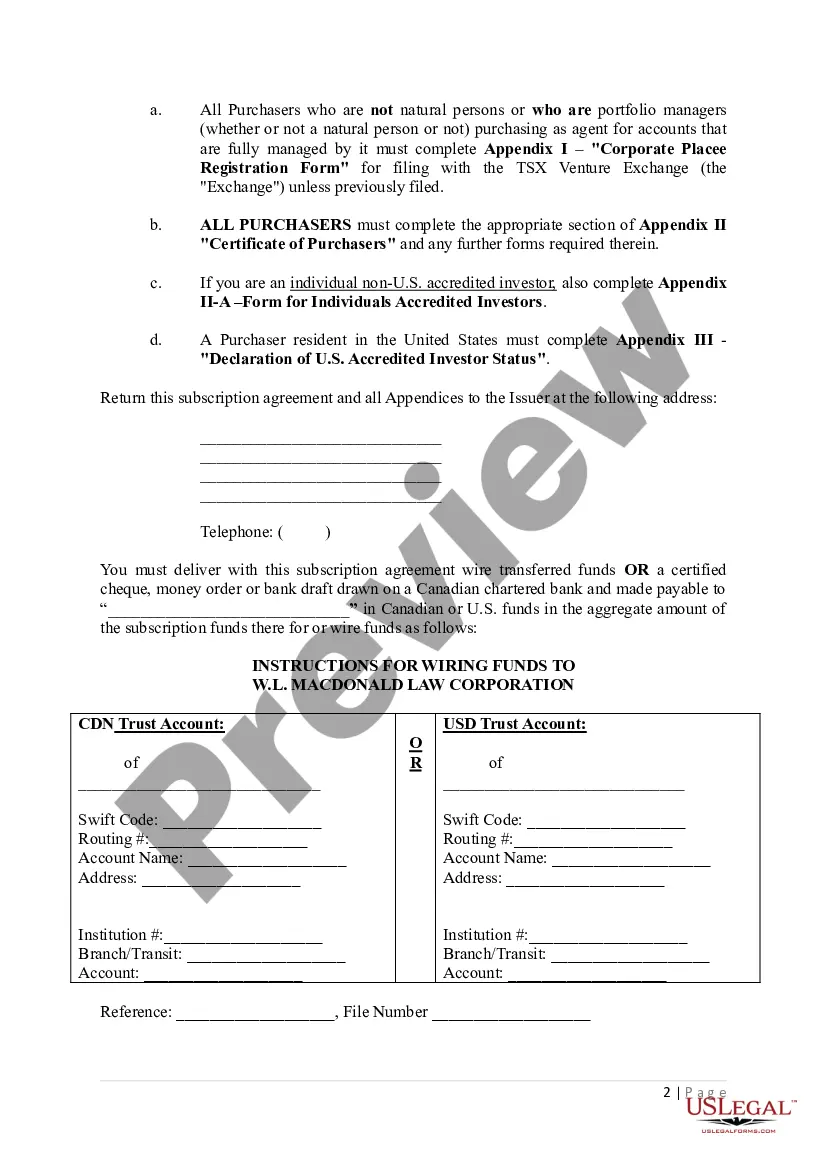

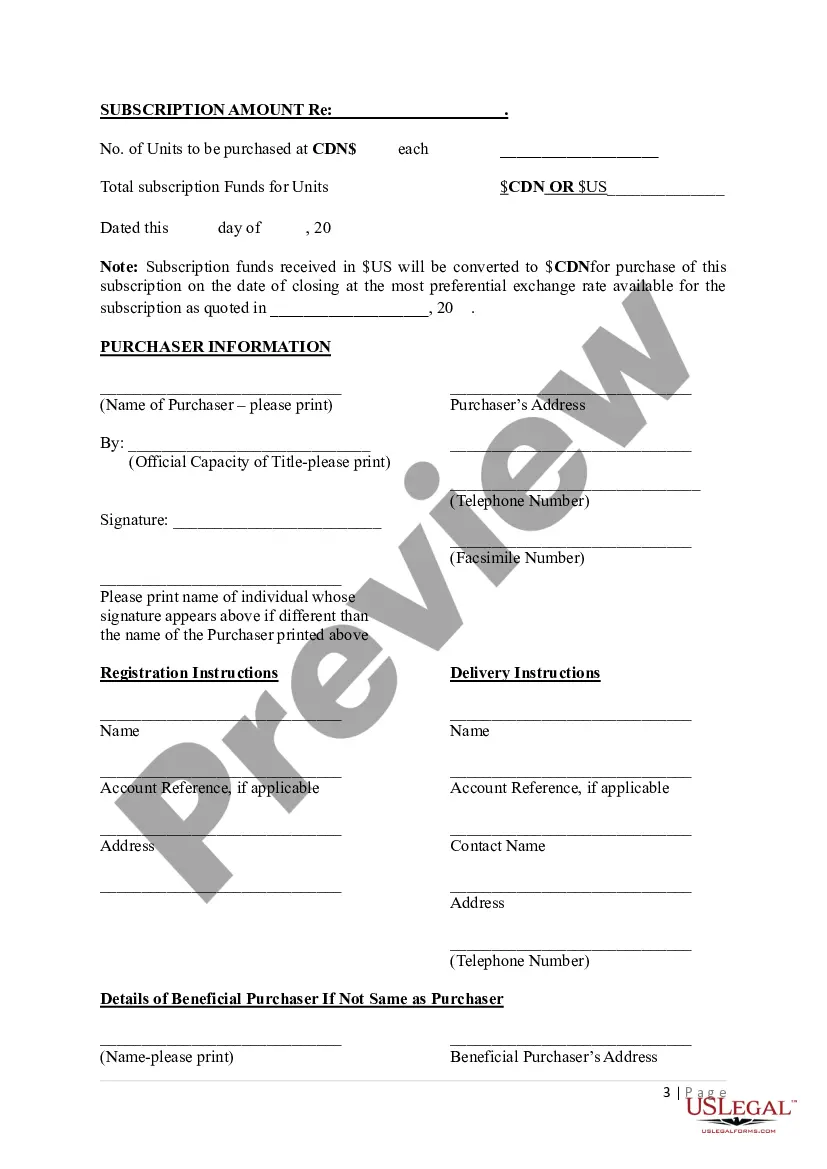

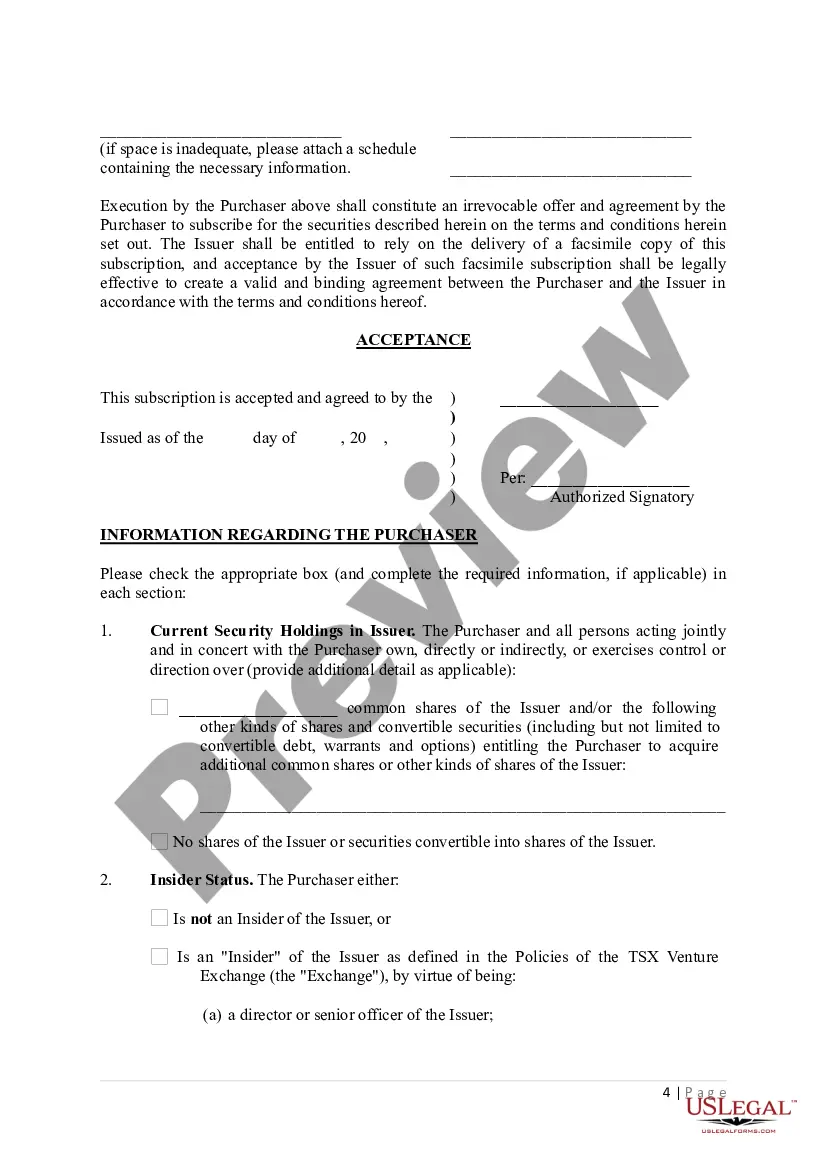

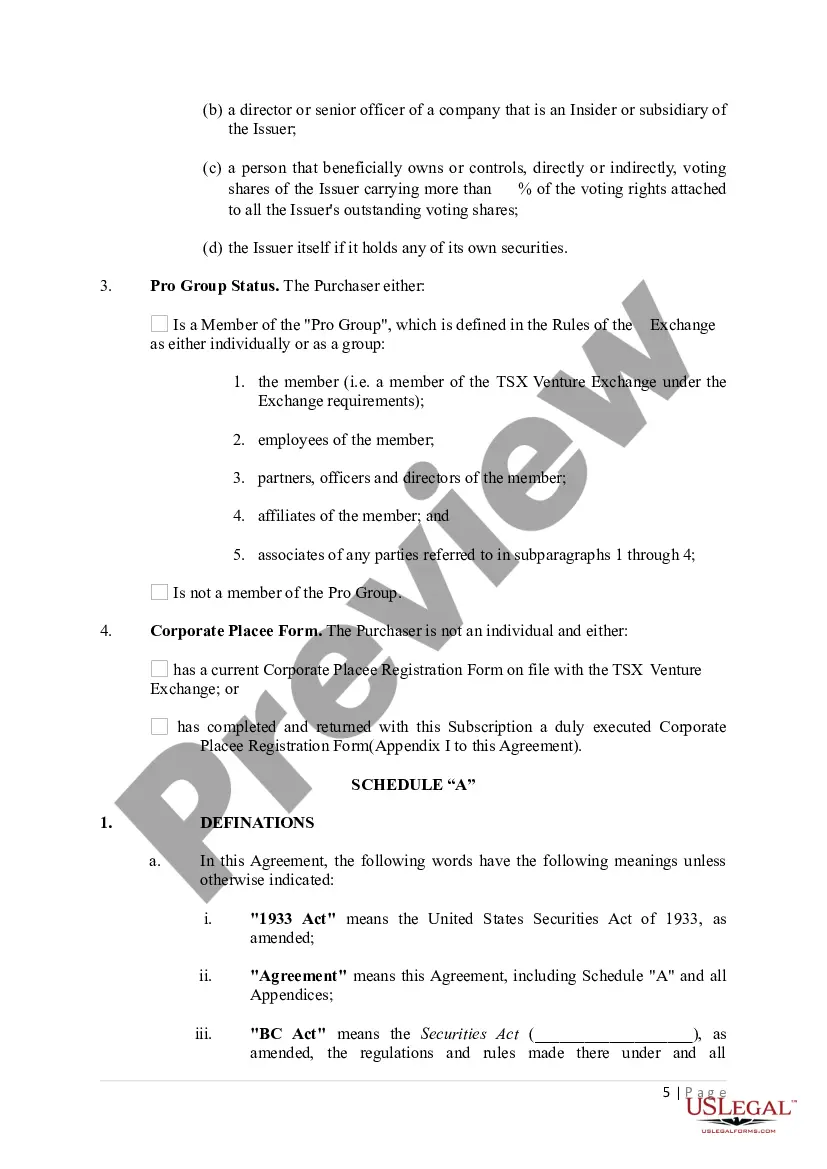

A Nevada Subscription Agreement is a legal document that outlines the terms and conditions under which an individual or entity can purchase shares or units of a company located in the state of Nevada. It serves as a legally binding contract between the company issuing the shares and the investor(s) who wish to obtain ownership in the company. The Nevada Subscription Agreement typically contains key provisions such as the number of shares or units to be purchased, the purchase price or consideration, the payment terms, and any restrictions on the transferability of the shares. It also includes representations and warranties made by the investor regarding their eligibility to invest and their understanding of the risks associated with the investment. One type of Nevada Subscription Agreement is a basic agreement used for private companies seeking capital from individual investors. This