The Nevada Form — Enhanced CD Agreement is a legal document used in the state of Nevada to establish the terms and conditions of an Enhanced Certificate of Deposit (CD) between a financial institution and an individual or entity. This agreement outlines the rights and obligations of both parties in relation to the CD investment. The Nevada Form — Enhanced CD Agreement is designed to protect the interests of both the financial institution and the CD holder. It provides a comprehensive framework for the management of the investment and ensures transparency in terms of the terms, rates, and maturity dates associated with the CD. Key provisions covered in the Nevada Form — Enhanced CD Agreement include: 1. Identification of the parties: This section includes the names and contact information of the financial institution and the CD holder. It is essential in establishing a clear understanding of whom the agreement pertains to. 2. Definitions: This section lists the definitions of various terms and phrases used throughout the agreement. Definitions may include terms like "CD," "maturity date," "early withdrawal penalty," and more. This ensures that both parties have a common understanding of the terminology used within the document. 3. CD Terms and Conditions: This section outlines the specific terms and conditions related to the CD, such as the initial deposit, the interest rate, the duration of the CD, and any penalties or fees associated with early withdrawal. 4. Interest Calculation: This section details how the interest on the CD will be calculated, such as compounding frequency and method. It ensures transparency regarding how the interest will accrue and be credited to the CD holder. 5. Maturity and Renewal: This section specifies what will happen when the CD reaches its maturity date. It outlines the options available to the CD holder, including automatic renewal, withdrawal of funds, or transfer to another account. 6. Early Withdrawal Penalty: This section explains the potential penalties and fees that may be incurred if the CD holder decides to withdraw funds before the maturity date. It helps establish the consequences of early withdrawal and the corresponding financial impact. 7. Tax Considerations: This section may provide information regarding the tax treatment of the CD investment, including reporting obligations and potential taxable events. It is important for the CD holder to understand their tax liabilities. Different variations of the Nevada Form — Enhanced CD Agreement may exist based on specific requirements or provisions set forth by individual financial institutions. These could include variations in the interest rates, minimum deposit requirements, renewal terms, or early withdrawal penalties. It is crucial for the CD holder to carefully review and understand the specific agreement provided by their chosen financial institution to ensure compliance and informed decision-making.

Nevada Form - Enhanced CD Agreement

Description

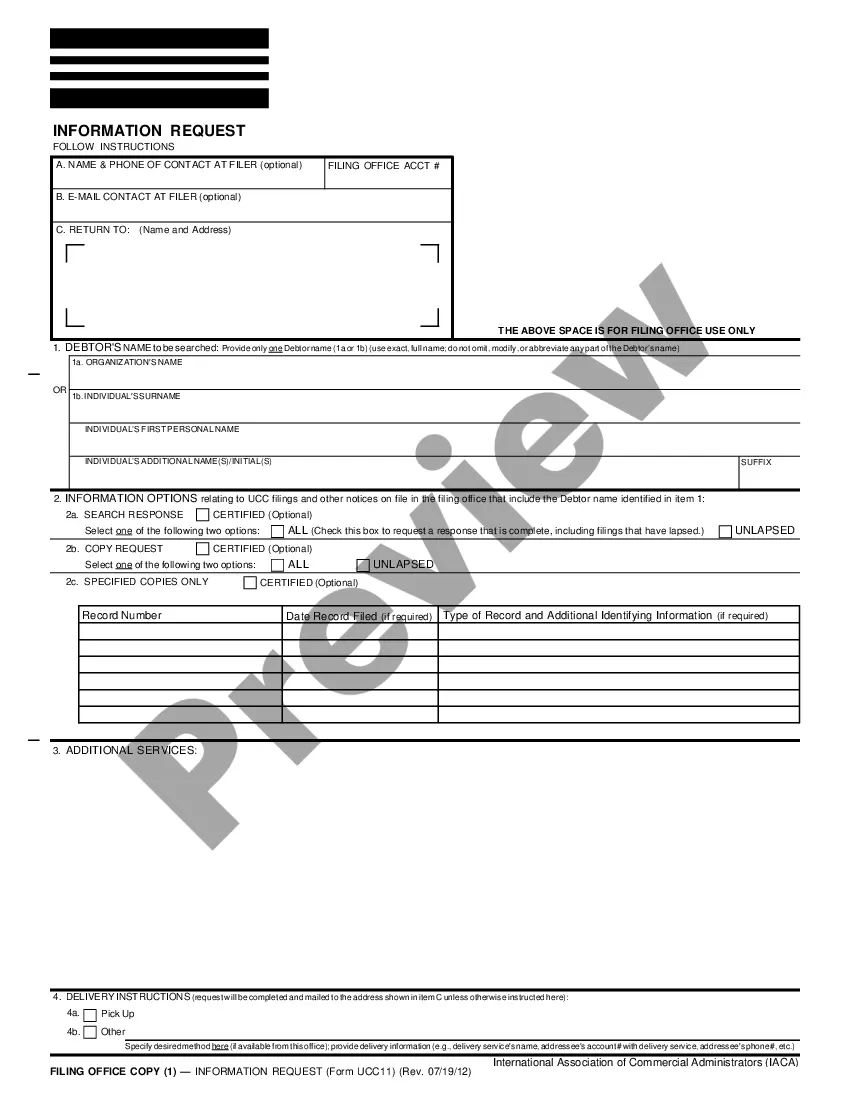

How to fill out Nevada Form - Enhanced CD Agreement?

Have you been in the placement that you require files for possibly organization or person functions nearly every time? There are a variety of legal papers themes available online, but getting types you can rely isn`t effortless. US Legal Forms delivers a large number of form themes, like the Nevada Form - Enhanced CD Agreement, which can be created to fulfill federal and state requirements.

When you are currently familiar with US Legal Forms internet site and possess a merchant account, just log in. Following that, you can down load the Nevada Form - Enhanced CD Agreement web template.

If you do not have an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for that right city/region.

- Make use of the Preview option to check the shape.

- Look at the description to ensure that you have selected the right form.

- In case the form isn`t what you are trying to find, utilize the Search discipline to find the form that meets your needs and requirements.

- If you obtain the right form, simply click Buy now.

- Choose the pricing prepare you want, complete the required information to produce your money, and buy an order using your PayPal or credit card.

- Choose a handy paper format and down load your copy.

Get every one of the papers themes you possess purchased in the My Forms menus. You can obtain a further copy of Nevada Form - Enhanced CD Agreement anytime, if necessary. Just click on the needed form to down load or print the papers web template.

Use US Legal Forms, by far the most considerable selection of legal types, to conserve time and stay away from faults. The services delivers expertly manufactured legal papers themes which can be used for a variety of functions. Make a merchant account on US Legal Forms and initiate creating your lifestyle easier.