Nevada Guaranty of Payment of Open Account

Description

How to fill out Nevada Guaranty Of Payment Of Open Account?

It is possible to commit hours on the Internet attempting to find the authorized document web template that meets the state and federal specifications you require. US Legal Forms gives a large number of authorized types which can be evaluated by pros. You can actually download or printing the Nevada Guaranty of Payment of Open Account from our assistance.

If you currently have a US Legal Forms profile, you can log in and click on the Download switch. Next, you can full, revise, printing, or indicator the Nevada Guaranty of Payment of Open Account. Each authorized document web template you purchase is yours for a long time. To acquire an additional version for any purchased develop, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site for the first time, stick to the basic directions below:

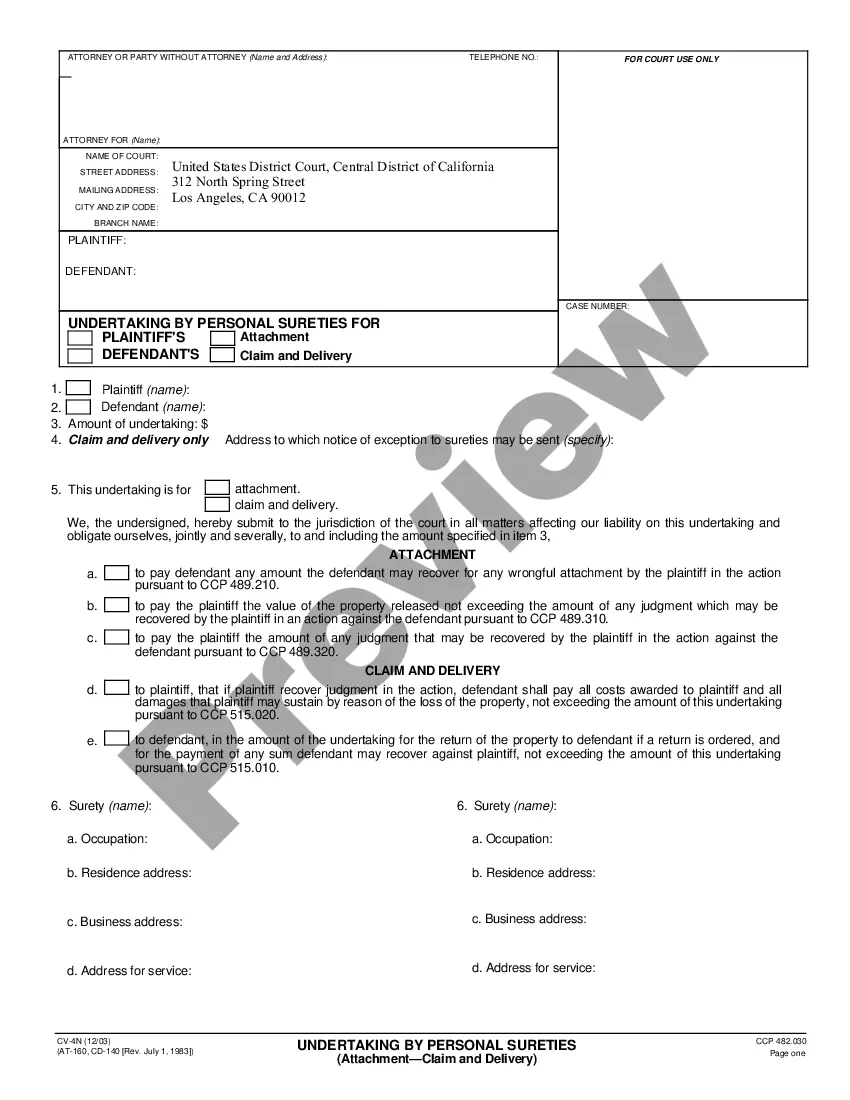

- Very first, make sure that you have selected the correct document web template for that region/city that you pick. Look at the develop outline to ensure you have selected the appropriate develop. If readily available, use the Review switch to appear from the document web template as well.

- If you wish to discover an additional variation from the develop, use the Lookup field to get the web template that suits you and specifications.

- When you have discovered the web template you want, simply click Acquire now to proceed.

- Find the costs plan you want, enter your credentials, and register for your account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal profile to fund the authorized develop.

- Find the structure from the document and download it to the product.

- Make adjustments to the document if needed. It is possible to full, revise and indicator and printing Nevada Guaranty of Payment of Open Account.

Download and printing a large number of document web templates utilizing the US Legal Forms website, which provides the greatest variety of authorized types. Use skilled and express-certain web templates to handle your business or individual requirements.

Form popularity

FAQ

A guaranteed fund is a type of collective investment scheme that guarantees to pay back a pre-determined percentage of the invested capital, subject to satisfaction of certain pre-determined conditions. A guaranteed fund doesn't work exactly like a savings deposit.

If your insurance company fails, the maximum amount of protection provided by the guaranty corporation for all policy types in the aggregate, no matter how many policies of the same or different types you bought from your company, is $500,000 per life.

Guaranty Fund established by law in every state, guaranty funds are maintained by a state's insurance commissioner to protect policyholders in the event that an insurer becomes insolvent or is unable to meet its financial obligations.

A Guaranteed Interest Account (GIA) is an ideal account for saving toward a special purchase, creating an emergency fund, a guaranteed holding of your investment portfolio and even guarding against market volatility. Our GIAs provide security of principal with a guaranteed rate of return.

Capital Guarantee Plans are basically ULIP plans, which is a combination of insurance and investment. Under this plan, 50-60% of the amount invested goes into debt for capital protection and the rest is invested in equity. The plan comes with a policy tenure of 10 years and a premium paying tenure of 5 years.

LIMITS ON AMOUNT OF COVERAGE With respect to life insurance policies and annuities, on any one insured life, the Association will pay a maximum of $300,000, regardless of how many policies and contracts there are with the same company, and even if they provide different types of coverage.

Auto, home, business and related types of insurance - the Guaranty Association will pay up to the policy limit, or up to $300,000, whichever is lower. Life, health and long-term care insurance, or annuities - the Guaranty Association will pay up to the policy limit, or up to $500,000, whichever is lower.

Individual and group life insurance policies as well as annuities, long-term care and disability income insurance policies are covered by life and health guaranty associations.

What Is a State Guaranty Fund? A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.