Nevada Geologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Nevada Geologist Agreement - Self-Employed Independent Contractor?

If you want to total, download, or printing legitimate file layouts, use US Legal Forms, the biggest collection of legitimate types, which can be found on the Internet. Use the site`s easy and practical look for to find the documents you need. A variety of layouts for organization and personal uses are categorized by types and claims, or search phrases. Use US Legal Forms to find the Nevada Geologist Agreement - Self-Employed Independent Contractor within a few click throughs.

In case you are already a US Legal Forms customer, log in to the profile and click the Acquire key to obtain the Nevada Geologist Agreement - Self-Employed Independent Contractor. You may also gain access to types you in the past delivered electronically inside the My Forms tab of your profile.

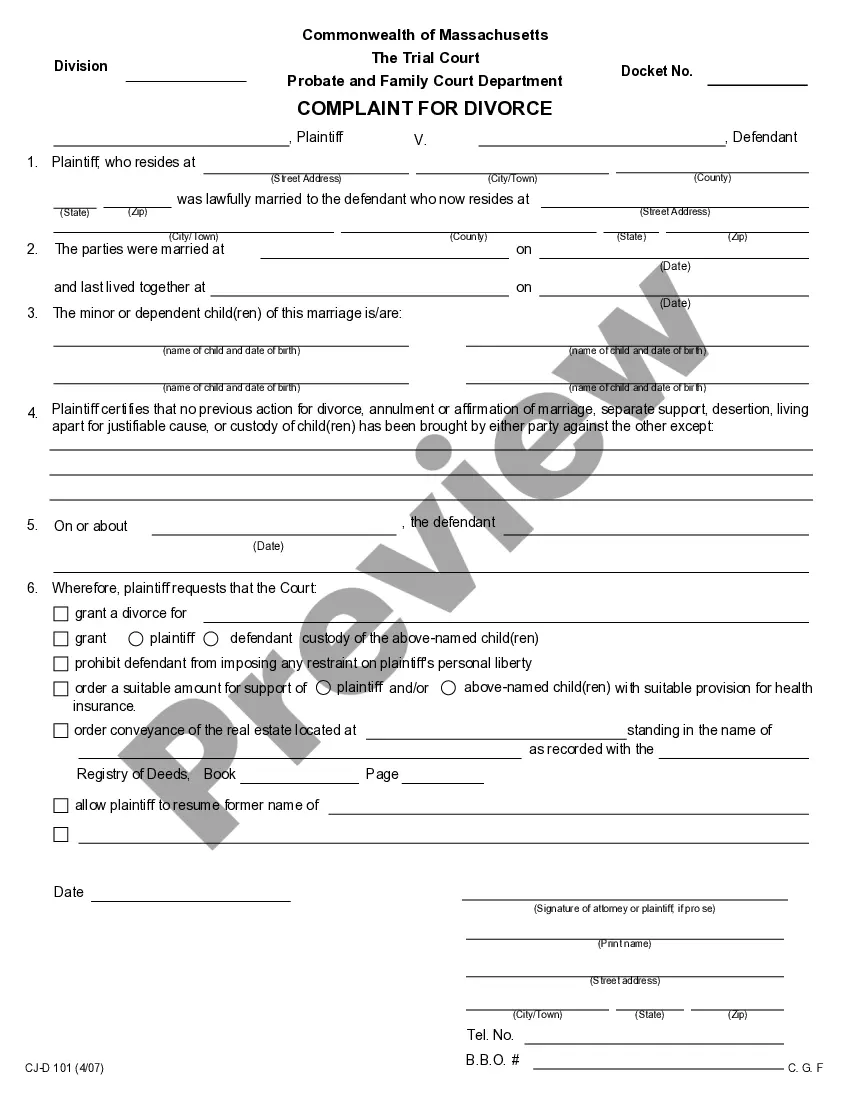

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for the correct area/land.

- Step 2. Make use of the Review choice to look over the form`s articles. Never forget to see the information.

- Step 3. In case you are unsatisfied with the develop, utilize the Lookup discipline on top of the screen to locate other models of your legitimate develop format.

- Step 4. Upon having located the shape you need, click the Acquire now key. Pick the costs program you prefer and add your references to sign up to have an profile.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the formatting of your legitimate develop and download it on your product.

- Step 7. Complete, revise and printing or signal the Nevada Geologist Agreement - Self-Employed Independent Contractor.

Each and every legitimate file format you buy is your own property eternally. You have acces to each and every develop you delivered electronically with your acccount. Click the My Forms segment and pick a develop to printing or download again.

Compete and download, and printing the Nevada Geologist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of expert and condition-particular types you may use to your organization or personal needs.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board. Contractors, including subcontractors and specialty contractors must be licensed before submitting bids.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.