agreement outlines the terms and conditions specific to the private placement of shares or units. Another type is a subscription agreement used for limited liability companies (LCS) in Nevada, detailing the terms and conditions for the sale and purchase of membership interests. In addition to these standard types of Nevada Subscription Agreements, there may be variations depending on the specific needs of the parties involved. For example, there could be agreements tailored for crowdfunding campaigns, where multiple investors contribute smaller amounts to fund a project or startup. These agreements would outline the terms for the purchase of shares or units through the crowdfunding platform. It is essential for both the company and the investor(s) to carefully review and understand the Nevada Subscription Agreement before signing. Consulting with legal professionals knowledgeable in securities laws and regulations is advisable to ensure compliance and protect the interests of all parties involved. In summary, a Nevada Subscription Agreement is a legally binding contract that governs the purchase of shares or units in a Nevada-based company. It outlines the terms and conditions of the investment and can vary depending on the type of company and the nature of the investment.

Nevada Subscription Agreement

Description

How to fill out Nevada Subscription Agreement?

You can invest hours online looking for the lawful papers format that fits the state and federal needs you need. US Legal Forms gives a large number of lawful forms that are analyzed by pros. It is possible to acquire or produce the Nevada Subscription Agreement from your assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load option. Afterward, it is possible to complete, revise, produce, or sign the Nevada Subscription Agreement. Each and every lawful papers format you get is your own permanently. To obtain yet another backup of any bought develop, go to the My Forms tab and click the related option.

If you use the US Legal Forms site the first time, keep to the easy guidelines under:

- Initial, ensure that you have selected the correct papers format to the region/city of your choice. Read the develop outline to make sure you have selected the right develop. If readily available, use the Review option to check throughout the papers format at the same time.

- In order to locate yet another variation in the develop, use the Search field to get the format that meets your requirements and needs.

- Upon having discovered the format you desire, click Purchase now to move forward.

- Pick the costs strategy you desire, type in your references, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your charge card or PayPal bank account to fund the lawful develop.

- Pick the format in the papers and acquire it to your system.

- Make changes to your papers if possible. You can complete, revise and sign and produce Nevada Subscription Agreement.

Down load and produce a large number of papers templates making use of the US Legal Forms web site, that provides the largest selection of lawful forms. Use expert and status-certain templates to deal with your company or person needs.