Nevada Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Nevada Tutoring Agreement - Self-Employed Independent Contractor?

If you wish to total, download, or print out legal document themes, use US Legal Forms, the most important assortment of legal varieties, that can be found on the Internet. Take advantage of the site`s easy and convenient search to get the papers you will need. Various themes for company and specific reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Nevada Tutoring Agreement - Self-Employed Independent Contractor within a handful of clicks.

Should you be previously a US Legal Forms consumer, log in in your accounts and then click the Acquire switch to obtain the Nevada Tutoring Agreement - Self-Employed Independent Contractor. You can even gain access to varieties you previously delivered electronically from the My Forms tab of your respective accounts.

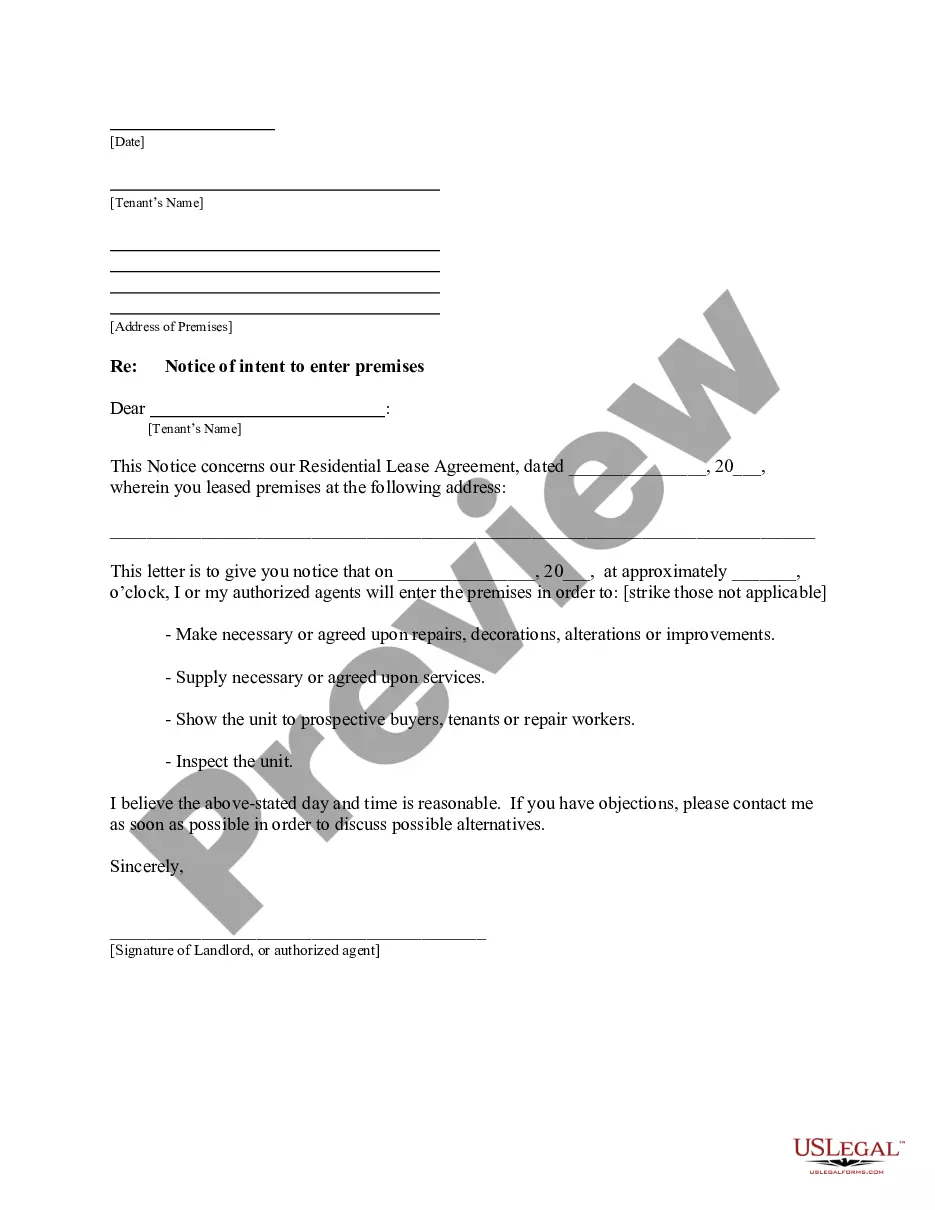

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for that correct town/nation.

- Step 2. Utilize the Preview option to check out the form`s information. Don`t forget to read through the explanation.

- Step 3. Should you be not satisfied with all the develop, take advantage of the Look for discipline towards the top of the screen to locate other variations in the legal develop template.

- Step 4. After you have located the form you will need, click the Get now switch. Select the costs program you like and add your credentials to register to have an accounts.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal accounts to perform the deal.

- Step 6. Pick the format in the legal develop and download it on your product.

- Step 7. Full, modify and print out or sign the Nevada Tutoring Agreement - Self-Employed Independent Contractor.

Every single legal document template you purchase is the one you have permanently. You possess acces to every develop you delivered electronically within your acccount. Select the My Forms area and choose a develop to print out or download once more.

Be competitive and download, and print out the Nevada Tutoring Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of specialist and status-certain varieties you can utilize to your company or specific demands.

Form popularity

FAQ

Yes, tutoring is normally an activity that is classified by the IRS as self-employment, because you don't receive a W-2 from an employer for doing it. If you wish to report business expenses as a reduction to business income, then you will need the TurboTax online Self-Employment program.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board. Contractors, including subcontractors and specialty contractors must be licensed before submitting bids.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

If you're actively running your own tutoring business, and not working for an agency or other employer, you're self-employed. That's true even if you have a full-time day job. In the eyes of the Internal Revenue Service, being self-employed classifies you as a 1099 independent contractor.

If you are running a tutoring business and not working under any employer, you are billed as self-employed. You may even work a full day job but still count as a self-employed tutor. According to IRS (Internal Revenue Service), you fall under the 1099 independent contractor category as a self-employed individual.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.