The Nevada Series Seed Preferred Stock Purchase Agreement is a legal document that outlines the terms and conditions governing the purchase of preferred stock in a company. It is specifically designed for startup companies based in the state of Nevada. This agreement is typically used to raise capital from investors who are interested in purchasing preferred stock in exchange for providing funding to the company. The Nevada Series Seed Preferred Stock Purchase Agreement includes various key provisions and clauses that protect the rights and interests of both the investor and the company. It outlines the purchase price, number of shares, and terms of payment for the preferred stock. Additionally, it specifies the rights, preferences, and privileges associated with the preferred stock, such as voting rights, dividends, liquidation preferences, and conversion rights. The agreement also covers the representations and warranties made by the company, as well as the investor's right to conduct due diligence and receive financial and operational information about the company. It may include provisions regarding the transfer of the preferred stock, restrictions on the investor's ability to sell or transfer the shares, and conditions for exercising certain rights or options. While the Nevada Series Seed Preferred Stock Purchase Agreement is a standard document, there may be variations or customized versions tailored to specific needs or circumstances. These variations could include additional provisions or modifications to better align with the specific requirements or preferences of the parties involved. For example, there may be different versions for companies in different industries or with specific business models. Some potential types or variations of the Nevada Series Seed Preferred Stock Purchase Agreement might include: 1. Technology Industry: This type of agreement may include provisions specific to startup companies in the technology sector, addressing topics like intellectual property rights, licensing, or protection of confidential information. 2. Healthcare Industry: Specifically tailored for startups operating in the healthcare or biotech field, this type of agreement may incorporate provisions related to regulatory compliance, clinical trials, or intellectual property protection. 3. Manufacturing or Product-based Industry: Companies that produce or sell physical products may have a customized agreement that includes clauses addressing distribution rights, warranties, product liability, or quality control. 4. Service-based Industry: For startups in service-oriented sectors such as consulting or software development, the agreement might include provisions regarding service delivery, performance guarantees, or exclusivity agreements. It is important for companies and investors to consult appropriate legal counsel when entering into a Nevada Series Seed Preferred Stock Purchase Agreement, ensuring that the document accurately represents the interests and objectives of all parties involved while complying with applicable state and federal laws.

Nevada Series Seed Preferred Stock Purchase Agreement

Description

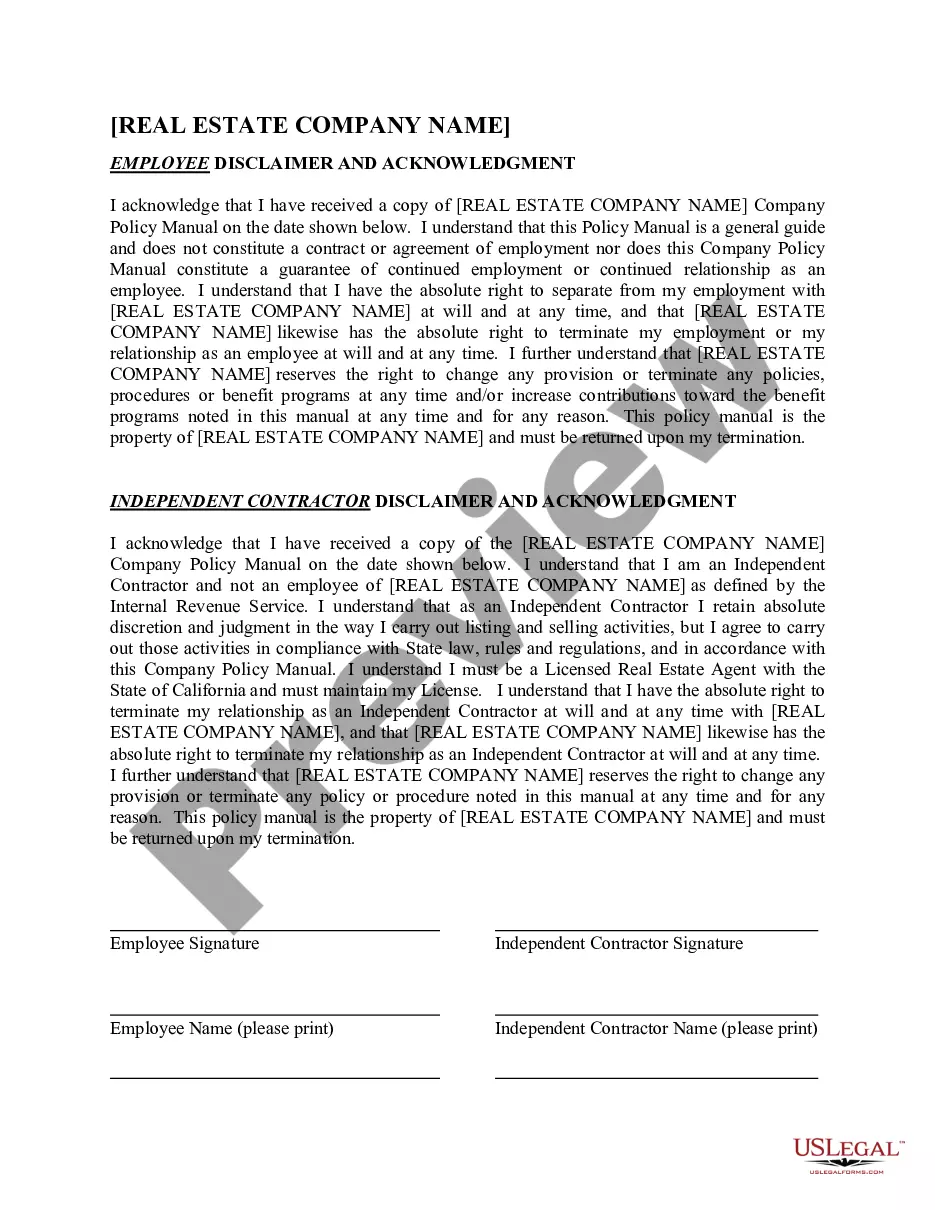

How to fill out Nevada Series Seed Preferred Stock Purchase Agreement?

Are you presently inside a position that you need files for possibly company or person purposes virtually every time? There are tons of authorized record web templates accessible on the Internet, but discovering versions you can rely is not easy. US Legal Forms provides a huge number of type web templates, such as the Nevada Series Seed Preferred Stock Purchase Agreement, which are published to satisfy federal and state demands.

Should you be already informed about US Legal Forms website and possess a merchant account, just log in. After that, you are able to acquire the Nevada Series Seed Preferred Stock Purchase Agreement design.

Should you not provide an account and wish to start using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for that appropriate town/county.

- Make use of the Preview key to examine the form.

- See the outline to actually have selected the correct type.

- In case the type is not what you`re searching for, take advantage of the Look for field to discover the type that meets your needs and demands.

- If you discover the appropriate type, click on Get now.

- Select the pricing prepare you desire, fill out the necessary info to create your bank account, and pay money for an order making use of your PayPal or credit card.

- Select a handy paper formatting and acquire your duplicate.

Locate all of the record web templates you have purchased in the My Forms food selection. You can obtain a extra duplicate of Nevada Series Seed Preferred Stock Purchase Agreement any time, if necessary. Just click the required type to acquire or printing the record design.

Use US Legal Forms, one of the most considerable collection of authorized varieties, to save lots of efforts and prevent faults. The services provides expertly made authorized record web templates that you can use for a range of purposes. Produce a merchant account on US Legal Forms and start creating your way of life a little easier.