and warranties regarding their authority, ownership rights, financial statements, and legal compliance. These ensure transparency between both parties. c) Conditions of Closing: The agreement outlines the conditions that must be fulfilled before the closing of the transaction, such as regulatory approvals, due diligence, or the completion of certain corporate actions. d) Indemnification and Liabilities: To protect both parties, the agreement defines the scope of indemnification, liability limitations, and procedures for resolving disputes arising from breaches of the agreement or misrepresentations. e) Governing Law and Arbitration: Nevada Investment Agreements typically include a choice of law provision, specifying that Nevada law governs any disputes. Arbitration clauses may also be included, designating the preferred method of dispute resolution. Conclusion: The Nevada Investment Agreement is a crucial document for investors looking to purchase shares of common stock. It serves as a legally enforceable roadmap that outlines the terms, conditions, and responsibilities associated with the transaction. By understanding the various types of investment agreements available, potential investors can make informed decisions aligned with their investment goals and risk tolerance.

Nevada Investment Agreement regarding the purchase of shares of common stock

Description

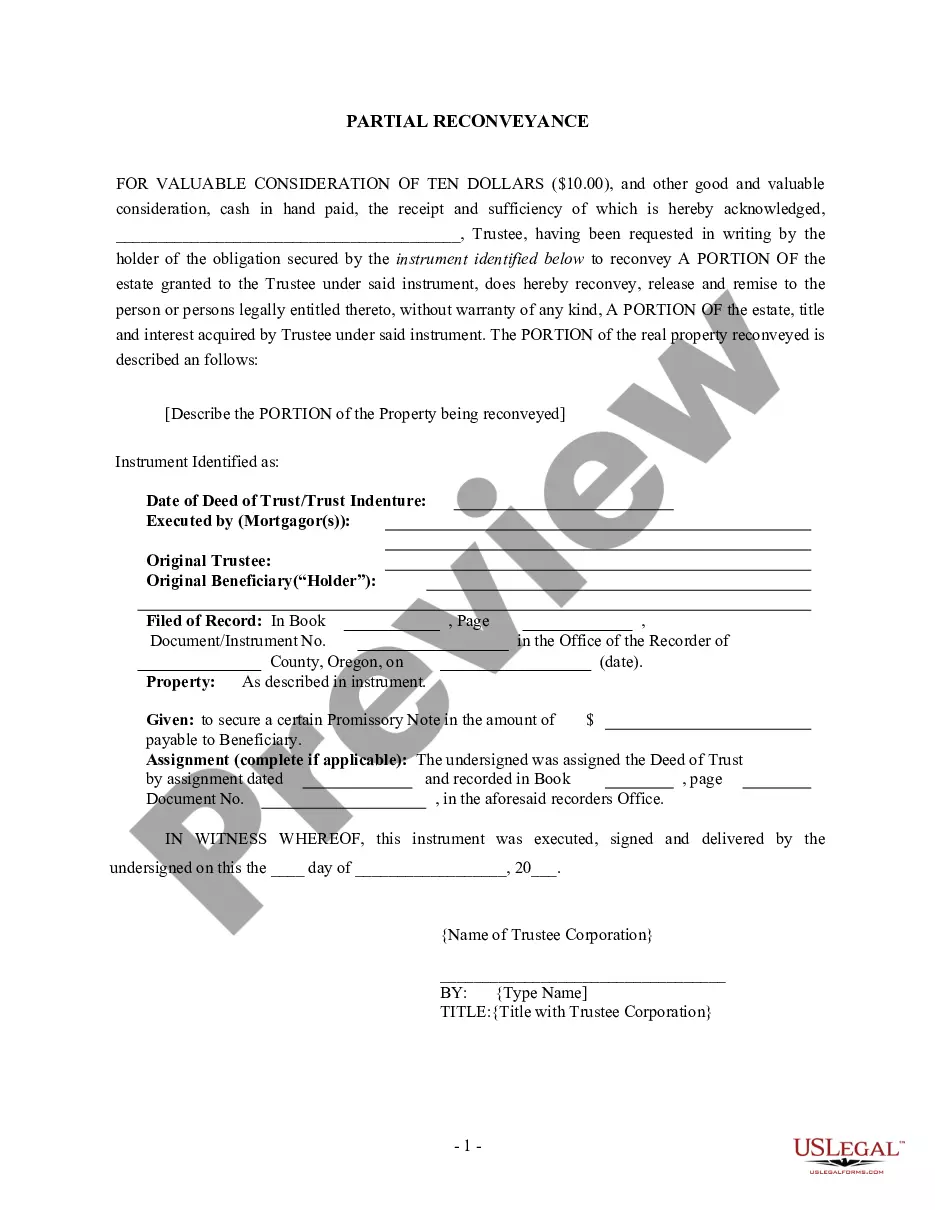

How to fill out Nevada Investment Agreement Regarding The Purchase Of Shares Of Common Stock?

You are able to invest hrs on the Internet looking for the lawful file web template that fits the state and federal demands you want. US Legal Forms offers 1000s of lawful types which can be reviewed by experts. It is simple to obtain or print the Nevada Investment Agreement regarding the purchase of shares of common stock from my assistance.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain button. Afterward, you are able to total, modify, print, or indicator the Nevada Investment Agreement regarding the purchase of shares of common stock. Each and every lawful file web template you purchase is your own property for a long time. To get another copy associated with a obtained type, go to the My Forms tab and click the related button.

If you are using the US Legal Forms site the first time, keep to the basic recommendations under:

- First, be sure that you have chosen the right file web template for the state/metropolis of your choosing. Look at the type information to ensure you have chosen the correct type. If accessible, utilize the Review button to check with the file web template also.

- In order to get another version of the type, utilize the Lookup area to discover the web template that fits your needs and demands.

- Once you have discovered the web template you would like, simply click Get now to continue.

- Choose the rates plan you would like, enter your credentials, and register for an account on US Legal Forms.

- Total the financial transaction. You should use your credit card or PayPal profile to cover the lawful type.

- Choose the structure of the file and obtain it in your product.

- Make adjustments in your file if necessary. You are able to total, modify and indicator and print Nevada Investment Agreement regarding the purchase of shares of common stock.

Obtain and print 1000s of file themes while using US Legal Forms website, that provides the most important selection of lawful types. Use specialist and status-particular themes to take on your organization or individual needs.

Form popularity

FAQ

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

An investment agreement is a legally binding contract between two or more parties that outlines the terms and conditions of an investment arrangement.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

An example would be if Dexter gives $100,000 to ABC (company) in exchange for a convertible debt note that will either be repaid in 1 year with 50% gain or converted into 100,000 shares of the company's stock.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.