Nevada Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Nevada Electronics Assembly Agreement - Self-Employed Independent Contractor?

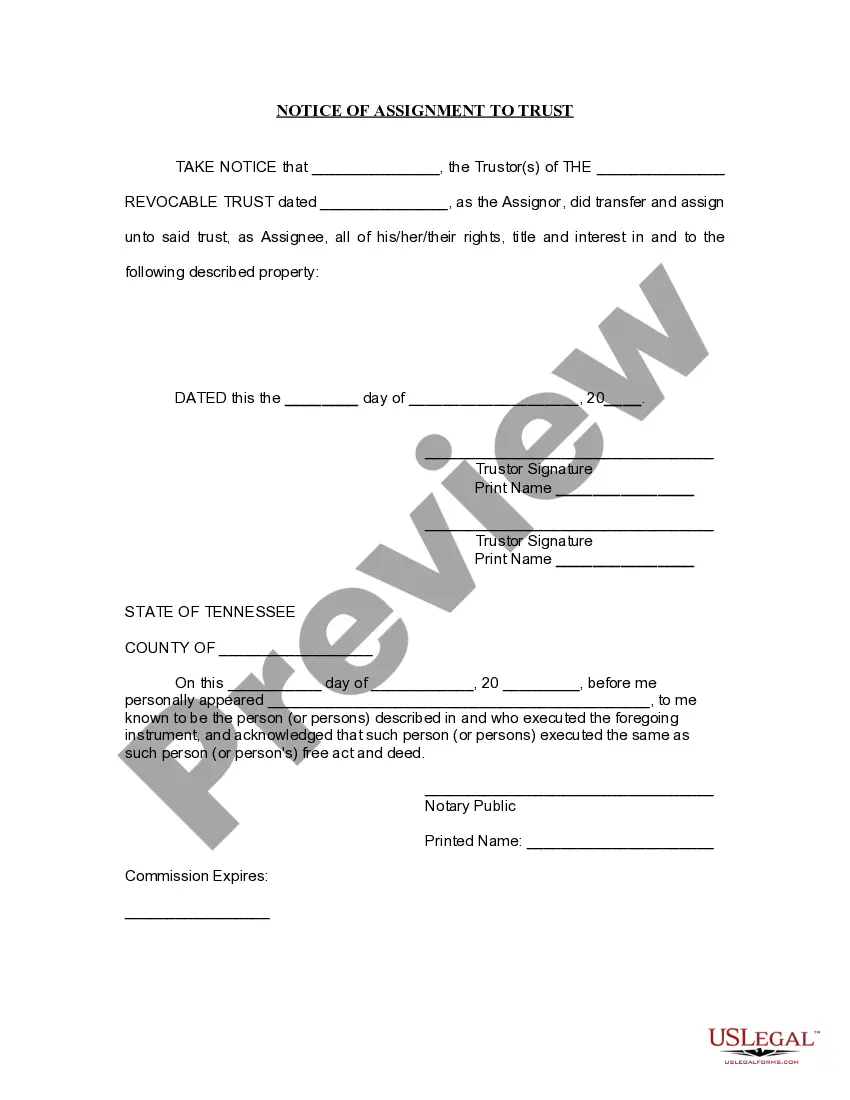

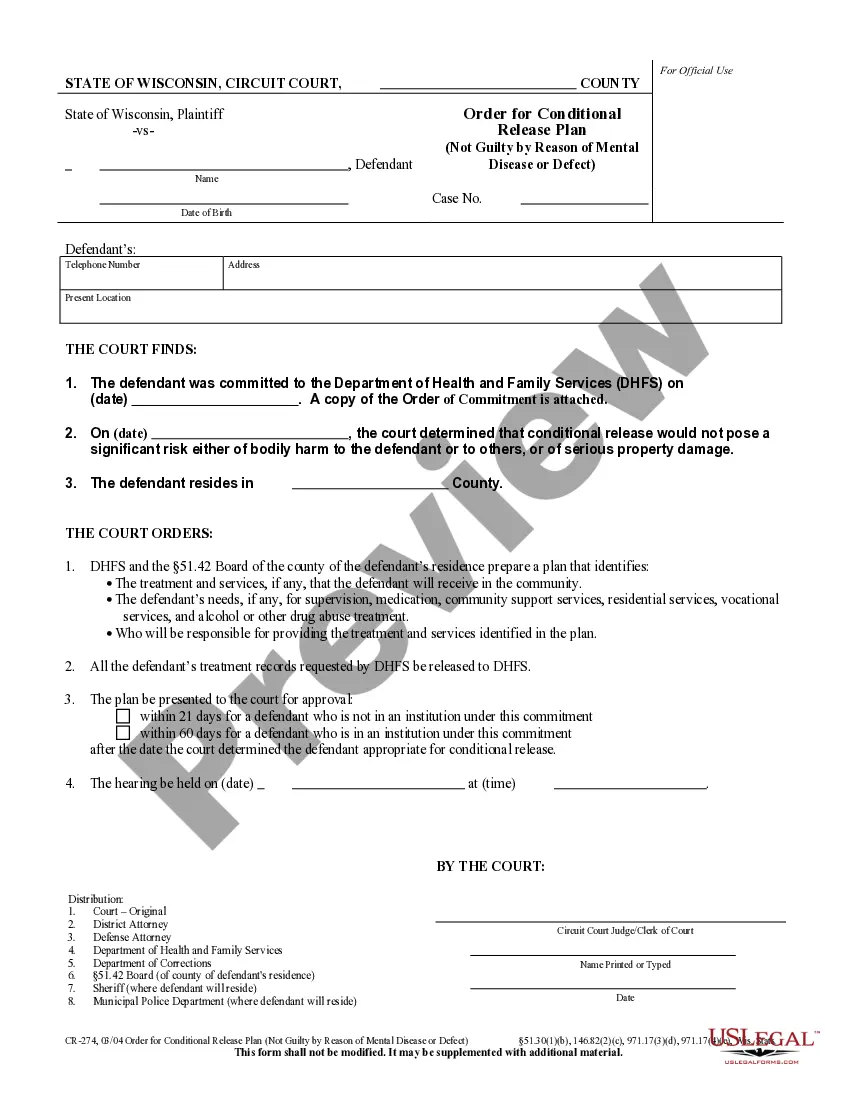

You can commit time on-line looking for the authorized papers format that fits the state and federal specifications you need. US Legal Forms gives a large number of authorized forms which can be evaluated by professionals. It is simple to download or printing the Nevada Electronics Assembly Agreement - Self-Employed Independent Contractor from my services.

If you already possess a US Legal Forms profile, it is possible to log in and click the Down load option. Following that, it is possible to total, change, printing, or signal the Nevada Electronics Assembly Agreement - Self-Employed Independent Contractor. Each authorized papers format you buy is yours for a long time. To get an additional duplicate associated with a acquired type, check out the My Forms tab and click the related option.

If you are using the US Legal Forms website initially, adhere to the simple instructions beneath:

- Initial, ensure that you have selected the best papers format for the area/city of your choice. Look at the type information to make sure you have picked out the appropriate type. If available, make use of the Review option to look throughout the papers format too.

- If you want to discover an additional edition in the type, make use of the Search area to get the format that meets your needs and specifications.

- Once you have found the format you would like, click Buy now to move forward.

- Choose the rates plan you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal profile to cover the authorized type.

- Choose the structure in the papers and download it to your system.

- Make changes to your papers if necessary. You can total, change and signal and printing Nevada Electronics Assembly Agreement - Self-Employed Independent Contractor.

Down load and printing a large number of papers layouts using the US Legal Forms site, which offers the greatest assortment of authorized forms. Use professional and status-particular layouts to take on your company or specific requires.

Form popularity

FAQ

Don't give an IC a company email. Don't give an IC a title within your company. Don't pay the IC's travel or other business expenses, unless they are unique to the project and have been negotiated in advance.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.